U.S. GDP data

- Core durable goods orders (m/m) (November), fact -0.3%, forecast 0.3%.

- Durable goods orders (m/m) (November), fact 0.8%, forecast 1.6%.

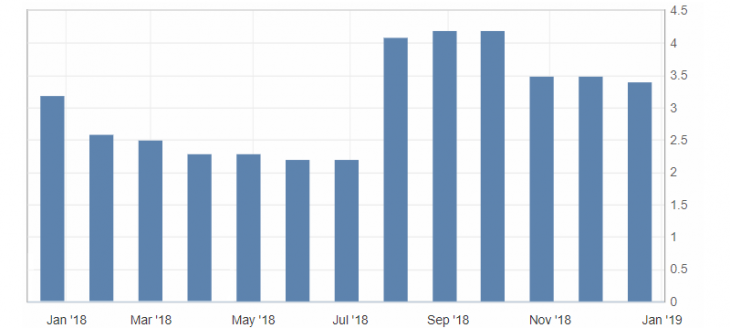

- GDP (q/q) (Q3), fact 3.4%, forecast 3.5%.

- GDP deflator (q/q) (Q3), fact 1.5%, forecast 1.4%.

Data on durable goods orders and the US GDP for November were very negative, confirming market concerns about the slowdown in the US economy. It is worth noting the recession of GDP growth in quarterly terms, which corresponds to the overall upward trend, but limits the possibilities of strengthening the US currency.

Fig. 1. U.S. GDP (q/q)

The dollar index and the market in general have reacted very discreetly to weak US statistics, which is due to the correction of short positions on the dollar before the Christmas holidays, which will significantly extend the upcoming weekend. Therefore, a continuous correction can be traced in the US dollar index, which is limited to resistance levels 96.70. The downward trend of the US dollar remains relevant.

Fig. 2. The US dollar index chart. The current price is 96.60 (10-year government bonds yield is the blue line)

Read also: “Fundamental Analysis – Basics and what to pay attention to the trader”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Expectations from the USD/CAD pair at the end of the year!

- Safe assets and how to trade them in the Forex market.

- Risky assets and how to trade them in the Forex market.

Current Investment ideas: