Expectations from the USD/JPY pair

The state of the pair USD/JPY remains extremely interesting from the standpoint of holding a long-term position, which is caused by a fracture of the downward trend in this pair and the discrepancy between the monetary policies of the US and Japan.

It’s not a secret that the market expects the US Federal Reserve to raise the interest rate in December to 1.50% at a time when the Bank of Japan continues to adhere to the policy of negative interest rates. Bank of Japan rate is -0.10%.

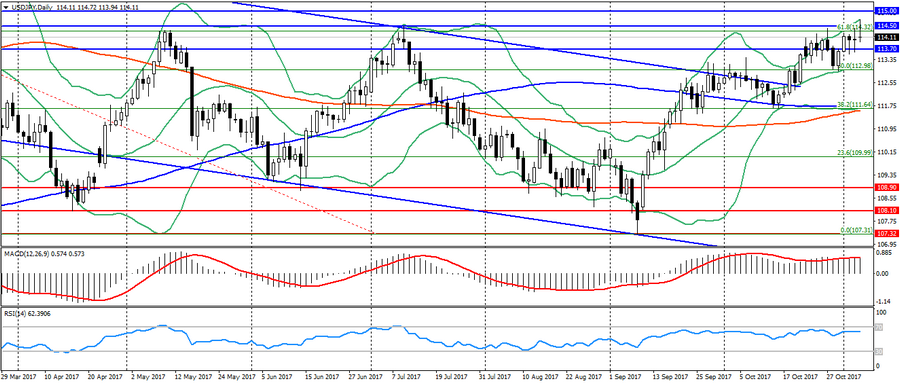

These fundamental factors also found a reflection in the technical picture of the pair USD/JPY. So, recently this pair completely broke the downward trend, which was traced from the end of 2016. That indicates the formation of a new uptrend.

The zone 114.30-50 is on the way to further strengthening of the pair USD/JPY. Consolidating above this zone, opens the way for buyers to mark 115.00, 115.50 and 116.30. In addition, such a movement indicates a more global movement of this pair to the levels of the end of 2016, namely 117.00 and 118.50.

In addition to expectations, the bullish trend of USD/JPY remains in a limited overbought zone amid the market’s unwillingness. So, it is possible to form a correction from it to the support of 113.70-50 for repeated testing of important resistance levels.

For more details about the market situation, follow https://esterholdings.com/en/category/mneniya-ekspertov/

Hanzenko Anton