Technical analysis of cross-rates. (Anton Hanzenko)

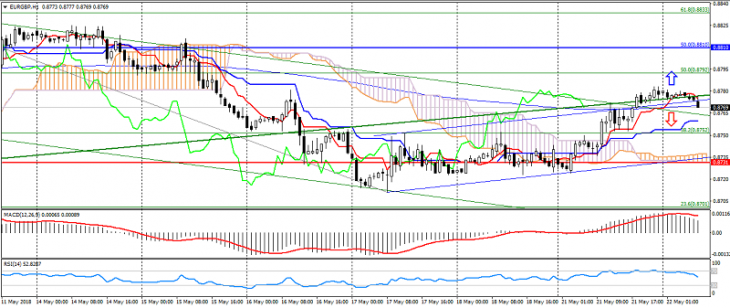

EUR GBP (current price: 0.8770)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.8780, 0.8800, 0.8820.

- Alternative recommendation: buy entry is from 0.8750, 0.8730, 0.8700.

The pair is limited by overbought and upward dynamics on the expectation of data on the UK.

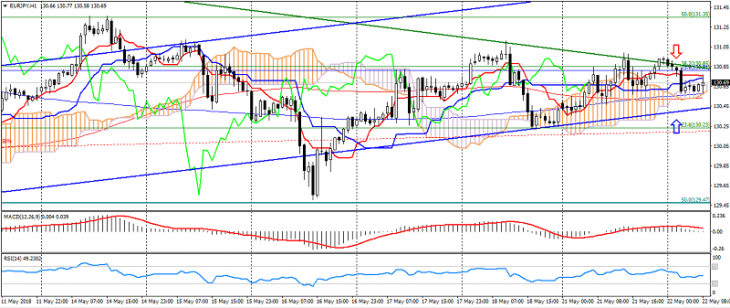

EUR JPY (current price: 130.70)

- Support levels: 130.20, 128.50, 126.80.

- Resistance levels: 133.00, 134.50, 136.80.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 130.80, 131.10, 131.40.

- Alternative recommendation: buy entry isfrom 130.40, 130.20, 130.00.

The pair moves in the sideways triangle, maintaining uncertainty.

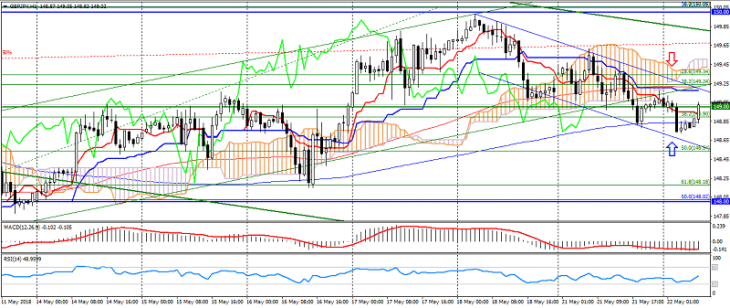

GBP JPY (current price: 149.00)

- Support levels: 146.00, 144.50, 143.50.

- Resistance levels: 148.00, 150.00, 151.50.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 149.20, 149.50, 149.80.

- Alternative recommendation: buy entry is from 148.60, 148.40, 148.20.

The pair moved into a correction phase after a two-week growth.

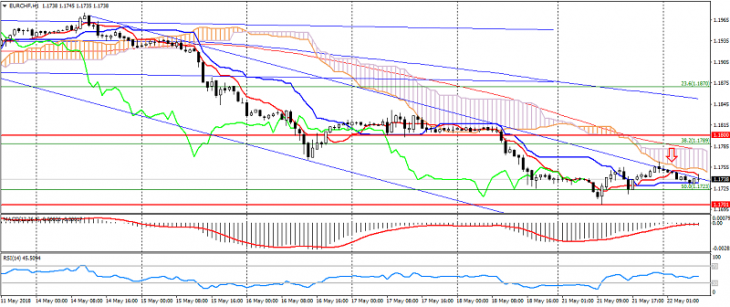

EUR CHF (current price: 1.1740)

- Support levels: 1.1880, 1.1800, 1.1700.

- Resistance levels: 1.2030, 1.2100, 1.2150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1760, 1.1780, 1.1800.

- Alternative recommendation: buy entry is from 1.1700, 1.1680, 1.1660.

The pair remains under pressure from the downtrend, despite a significant oversold.