EUR/USD: валютная пара входит в область перепроданности

Анализ по уровням Мюррея

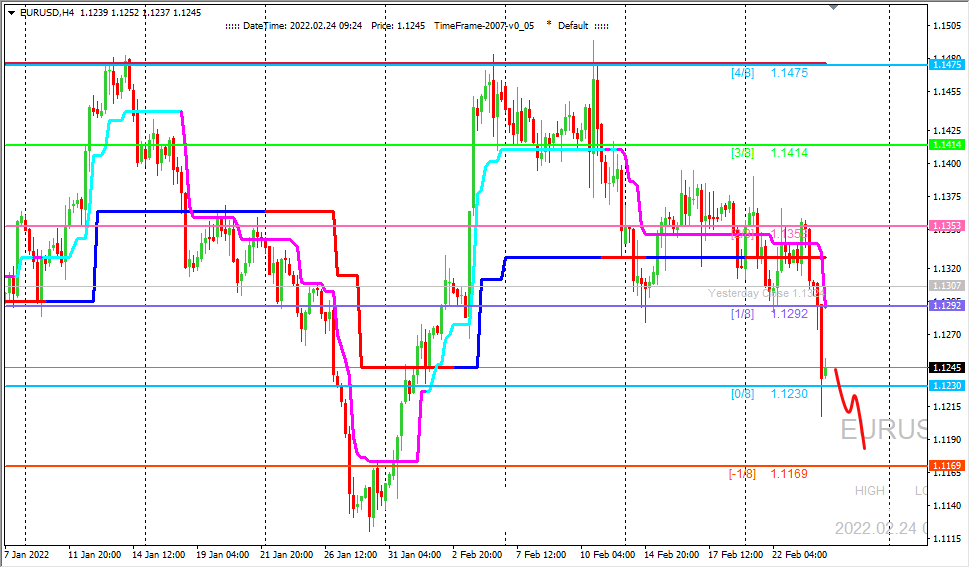

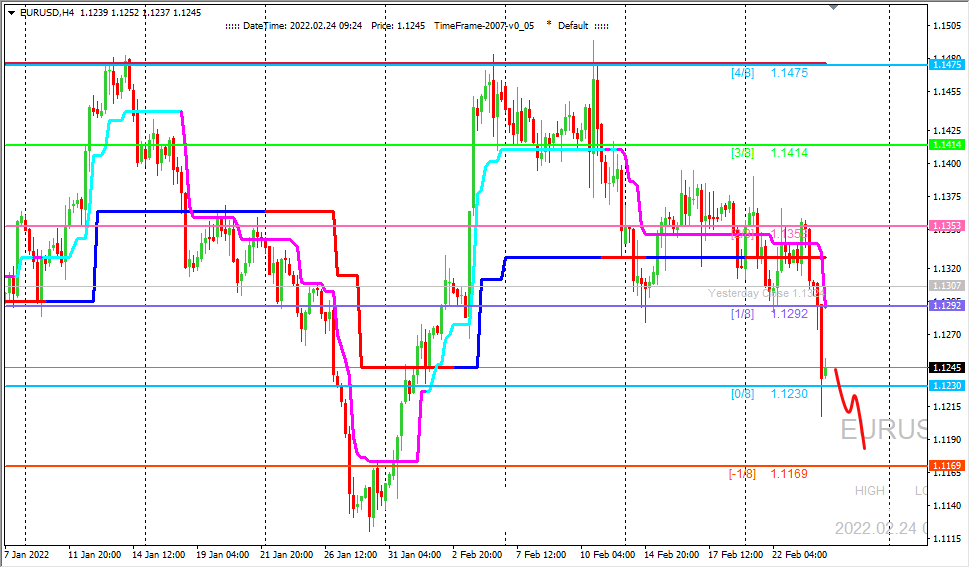

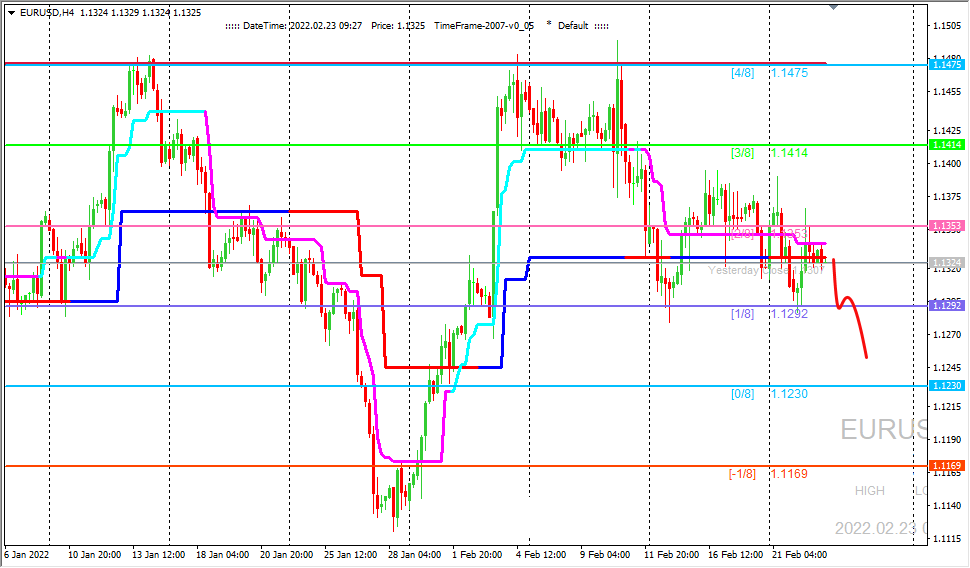

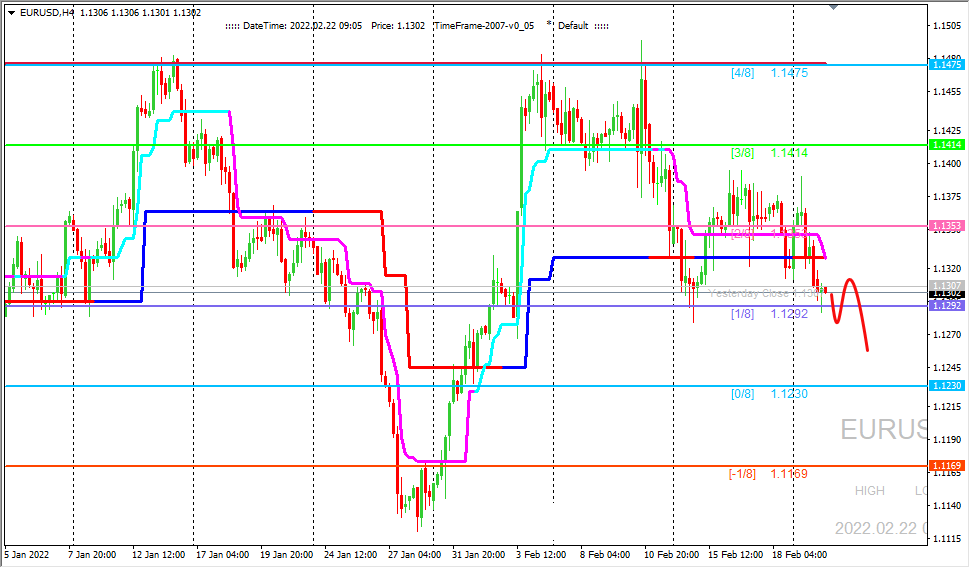

Четырехчасового график пары EUR/USD. Валютная пара продолжила движение вниз продавив отметку (1/8) и сейчас цена тестирует главный уровень поддержки 1.1230 (0/8).

Четырехчасового график пары EUR/USD. Валютная пара продолжила движение вниз продавив отметку (1/8) и сейчас цена тестирует главный уровень поддержки 1.1230 (0/8).

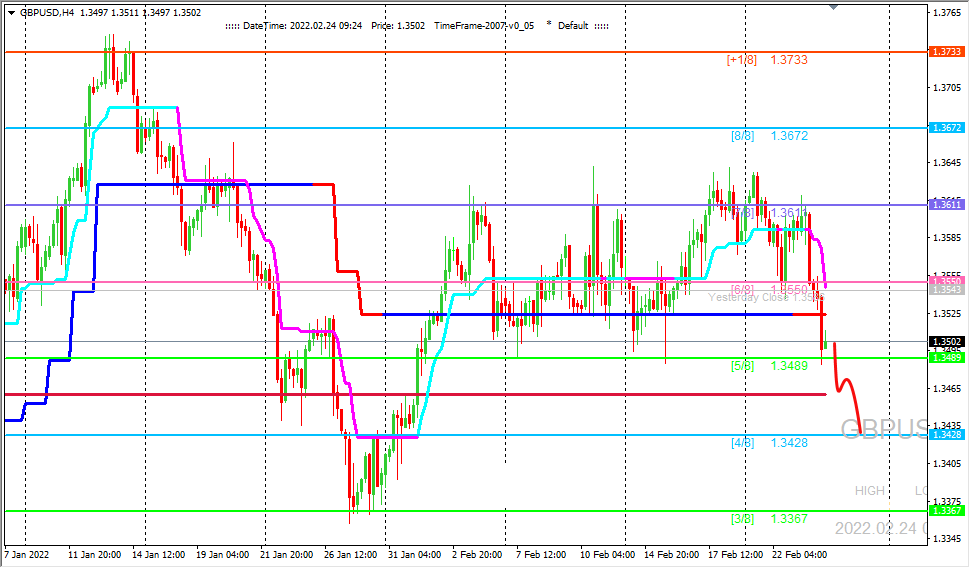

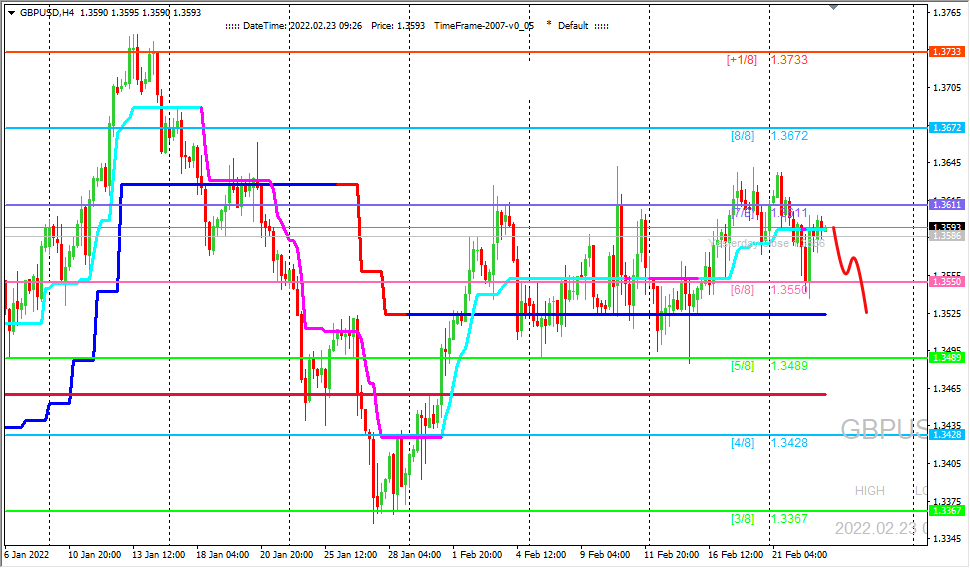

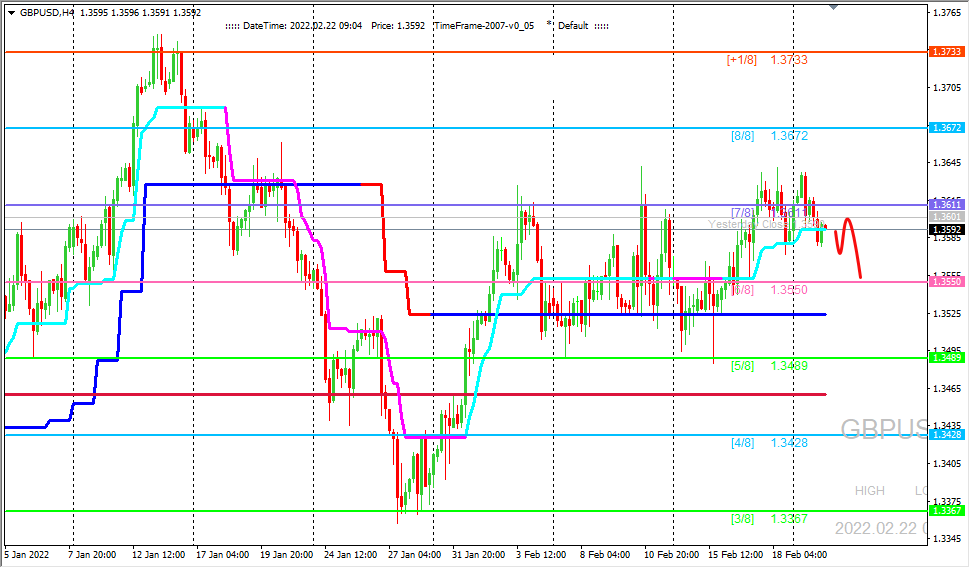

Четырехчасовой график GBP/USD. От разворотного уровня (7/8) развивается нисходящее движение основной целью для которого выступает главный уровень поддержки/сопротивления 1.3428 (4/8).

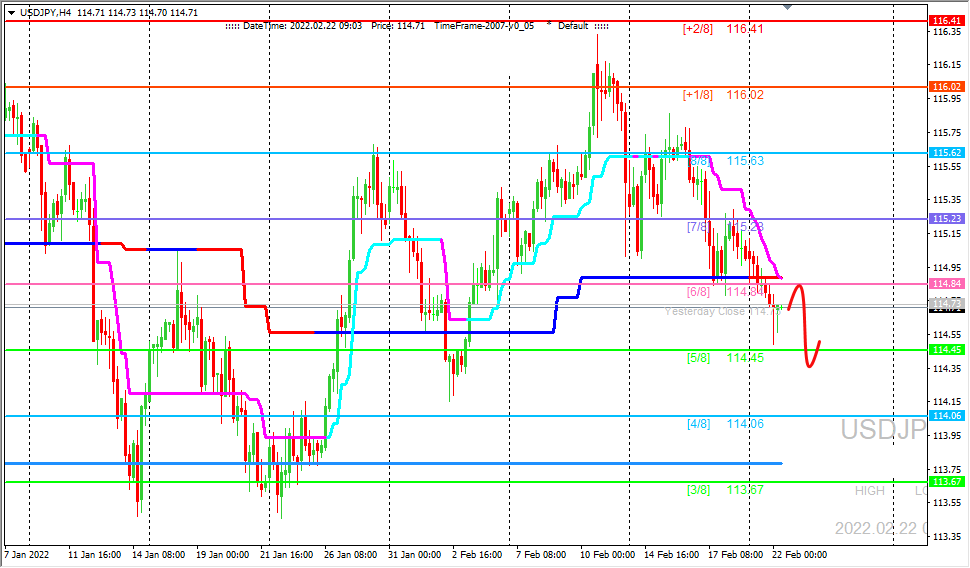

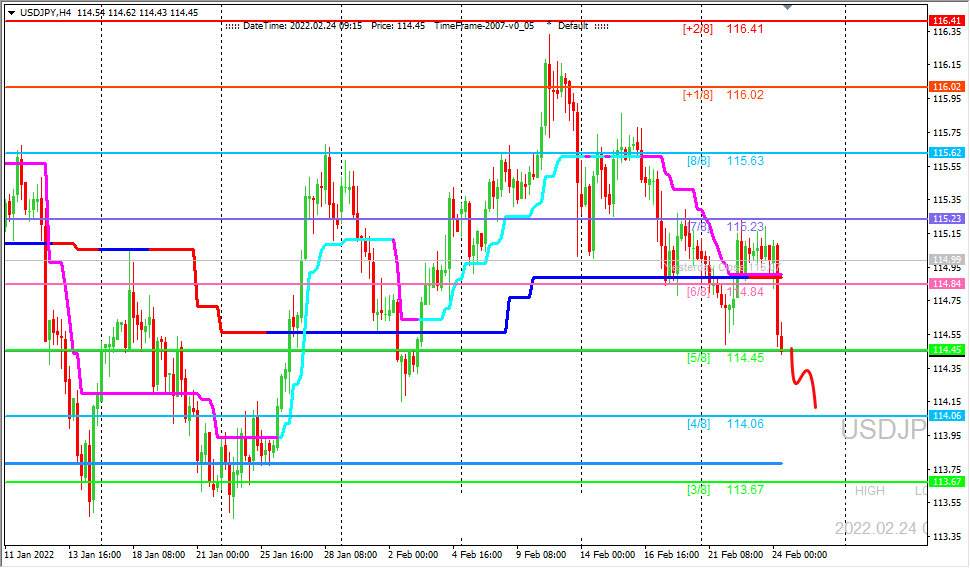

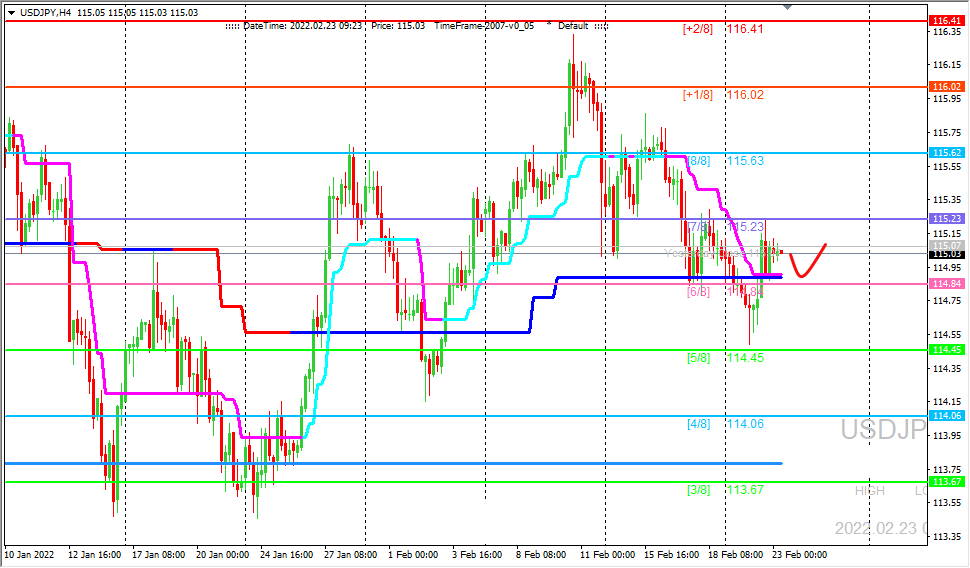

Четырехчасовой график USD/JPY. Валютная пара возобновила движение вниз. Цена находится на отметке (5/8).

Четырехчасового график пары EUR/USD. Валютная пара продолжает удерживаться ниже уровня (2/8) и сохраняет склонность к снижению.

Четырехчасовой график GBP/USD. Валютная пара протестировала уровень (6/8).

Четырехчасовой график USD/JPY. Валютная пара смогла закрепиться выше линии четырехчасового супертренда, что дает покупателям шанс на продолжение умеренного восходящего движения.

Четырехчасового график пары EUR/USD. В очередной раз при подходе к отметке 1.1400 валютная пара встретила сильное сопротивление и возобновила движение вниз.

Четырехчасовой график GBP/USD. Валютная пара пока не может подняться выше разворотного уровня (7/8). Цена уже торгуется в районе линии четырехчасового супертренда.

Четырехчасовой график USD/JPY. Валютная пара локально движется в рамках коррекционного движения от уровня (5/8), но цена по-прежнему удерживается ниже линии четырехчасового супертренда.