The Envelopes indicator is another simple and effective indicator. Anton Hanzenko.

The Envelopes Indicator (Moving Average Envelopes) is a trend indicator that creates a flexible channel in which the price is most of the time. This indicator is based on moving averages like the Bollinger Bands indicator. It is a very common and useful indicator of technical analysis.

The Envelopes indicator is flexible in application, as well as moving averages, and is suitable for any currency pairs and timeframes. With proper settings, the indicator shows a decent result.

Indicator parameters:

Period – actually sets the moving average parameter. The smaller the value, the more sensitive the indicator is to the signals, and the longer the period, the less sensitive the indicator.

Shift – shifts the indicator on a time scale depending on the value. A negative number shifts the indicator to the left, a positive number – to the right.

The MA method is the movings calculation method.

Apply to – the price value that will be used.

Deviation – the magnitude of the shift along the price axis. Sets the channel width. The parameter is selected visually from the instrument volatility.

Trading on the Envelopes indicator:

There are two main trading strategies for the indicator:

- Trade within the Envelopes price channel

- Break through the price channel Envelopes

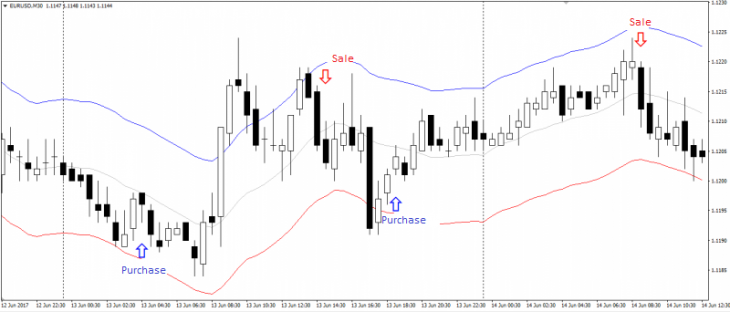

Trading within the price channel is usually suitable for short-term transactions. The essence of trade within the Envelopes price channel lies in sales, when the price is near the upper border of the corridor, and in purchases when the price is near the lower bound.

This method is great for a restraint trading in a sideways trend. In addition, the Envelopes indicator indicates the formation of a flat on the market by the horizontal location of the channel borders. The slopes of the channel indicate the possibility of the end of the side trend and the formation of a trend.

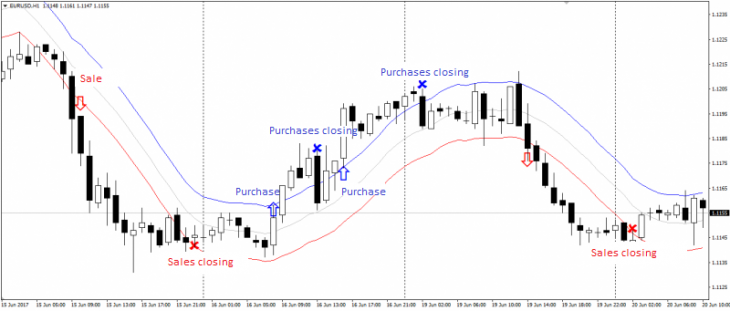

Trading on breakout the Envelopes price channel is suitable for medium-term and long-term transactions. The essence of trading to break through the price channel is to fix the price above the upper or lower border of the corridor, which indicates further movement outside the corridor. When price return to the corridor it indicates a slowing trend and serves as a signal to close the transaction.

Above is an example of trading for breaking through the price channel, but, as you can see, both options of trading are very connected and can be used simultaneously, alternating with each other.

Disadvantages of the indicator:

The Envelopes indicator is lagging as the moving averages, so it can cause some difficulties. You can avoid problems using the parameter settings, increasing its sensitivity, but in this case, it is worth remembering the increase in the number of false alarms.

The second significant drawback of the indicator may be the ambiguity of the signal or its falsity, so the indicator should be used in conjunction with other indicators that will allow you to filter out false signals.

You can learn more about this indicator and not only on training courses from Ester Holdings Inc.

Anton Hanzenko