Trend and advantages of its understanding. Alexander Sivtsov.

Both an experienced trader and a beginner knows that the price moves in three main directions: the downtrend and uptrend, as well as the sideways or flat. The definition of direction in the market itself is the basis for the formation of a future trading strategy, both in the short and in the long term.

A downtrend is a price movement in the market, as a result of which the price of an instrument steadily decreases and the formed highs are predominantly lower than the previous ones. With this movement a downward channel forms and makes it possible to search for entry points into the market for the further sale of the instrument.

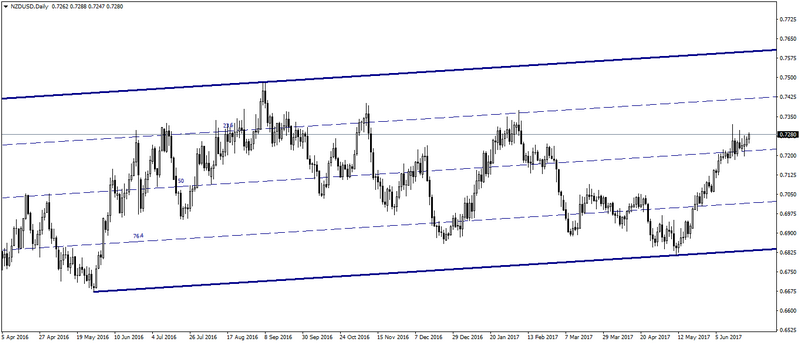

An uptrend is a price movement in the market in which the price of an instrument rises, as a result of which lows are formed, mostly higher than the previous ones. As a result of this movement an upward channel forms and makes it possible to determine the price for entry points into the market for further growth of the instrument price.

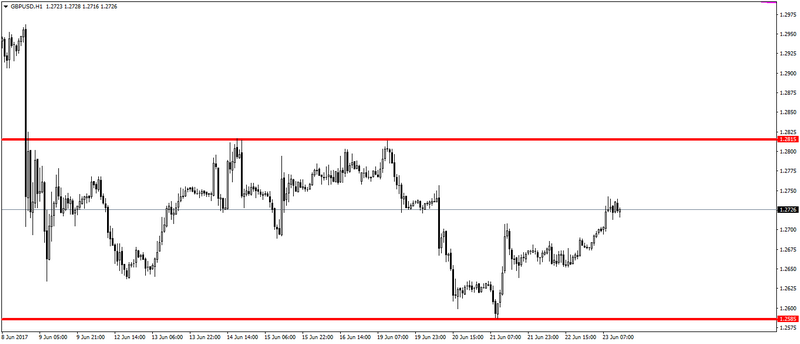

Sideways trend or flat – a balance between trade of buyers and sellers. Flat is formed in the absence of significant fundamental factors on the market, due to which bulls or bears dominate. The advantage of flat is that you enter the market with both buying and selling, that increases the number of potential transactions compared to the uptrend or downtrend.

It is important to distinguish between flat and consolidation in the market, both price movements are sideways, and the difference is in the width of the channel. During consolidation, the channel is rather narrow, in which it is not recommended to trade, since the price can break through at any time. The minimum flat width for trading with a more balanced risk is 35 points. And the wider is the channel, the stronger are the support and resistance levels.

When trading with a trend or in a flat, it is worth considering that at different time intervals there is both the same and a different tendency, which in certain cases can reinforce one or another signal to enter the market. Suppose if the resistance lines of the channels built at different time intervals converge at one point – it greatly enhances the sell signal, exactly as with the crossing of the support lines and buy signals.

When trading, remember that the market is driven by the foundation, but only by the correct technical analysis shows the entry point. Get training in Еster Holdings Inc. to improve your technical analysis skills and to increase your deposit in the future.

Alexander Sivtsov