U.S. Business Activity Data

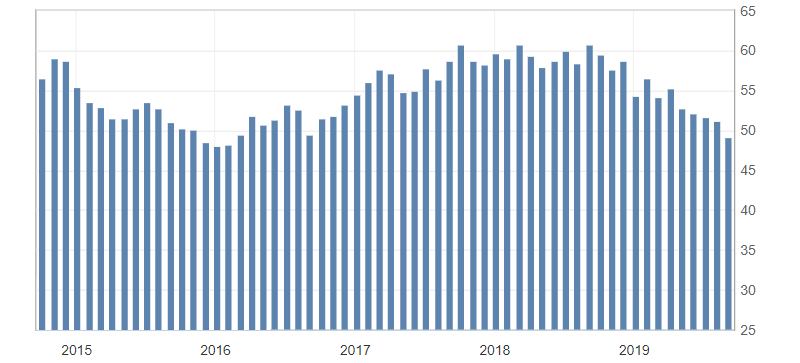

- Manufacturing PMI (Aug), fact 50.3, forecast 49.9.

- ISM Manufacturing Employment Index (Aug), fact 47.4, previous 51.7

- ISM Manufacturing PMI (Aug), fact 49.1, forecast 51.1.

US Manufacturing Sector Activity (PMI) continued to decline, dropping to a five-year low, confirming a slowdown in the US manufacturing. Against the background of these statistics, fears about US economic growth and the likelihood of stimulating the economy by the US Federal Reserve have sharply increased.

Fig. 1. US Manufacturing PMI

In the face of escalating risks in the United States, the American currency was under the pressure. The US dollar index against a basket of competitors accelerated the decline, forming a correction after growth. Despite the pressure of correction for the dollar, its decline is limited by support levels: 99.00 and 98.80. And the dynamics of the index will be limited by lateral dynamics from 99.40-20 to 99.00-98.80.

Fig. 2. The US dollar index chart. Current price – 99.00 (10-year US government bonds yield – blue line)

Read also: “Trade war.

Relations between Japan and South Korea “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Currency is a weapon in a trade war!

- How far the prospects for USD/JPY may be downward

- What does the US Fed Chairman Powell statement mean for the US dollar

Current Investment ideas: