Analysis of cross-rates in relation to major currency pairs. Anton Hanzenko.

Having become acquainted with the features of cross-rates and their peculiarities, it becomes clear that the connection between crosses and major currency pairs is very significant. This relationship can be used in deeper technical analysis of specific currencies. And the analysis of cross-rates regarding the major currency pairs will help.

The analysis of currency pairs with the help of cross-rates has the main goal – to determine the strength (demand) of a currency in relation to others, which will eventually reveal the leaders and outsiders of growth.

Analysis of cross-rates based on specific examples

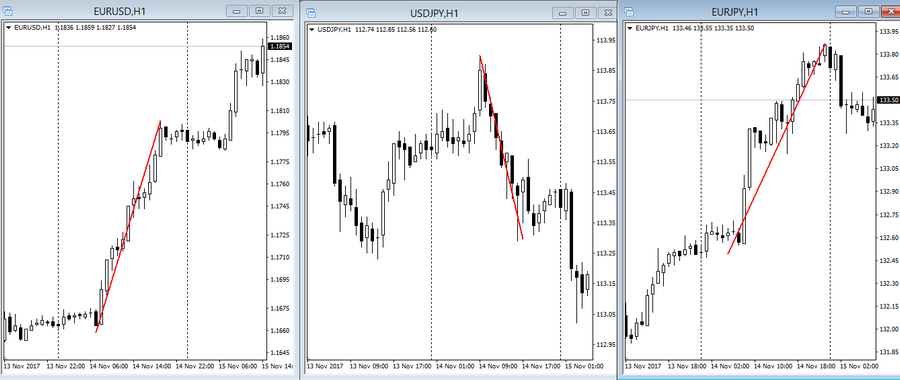

For example, EUR/USD and USD/JPY pairs will be needed to analyze the EUR/JPY cross. In fact, the euro and the yen will be analyzed against the US dollar. It is also possible to reverse the principle of another currency. For example, EUR/USD and USD/JPY pairs will be needed to analyze the EUR/USD relative to the yen.

Accordingly, if we see the strengthening of the euro against the US dollar and the yen, one can expect the dollar to fall against the yen. Because of the greater weakness of the American against the yen against the euro.

This approach is efficient when you need to identify the “outsider” of growth and sell it in other pairs or to identify the “leader” and buy, where it is not yet overbought.

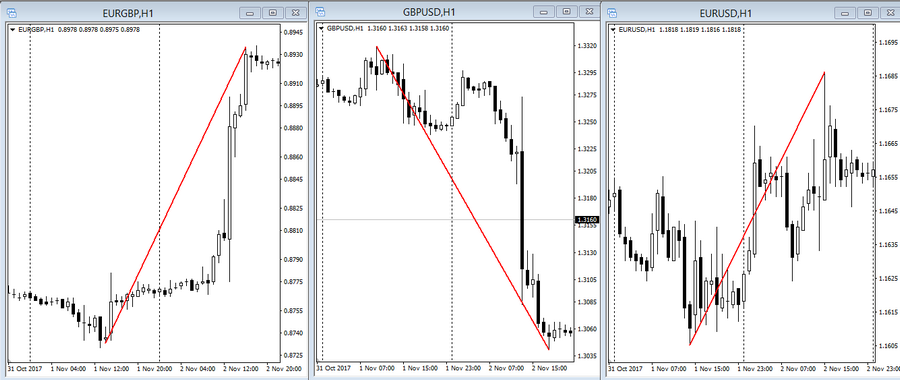

Comparing the euro and the British pound against the US dollar, one can note the significant weakness of the pound against the euro and the dollar, but a slight advantage of the euro over the dollar.

This is expressed in multidirectional fluctuations on the EUR/USD pair. Specifically in this case, the driver of the decline was the sale of the British pound, and the advantage of the euro over the dollar was due to fundamental factors.

This analysis is very subjective and will not give exact entry and exit points for deals, but will allow you to orient yourself in the market in a situation of changing the trend or news output, thereby eliminating false signals.

In addition, the analysis of cross-rates can be applied together with trade in related pairs. Let’s say that we decided that the British pound remains under the pressure of the euro, but this cross (EUR/GBP) is in a significant overbought near strong resistance levels. In this case, it is worth to sell GBP/USD and buy EUR/USD, which in the end will bring profit in the sum of these two transactions. Even if one of them is less profitable.

This approach is widely used by professional traders and requires profound knowledge in cross-rate trading, some of which you can find in the Trader’s Blog.

Hanzenko Anton