Volatility is the pulse of the market. Indicators of volatility. Anton Hanzenko.

Without exaggeration, volatility is the pulse of the market and without volatility it simply does not exist. With low volatility, the market is moving sideways, and trading volumes are declining, which indicates a weak investor’s interest in such an asset. Also there are periods of high volatility in the market, which is caused by the demand for an asset, as a rule, it happens after the publication of significant news or statements.

In any case, volatility is an integral part of the market, which brings both benefits and negative for bidders. Therefore, it is necessary to recognize clearly the periods of volatility in the market and be able to use it as a plus.

There are many different in nature and in the meaning of indicators of volatility, for example, the VIX index or Bollinger indicator, indicating market volatility. However, today I want to talk about other indicators that are not regarded as indicators of volatility.

ADX as an indicator of volatility

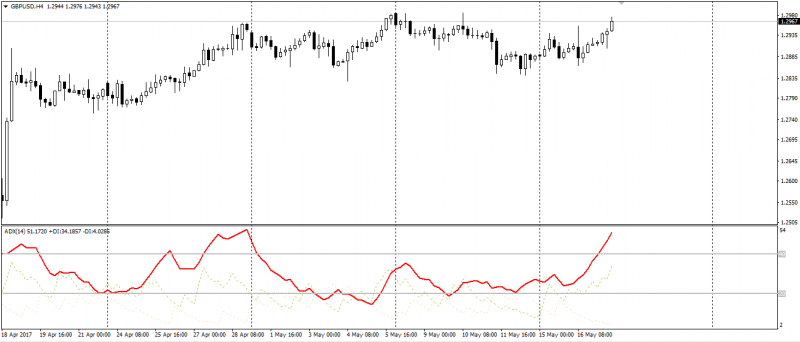

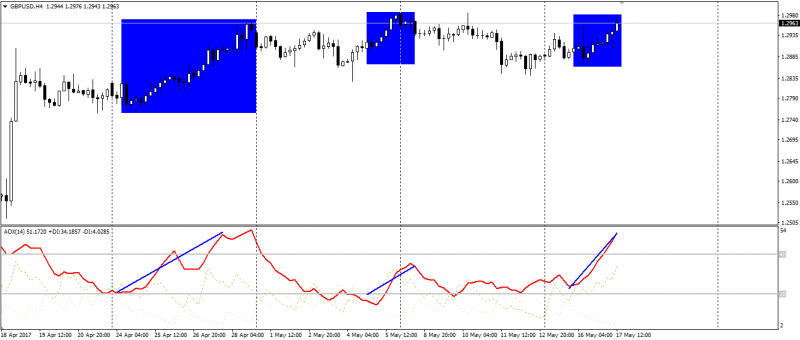

Previously, ADX was considered as a trend (read here). Today we will get acquainted with the other side of this indicator, with properties indicating market volatility.

To determine volatility using the ADX indicator, you need to add two levels 20 and 40 to the indicator.

For convenience, levels 20 and 40 are gray, and the ADX line is red, the auxiliary lines of the -DI and + DI indicators have a standard color and are not used. If the ADX line is above level 40 – it indicates a strong trend. When ADX is below level 20, the trend is weak. The slope of the ADX line itself indicates the level of market volatility.

The steeper the line of the ADX, the higher is the volatility and vice versa the less is the dip, the lower the volatility.

Indicator Average True Range (ATR)

ATR (average true range) – indicates the current market volatility. The indicator is auxiliary and is not used independently, as it does not provide forecasts for the market. The core value of ATR is in its actual readings, which can be compared between similar or very similar assets.

The value of the ATR indicator is used to measure intraday volatility and secure placement of stop orders. Using ATR in placing stop orders, by measuring intraday volatility in advance, you can protect yourself from market noise.

Volatility: Disadvantages

Both ADX and ATR indicators have similar disadvantages. Both are downward, which is quite common for such indicators. The second disadvantage is the fact that they do not indicate the direction of the trend, but it can be easily corrected with the help of moving averages.

You can learn about these indicators and not only this during the training courses from Еster Holdings Inc.

Anton Hanzenko