Тechnical analysis of currency pairs (Anton Hanzenko)

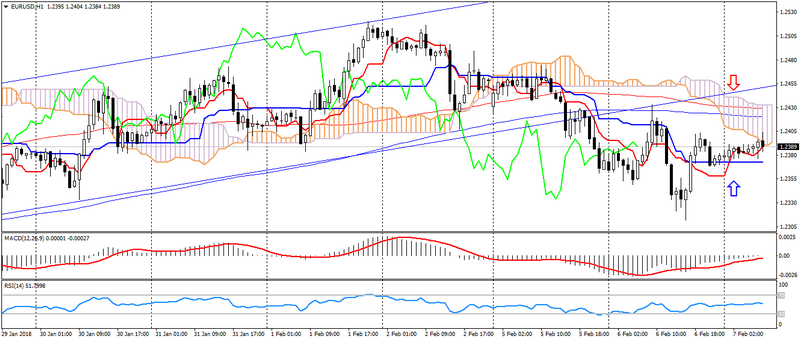

EUR USD (current price: 1.2390)

- Support levels: 1.2100 ( September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12,26,9) (signal-upward movement): the indicator is below 0, the signal line has left the histogram bar. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement, flat): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2420, 1.2450, 1.2480.

- Alternative recommendation: buy entry is started from 1.2350, 1.2320, 1.2270.

The euro after yesterday’s mixed volatility is traded in a sideways trend, keeping the potential for growth on the formation of the reversal pattern.

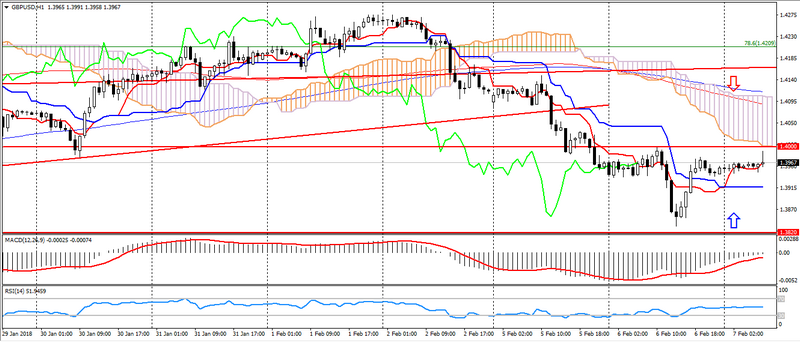

GBP USD (current price: 1.3970)

- Support levels: 1.4000 (April 2016 minimum), 1.3820, 1.3650 (September 2017 maximum).

- Resistance levels: 1.43500, 1.4500, 1.4750 (May May 2016 maximum).

- Computer analysis: MACD (12,26,9) (signal – upward movement): the indicator is below 0, the signal line has left the histogram bar. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement, flat): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.4000, 1.4040, 1.4090.

- Alternative recommendation: buy entry is started from 1.3920, 1.3900, 1.3850.

The British pound is also traded with a strengthening on the correction of the American and the pair as a whole after the decline. In this case, this pair is limited to bullish divergence, which can enhance the correction.

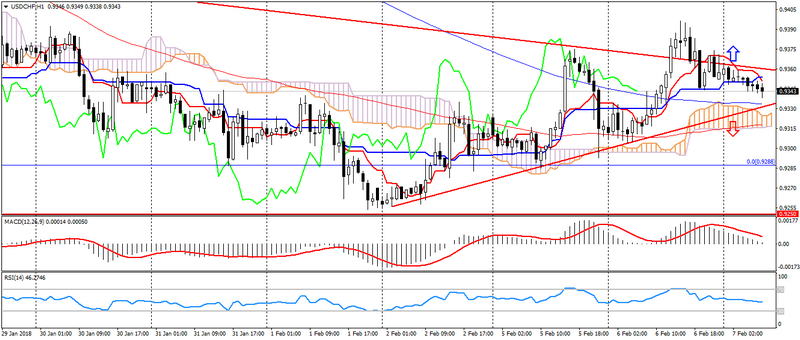

USD CHF (current price: 0.9340)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels:, 0.9550, 0.9800, 1.0030 (November 2017 maximum).

- Computer analysis: MACD (12.26.9) (signal – downward movement): the indicator is above 0, the signal line has left the histogram bar. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal is a downward movement, flat: the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.9370, 0.9390, 0.9420.

- Alternative recommendation: buy entry is started from 0.9330, 0.9300, 0.9280.

The Swiss franc maintains a positive momentum due to the fears and a downtrend in the pair.

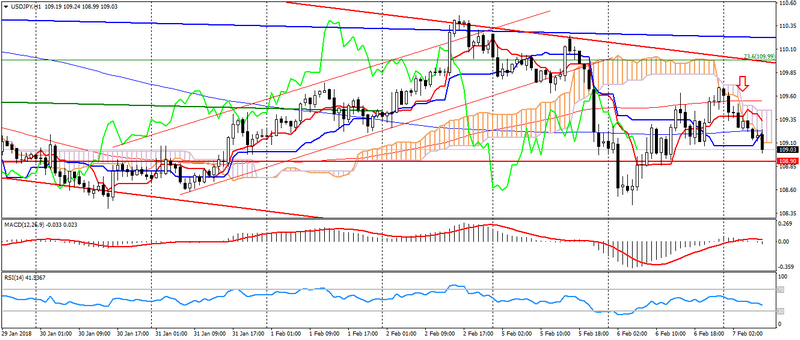

USD JPY (current price: 109.00)

- Support levels: 108.90, 108.10 (April 2017 minimum), 107.30 (2017 minimum ).

- Resistance levels: 110.80, 111.70 (October 2017 minimum), 113.70.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the histogram bar. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement, flat): the Tenkan-sen line above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 109.30, 109.60, 109.80.

- Alternative recommendation: buy entry is started from 108.90, 108.60, 108.20.

The Japanese yen is strengthening across the whole spectrum of the market due to the flight of investors from risks, despite the reduction in the tension in the stock exchanges.

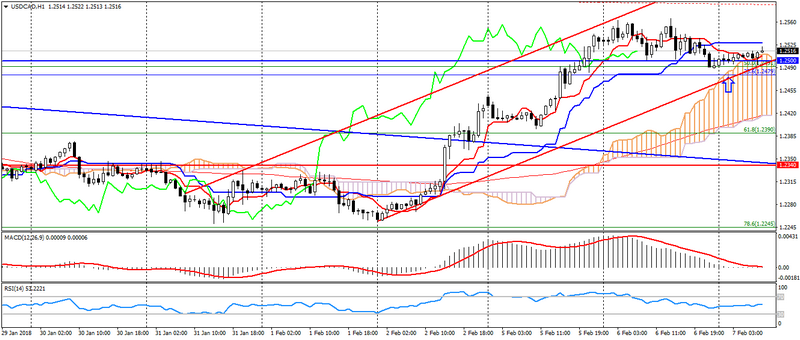

USD CAD (current price: 1.2510)

- Support levels: 1.2340.1.2200, 1.2060 (2017 minimum).

- Resistance levels: 1.2500, 1.2650, 1.2770 (August 2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9,26,52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2530, 1.2560, 1.2600.

- Alternative recommendation: buy entry is started from 1.2490, 1.2450, 1.2400.

The Canadian dollar since the beginning of the day remains under pressure of fears and flight of investors from risks. Also, this pair remains in an uptrend, which exerts additional pressure on the Canadian.

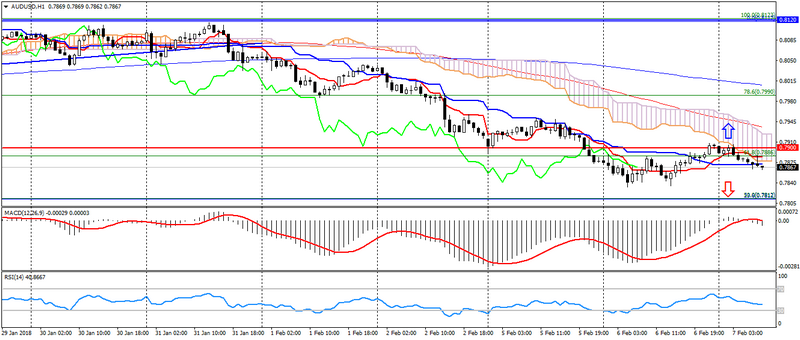

AUD USD (current price: 0.7860)

- Support levels: 0.7900, 0.7700 (March 2017 maximum), 0.7500.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7900, 0.7940, 0.7970.

- Alternative recommendation: buy entry is started from 0.7840, 0.7800, 0.7780.

The Australian remains under pressure of flight from risks, but in conditions of considerable oversold of the pair and the return of optimism to the market correction is possible.

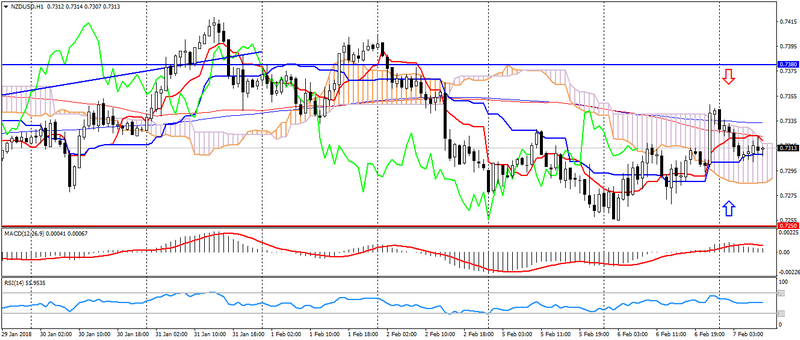

NZD USD (current price: 0.7310)

- Support levels: 0.7250, 0.7130 (August 2017 minimum ), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-upward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7330, 0.7350, 0.7380.

- Alternative recommendation: buy entry is started from 0.7290, 0.7270, 0.7250.

The New Zealand dollar has been weakening since the beginning of the day due to the fears, but the further dynamics of the pair is limited by an uptrend.

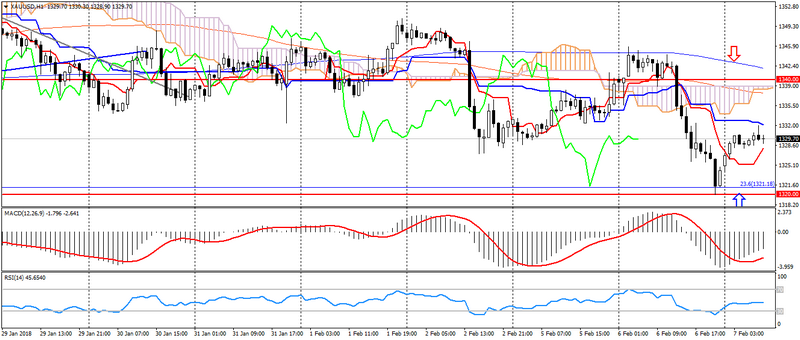

XAU USD (current price: 1329.00)

- Support levels: 1340.00, 1320.00, 1303.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the histogram bar. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal-going traffic): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1333.00, 1335.00, 1340.00.

- Alternative recommendation: buy entry is started from 1325.00, 1320.00, 1326.00.

Gold maintains a positive dynamic on investors’ flight from risks, but is limited to the existing trading range.