U.S. employment data for February

- Average hourly earnings (m/m) (Feb), fact 0.4%, forecast 0.3%.

- Building permits (m/m) (Jan), fact 1.4%, forecast -2.9%.

- Building permits (Jan), fact 1,345M, forecast 1,289M.

- Housing starts (January), fact 1,230M, forecast 1,197M.

- Housing starts (m/m) (January), fact 18.6%, forecast 9.9%.

- Nonfarm payrolls (Feb.), fact 20K, forecast 181K.

- Private nonfarm payrolls (Feb), fact 25K, forecast 170K.

- Unemployment rate (Feb), fact 3.8%, forecast 3.9%.

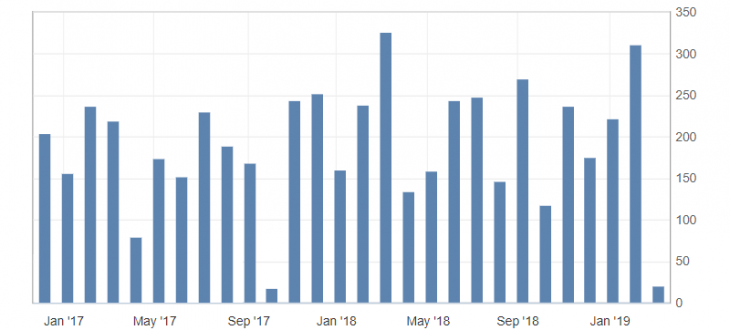

The US employment report for February turned out to be quite ambiguous. The main negative note of the report was the data on the change in the number of people employed in the US non-farm sector, which fell to the minimum values of October 2017. At the same time, other significant parameters of wage growth and unemployment remain at a very optimistic level.

Separately, it is worth noting construction data in the United States, which are not comparable to employment, but were very positive and partially smoothed over ambiguous employment data in the United States.

Fig. 1. Graph of changes in the number of people employed in the US non-farm sector

The main pressure on the dollar comes from the low level of new jobs in the US non-farm sector. It is also worth noting that the American dollar is overbought, that puts an additional pressure on the dollar. At the same time, this decline in the dollar is impulsive and will be limited by a number of positive data. Therefore, the decline in the US dollar index will be limited to support levels: 97.20 and 97.00.

Fig. 2. The US dollar index chart. The current price is 97.30 (10-year government bonds yield is the blue line)

Read also: “State bonds, as a factor to buy one or another currency “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Emerging markets and their prospects

- The US Dollar Index (DXY) as an auxiliary indicator for trading in commodity currencies

- To increase or not to increase, the difficult choice of the US Federal Reserve

Current Investment ideas: