Expectations from the July Fed meeting

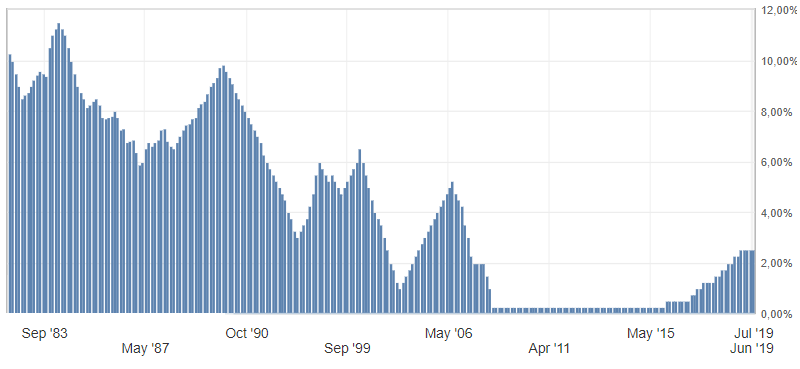

After a series of speeches by the Fed Chairman Powell, who hinted about the possibility of lowering key interest rates in the United States, expectations for rates cuts increased sharply in the market, which in fact took into account the decrease in the key interest rate by 25 b.p., from the mark of 2.50% to 2.25%. Despite the fact that the July rates cuts has already been taken into account by the market, there is a high degree of uncertainty in the US Federal Reserve future monetary policy.

Market expectations

To begin with, the last time the Fed lowered rates in December 2008, eleven years ago. And this decision was due to the crisis. At the moment, we are not talking about a similar situation with the crisis. The US trade war remains the main risk of a slowdown in the global economy.

Fig. 1. Chart of changes in the US Federal Reserve rates

There are two main opinions in the market regarding the US monetary policy after the very soft rhetoric of the US Federal Reserve Chairman Powell:

- Rates cuts at the US Federal Reserve July meeting by 25 b. n. and another 25 b. n. in September or December.

- Rates cuts in the US by 50 b.p. immediately at the July meeting and not affected by the rate by the end of the year.

The first option looks more believable, and I am also more inclined to it. In addition, this development is more consistent with the restrained policy of the US Federal Reserve to lower rates. But what is important, such a development of events keeps the place for the Fed to maneuver. So, for example, in the face of a change in market sentiment and the political situation in the United States, the Fed may reconsider its views on the market by the end of the year and refuse or strengthen the stimulus of the economy.

The second option looks tougher and more favourable for the Trump administration. If it will be implemented, it will collapse the US dollar across the market significantly. Such a rapid decline in interest rates will virtually cancel all questions for the Fed to change monetary policy by the end of the year.

But the Fed has resorted to such a rapid reduction in interest rates only during the crisis period. In addition to lowering the US dollar, it may cause market concerns regarding a more significant slowdown in the US economy.

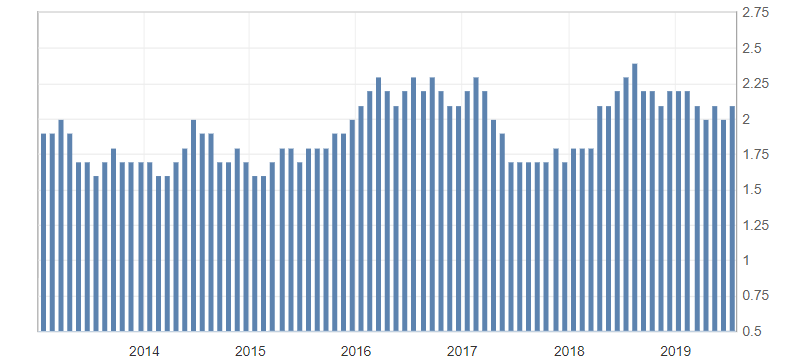

Despite the credibility of sources who expect lower rates in the United States. They are all based solely on the soft rhetoric of the Fed. Powell expressed doubt about the growth of consumer inflation in the United States. The latter, in turn, looks more confident than at the end of 2017 and early 2018.

Fig. 2. Core consumer price index (CPI) in the United States (yy)

Anton Hanzenko