The Canadian dollar pending a meeting of the Bank of Canada

From tomorrow’s publication of the minutes of the meeting of the Bank of Canada is expected to raise interest rates in Canada by 25 bp. to the level of 1.25%. Also, the Bank of Canada report and accompanying speech will be published.

Despite the importance of news, the dynamics of the pair USD / CAD remains very low-key and is limited by the lateral trend of the previous day. The expectations of the market for raising rates are already partially taken into account in the cost of the Canadian. The question on the Canadian economy and the existing risks of the dissolution of trade relations between the United States and Canada, which will largely affect the dynamics of the Canadian currency, remain questionable.

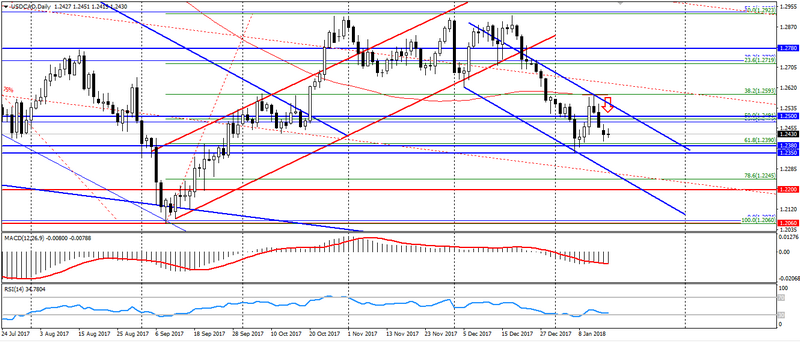

The dynamics of the pair USD/CAD remains in a limited downtrend from the beginning of December, which corresponds to a global downtrend. The main support for this pair are the levels: 1.2380 and 1.2350. The breakthrough of these levels, in the long term, will open the way to the levels of 1.2240-00 and 1.2060-50. Resistance levels are: 1.2480-1.2500 and 1.2530-40. In case of a negative report, the CBA of Canada can cause a test of these levels, but will maintain a downtrend.

Fig. USD/CAD. The current price is 1.2430.

Hanzenko Anton