5 candlesticks pattern rule. Candlestick analysis. Anton Ganzenko.

Each trader encountered such a concept as a false signal during bidding, and often understood this when it was already a losing entrepot. To avoid such situations, there are filtering signals that allow you to be more confident about this or that situation on the market. One of these filtering signals is a rule of 5 candlesticks.

The Rule itself is a conventional figure consisting of at least five candles with a small body that move in the sideways trend, flat, without a pronounced direction. This candlestick formation acts more as a filtering signal than a signal to enter the transaction, because it indicates a false signal that preceded it, thereby indicating the uncertainty in the market.

This formation is formed on the same timeframe as the main signal for entering the transaction. So, after the formation of a clear signal of entry into the transaction, whether it is a pattern, a complex figure of technical analysis or an indicator signal, we enter the transaction at a signal. But, after a minimum of five candlesticks duration, there is no clear movement, and the candlesticks have a small candle body – this is the rule of 5 candlesticks. After that, it is worth ignoring the signal and closing the deal, because the market ignored this signal due to some circumstances.

The market, despite the history, is always more inclined to elaborate the latest, fresh data and signals, so the more recent signals recoup significantly than the old and stronger ones. This behavior of the market is explained by the fact that the market is constantly in motion, and the information is constantly being updated and new signals are appearing.

Relying on this statement, rule of 5 candlesticks appeared, which can be rephrased as if the signal does not manifest itself during the next 5 candles, then the market probably ignored this signal under the influence of other factors.

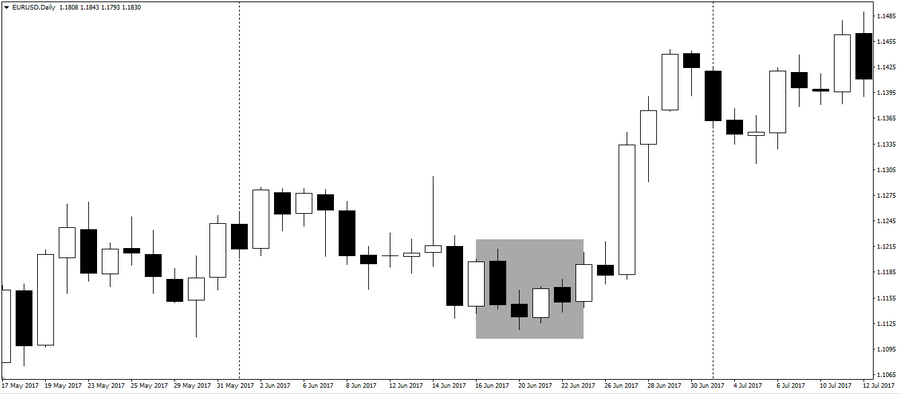

One example of the rule is shown in the figure below, where after the formation of a gap it was possible to enter into a purchase transaction, thereby waiting for the closing of the gap.

But, after the formation of the Rule (gray rectangle), it was worth closing the deal, because the market ignored this signal.

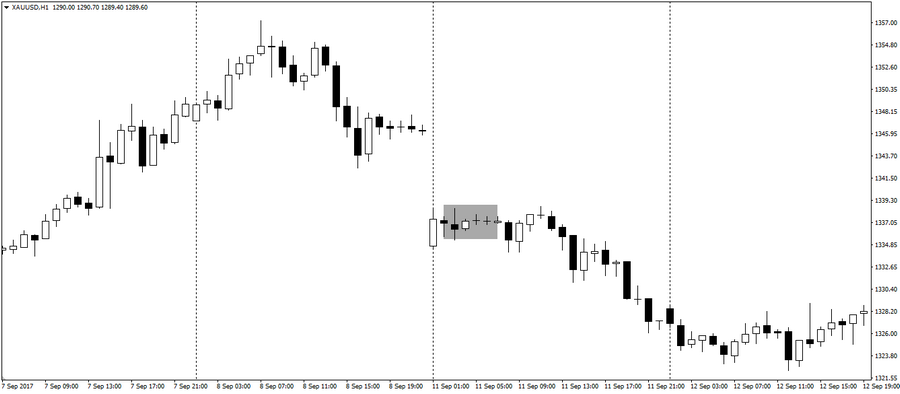

The second picture shows a false pinbar, where after a short time, the market formed 5 candlesticks, indicating the end of the signal’s processing and the price reversal in the opposite direction. In this case, the rule saved from the notable losses.

5 candlesticks pattern rule – an excellent filtering signal for most strategies, which will filter out false signals and secure from negative transactions.

Ganzenko Anton