Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

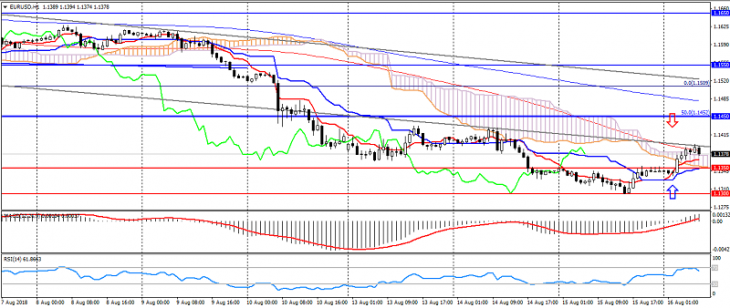

EUR USD (current price: 1.1380)

- Support levels: 1.1350, 1.1300, 1.1200.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.1420, 1.1440, 1.1480.

- Alternative recommendation: buy entry is from 1.1350, 1.1320, 1.1300.

The euro is trading with a strengthening on correction, but is limited by a downtrend and existing risks.

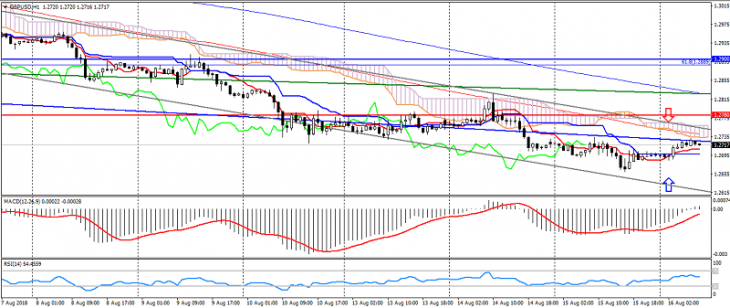

GBP USD (current price: 1.2720)

- Support levels: 1.2780, 1.2600 (June 2017 low), 1.2370 (low of April 2017).

- Resistance levels: 1.2900, 1.3050, 1.3150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2750, 1.2780, 1.2800.

- Alternative recommendation: buy entry is from 1.2690, 1.2670, 1.2650.

The British pound is trading in flat, thereby adjusting after the decline, but is limited to a downward trend.

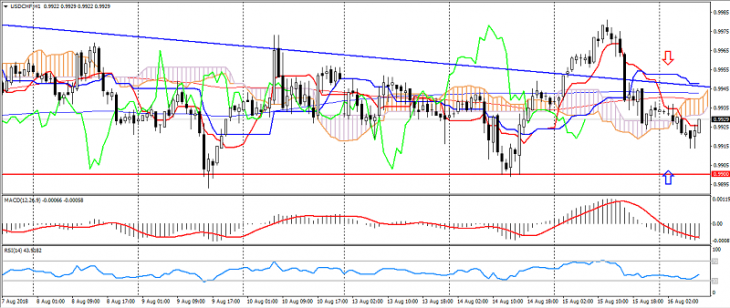

USD CHF (current price: 0.9920)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9940, 0.9960, 0.9980.

- Alternative recommendation: buy entry is from 0.9900, 0.9880, 0.9860.

The Swiss franc is trading in flat, remaining under pressure of risks.

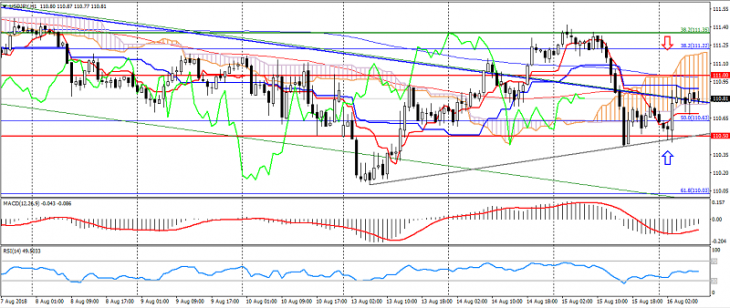

USD JPY (current price: 111.80)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 111.40, 111.60 111.80.

- Alternative recommendation: buy entry is from 111.50, 110.30, 110.00.

The USD/JPY pair is trading with a strengthening on the growth of the dollar, while not in a hurry to exit the downward channel.

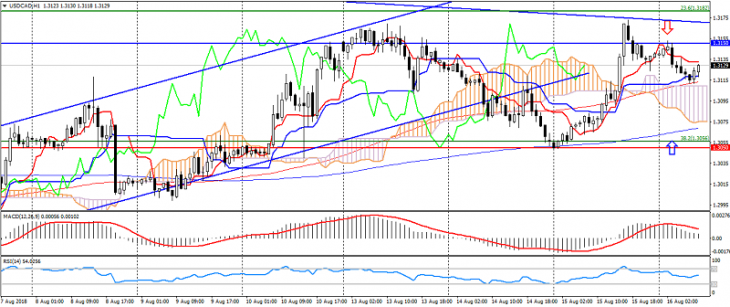

USD CAD (current price: 1.3130)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3150, 1.3170, 1.3190.

- Alternative recommendation: buy entry is from 1.3090, 1.3050, 1.3030.

The US dollar the Canadian dollar has moved to a decline from 1.1380, which may indicate the formation of a “double top”.

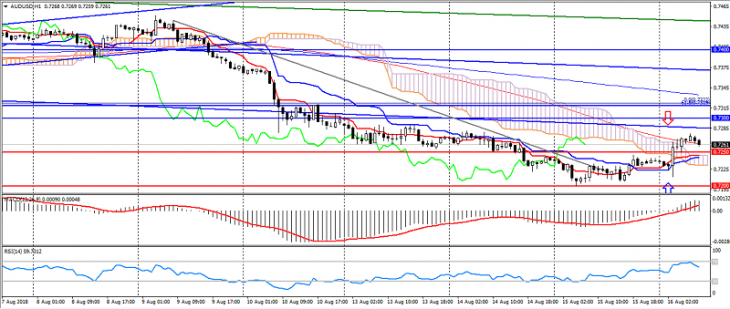

AUD USD (current price: 0.7260)

- Support levels: 0.7250, 0.7200, 0.7100.

- Resistance levels: 0.7300, 0.7400, 0.7500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7280, 0.7300, 0.7320.

- Alternative recommendation: buy entry is from 0.7250, 0.7230, 0.7200.

The Australian dollar moved to correction on the growth of optimism and positive data for Australia, but continues to be limited by a downward trend.

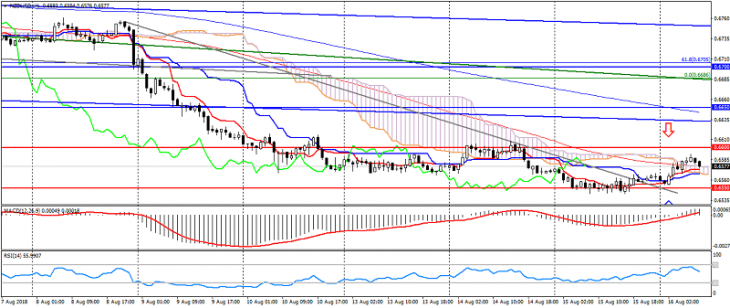

NZD USD (current price: 0.6580)

- Support levels: 0.6600, 0.6550, 0.6500.

- Resistance levels: 0.6650, 0.6700, 0.6800.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.6600, 0.6630, 0.6650.

- Alternative recommendation: buy entry is from 0.6550, 0.6530, 0.6500.

The New Zealand dollar is caught in the range of 0.6600-0.6550, keeping the potential for a decrease in risks.

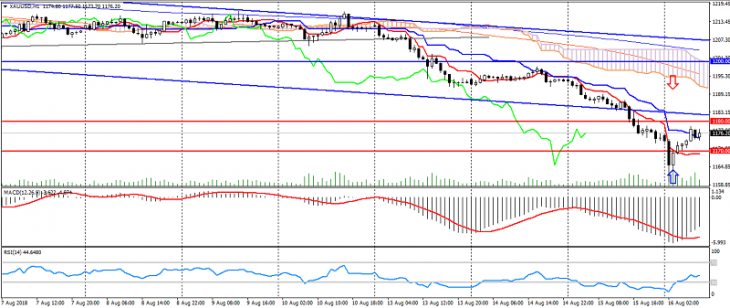

XAU USD (current price: 1176.00)

- Support levels: 1180.00, 1170.00, 1155.00.

- Resistance levels: 1200.00, 1220.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1180.00, 1184.00, 1190.00.

- Alternative recommendation: buy entry is from 1175.00, 1170.00, 1168.00.

Gold after the update of the minimum went to correction, while continuing to limit the downward trend.