Not bright prospects of black gold. Weekly review of WTI oil futures.

Good afternoon! With you Andrew Green.

At the beginning of this article I would like to admit: I have never seen crude oil in my life … Yes, that’s true). But so much has already earned on it, that it would be possible to fill a small oil storage). One of the many advantages of stock trading – we very often earn on what we do not see and not able to touch. But the profit from trade is a very real material benefit for us, which come to our lives and the lives of our loved ones.

The oil market, against the backdrop of a general mess in the stock markets around the world, has lost some of its position as the main driver. All attention, on the same arrangements of the main exporters and producers of the OPEC countries and non-OPEC countries, led by Russia. It seems that they began to act and produce the result of restrictions on the production and processing of oil, as they immediately joined the general holiday of rising oil prices and American oil shale miners, led by Baker Hughes (the third largest oil and gas service company in the world after Schlumberger and Halliburton.The list of services of the company includes drilling, stock assessment, development of deposits, etc. The company operates in more than 90 countries around the world).

As a result, the number of working oil platforms has grown to three-year highs – 798 units! Such rates of increase in production in the United States, in fact, can nullify all attempts by traditional oil producers to limit their own production volumes. Although the OAU and Russia confirm the desire to extend quotas for oil production by the end of the year, the position of Saudi Arabia and several other OPEC members is by no means so unambiguous. And, of course, it is necessary to take into account the political factor of pressure by low prices for energy resources, to such countries as Iran and the Russian Federation. For the US, the oil market is another tool for building up its foreign policy status.

The following week will traditionally provide us with the following sources of information on the oil market:

- Wednesday, February 21, 2013 – data from the American Petroleum Institute, a weekly report on oil supplies;

- Thursday, February 22, 2018 – a weekly report on US stocks from U.S. Energy Information Administration;

- Friday, February 23, 2013 – data from Baker Hughes, about the change in the number of operating oil platforms in the US for the week.

The standard set with a deviation for 1 day, in connection with the weekend in the US. Monday, February 19, 2013 – President’s Day.

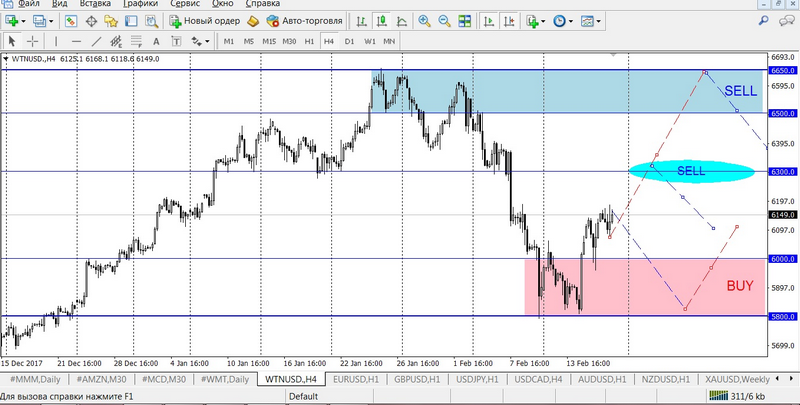

Now a little about technical analysis. Let’s take a look at Figure 1, the timeframe of H4, on WTI futures contracts. For an experienced eye, everything, in general, is understandable).

Minima for two weeks in a row formed a good support zone around 5800 (58.00 USD). In potential, the breakdown of this zone will give an impulse for movement to a very beautiful shopping area around 55.00.

Nevertheless, after double-tapping, the price chart rushed up to the resistance line, which two weeks earlier served as a breakdown line for the double top, – 63.00. Here I am considering short-term positions for sales with small stops. But the main option for sales, in the case of a breakdown of 63.00 is of course the multi-year highs of 66-67.00. Here we settle down to 70.00, with cut-off only above 72.00. For such a trade, substantial capital is needed, no less than 30000.00 USD, and only thanks to the leverage from partners of the brokerage company Ester. For those who have less capital, I recommend that you consider the following options for trading.

Examples of transactions:

- SELL limit 6300, SL 6450, TP 6100

- SELL limit 6600, SL 6700, TP 6400

- BUY limit 5850, SL 5750, TP 6100

I will be paraphrasing Mayakovsky Vladimir Vladimirovich a bit:

“… Trade always, trade everywhere, trade without no doubt …”

Cast away your doubts! Only by trying, we can conclude –

it is worth it, or not.

To argue about trading from the words of others it’s all the same if

you try the taste of the cake by some touches.

Andrew Green