Results of the Bank of Canada meeting

As expected, the Bank of Canada raised the interest rate from 1.00% to 1.25%, thereby supporting the Canadian dollar. That is why the pair USD/CAD fell sharply to the level of 1.2362, losing about 100 positions . Then the pair sharply shifted to growth due to the publication of the Bank of Canada’s report on monetary policy. The report pointed to a significant growth in the market and the approach of inflation to the target level.

The market participants was focused on uncertainty regarding NAFTA, which could put pressure on the prospects for the economy. Also, the protocols did not clarify the situation with a further increase in interest rates. The Central Bank management reported that it is necessary to maintain a soft policy to support economic growth. The Bank of Canada will be cautious about further interest rate hikes, focusing on incoming economic data.

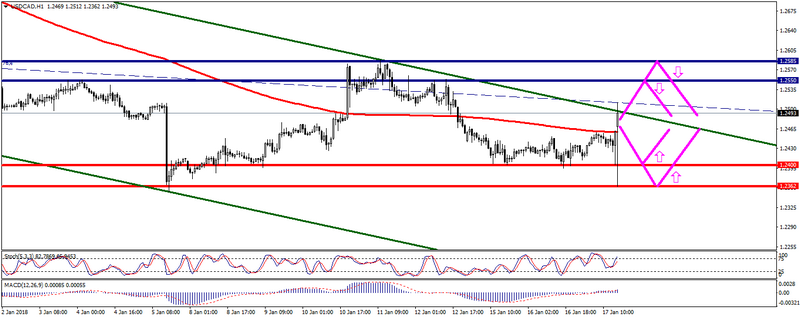

Technical Analysis: Despite the weakening of the Canadian, the pair USD/CAD maintains a downtrend in the short term. The main resistance levels are 1,2550; 1.2585. Support levels are considered 1,2400; 1.2362.

Fig. USD/CAD. The current price is $ 1.2493.

Alexander Sivtsov