The Bank of England and the prospects for tightening of monetary policy. Alexander Sivtsov.

In this article we will discuss one of the oldest regulatory banks in the world. Bank of England – was founded in 1694 as a private joint-stock bank. In 1946, the bank was nationalized, and in 1997 received the status of an independent regulator of monetary policy of Great Britain.

Bank of England – Management structure

The Bank of England is managed by a board of directors, which consists of the Governor, two deputies and 16 board members. All members of the board of directors are appointed by royal decree after approval by the Parliament of Great Britain. The Monetary Policy Committee (MPC) is, also, in the management structure of the bank, which usually consists of 9 members, headed by Bank of England Governor Mark Carney. To date, the committee includes 8 members. It is the Monetary Policy Committee (MPC) that is of interest to market participants, since it decide whether to change the Bank of England interest rate.

Monetary policy of the Bank of England

In 2016, after the United Kingdom decided to leave the EU, the Bank of England decided to lower the interest rate from 0.50% to 0.25%, to further stimulate the economy and protect it from the effects of Brexit. An inflation rate by May 2017 has reached the level of 2.9% while the data for June 2016 were at the level of 0.6%.

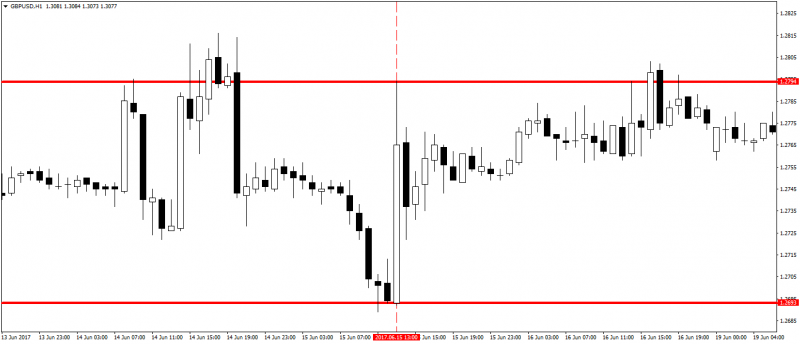

In connection with this rate of inflation, some members of the monetary policy committee began to incline to raise the interest rate to stabilize the level of inflation in the country. At a meeting of the Bank of England on June 15, 2017, 3 out of 8 members of the committee voted to raise the interest rate, which led to an increase in the British currency against the US dollar by almost 100 points.

Prospects for tightening the monetary policy of the Bank of England.

The next meeting of the Committee on Monetary Policy of the Bank of England will be held on August 3. According to forecasts, the discount rate will be kept at the level of 0.25%. But market participants will be focused on the number of votes for raising the interest rate. To date, it is predicted that only 2 members of the committee advocate an increase in the interest rate of the Bank of England. These include Michael Saunders and Ian McCafferty. Also, senior economist Andy Haldane is considering an option to raise the interest rate. Do not forget that the committee will have two dark horses. The main proponent of the interest rate increase, Kristin Forbes, will give way to Professor of Economics Silvana Tenreyro. Also, in the MPC will be a new deputy head of the Central Bank Charlotte Hogg.

How economic data can affect the increase in the interest rate of the Bank of England.

According to the latest data on inflation, the level fell in June to 2.6%, which is also partly due to a decrease in energy prices. The reduction in inflation in the UK led to an increase in retail sales, which is also one of the important indicators, as sales volume is a component of GDP. In turn, too early increase in the interest rate may have a negative impact on household spendings and reduce sales in the UK.

Conclusion

It is worth noting that at the next meeting, the Bank of England will keep the interest rate at 0.25%; In this case, if more than two members of the committee vote for the interest rate increase, the pound will receive significant support, as this will be a strong signal for the Bank of England to tighten the interest rate in the future.

Follow the Expert opinions on Ester’s website – stay up to date with top-end forecasts!

Alexander Sivtsov