Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

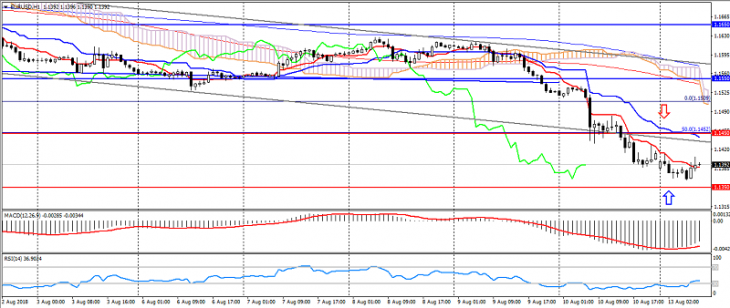

EUR USD (current price: 1.1390)

- Support levels: 1.1450, 1.1350, 1.1300.

- Resistance levels: 1.1550, 1.1650, 1.1750 (June maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1430, 1.1450, 1.1500.

- Alternative recommendation: buy entry is from 1.1350, 1.1320, 1.1300.

The euro is trading near the annual lows, limited by oversold.

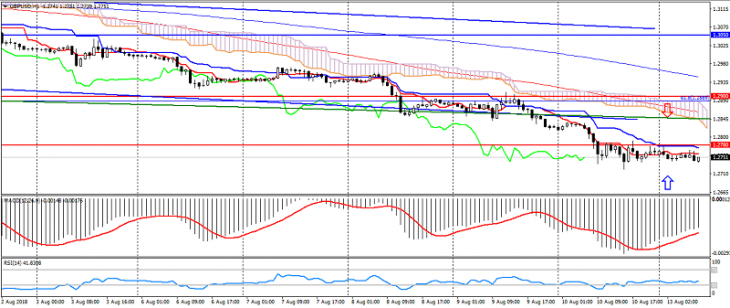

GBP USD (current price: 1.2750)

- Support levels: 1.2900 (psychological level), 1.2780, 1.2600 (the minimum of June 2017).

- Resistance levels: 1.3050, 1.3150, 1.3350 (June maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the light oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2780, 1.2830, 1.2860.

- Alternative recommendation: buy entry is from 1.2710, 1.2680, 1.2650.

British pound remains near the lows of Friday, remaining under the pressure of a downtrend.

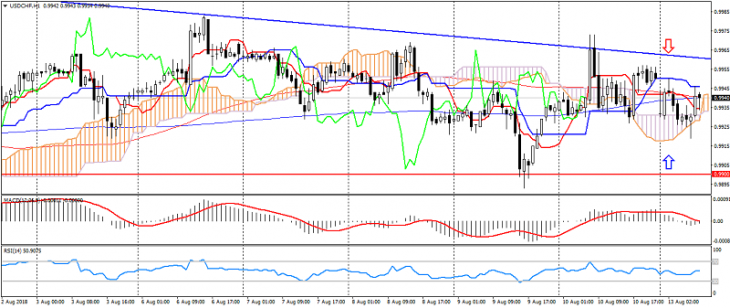

USD CHF (current price: 0.9940)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.9950, 0.9980, 1.0000.

- Alternative recommendation: buy entry is from 0.9920, 0.9900, 0.9880.

The Swiss franc is trading with a slight decrease, limiting itself to a downward trend, but at the same time remaining under pressure of risks.

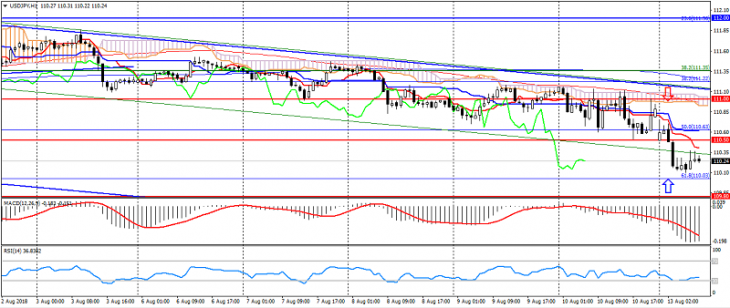

USD JPY (current price: 110.20)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 110.50, 110.80 111.00.

- Alternative recommendation: buy entry is from 110.00, 109.80, 109.50.

The US dollar the Japanese yen accelerated the decline early in the day on rising risks, but is limited to oversold.

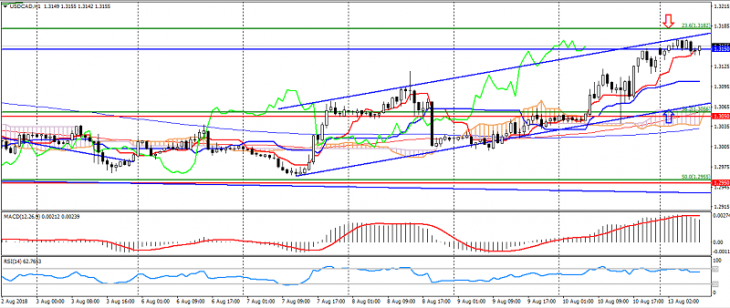

USD CAD (current price: 1.3150)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3180, 1.3200, 1.3230.

- Alternative recommendation: buy entry is from 1.3130, 1.3100, 1.3080.

A pair of US dollars the Canadian dollar is traded in an uptrend, limited to overbought.

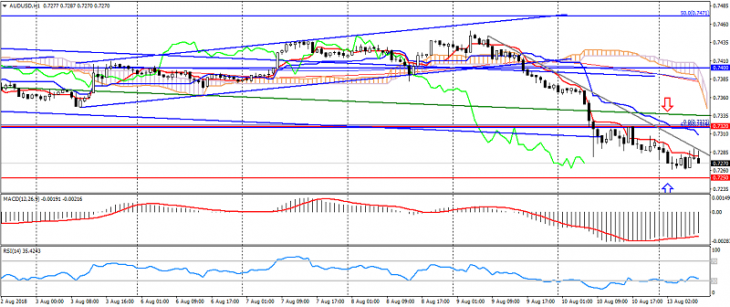

AUD USD (current price: 0.7270)

- Support levels: 0.7320, 0.7250, 0.7200.

- Resistance levels: 0.7400, 0.7500, 0.7550.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the zone of easy overselling. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7300, 0.7320, 0.7350.

- Alternative recommendation: buy entry is from 0.7250, 0.7230, 0.7200.

The Australian dollar also remains under pressure to increase risks, limiting oversold.

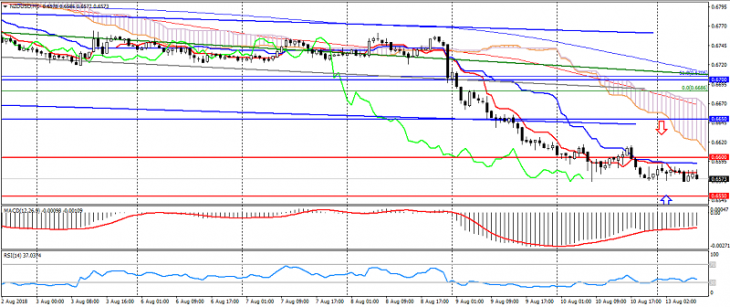

NZD USD (current price: 0.6570)

- Support levels are 0.6600, 0.6550, 0.6500.

- Resistance levels: 0.6650, 0.6700, 0.6800.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6600, 0.6620, 0.6650.

- Alternative recommendation: buy entry is from 0.6550, 0.6530, 0.6500.

The New Zealand dollar remains under pressure from risks and a downtrend.

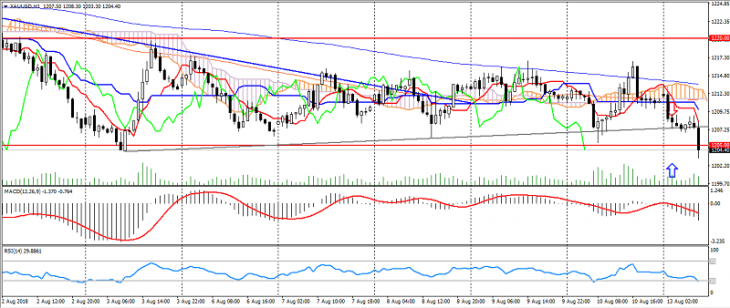

XAU USD (current price: 1204.00)

- Support levels: 1220.00, 1205.00, 1193.00.

- Resistance levels: 1240.00, 1250.00, 1265.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1208.00, 1212.00, 1217.00.

- Alternative recommendation: buy entry is from 1202.00, 1200.00, 1190.00.

Gold returned to a decline on the growth of the US dollar.