Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

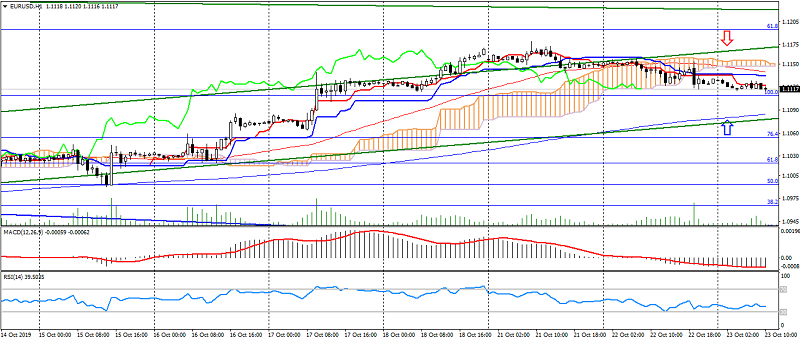

EUR USD (current price: 1.1120)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator below 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.1150, 1.1180, 1.1200.

- Alternative recommendation: buy entry is from 1.1100, 1. 10980, 1.0950.

The euro/dollar is trading down on correction, maintaining an upward trend.

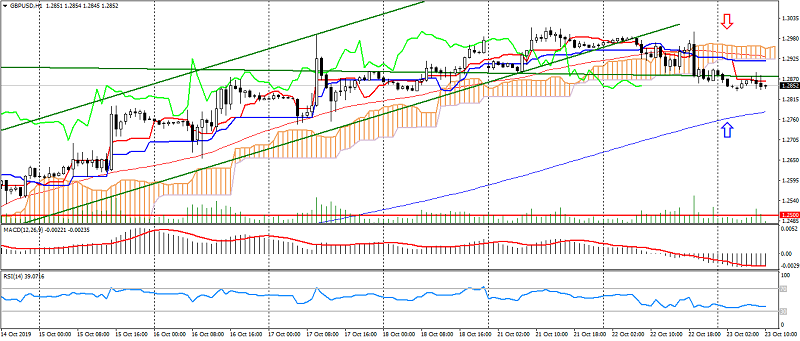

GBP USD (current price: 1.2850)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator below 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.2880, 1.2930, 1.2980.

- Alternative recommendation: buy entry is from 1.2800, 1.2750, 1.2700.

The British pound turned to correction after growth, maintaining optimism for Brexit.

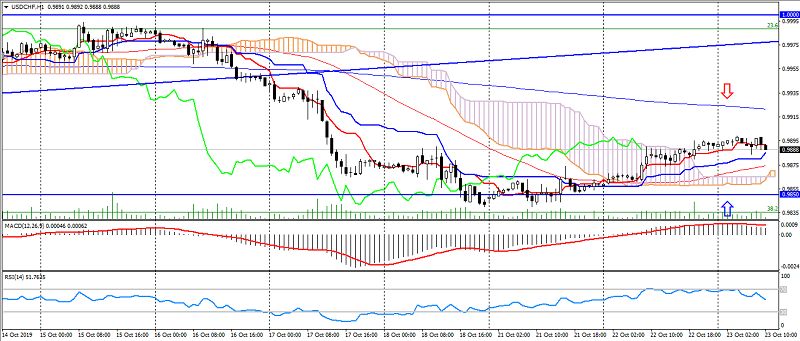

USD CHF (current price: 0.9890)

- Support levels: 0.9750, 0.9650, 0.9500.

- Resistance levels: 0.9850, 1.0000, 1.0060.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is above 0, the signal line has left the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.9920, 0.9950, 0.9980.

- Alternative recommendation: buy entry is from 0.9850, 0.9830, 0.9800.

The US dollar Swiss franc has moved to growth on the correction and recovery of the American dollar.

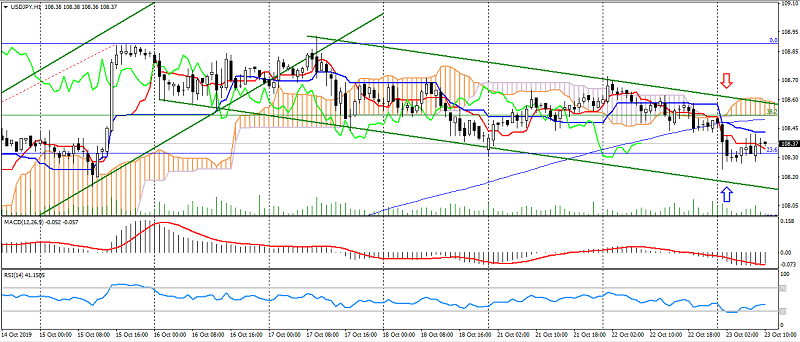

USD JPY (current price: 108.40)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is below 0, the signal line has left the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 108.50, 108.80, 109.00.

- Alternative recommendation: buy entry is from 108.30, 108.00, 107.80.

The US dollar Japanese yen remains under the pressure from downward dynamics and rising risks.

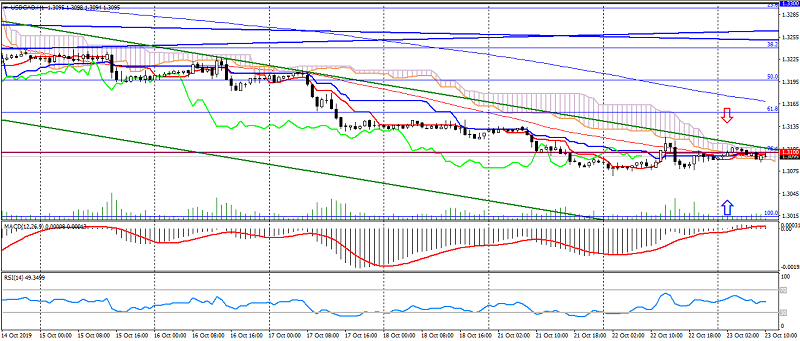

USD CAD (current price: 1.3100)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3120, 1.3150, 1.3180.

- Alternative recommendation: buy entry is from 1.3080, 1.3050, 1.3020.

The pair US dollar Canadian dollar is trading modestly on pessimism, maintaining a downward trend.

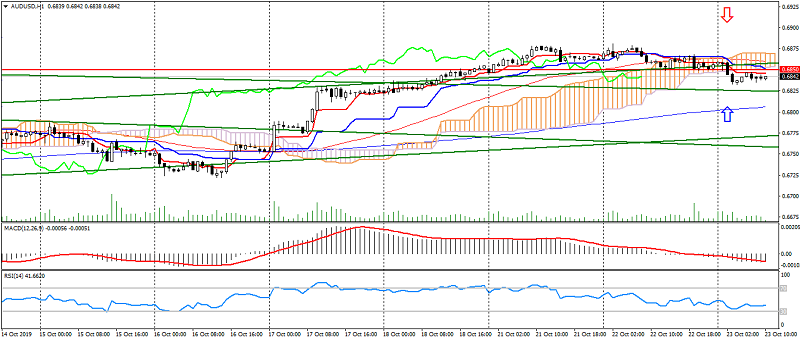

AUD USD (current price: 0.6840)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator below 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 0.6850, 0.6880, 0.6900.

- Alternative recommendation: buy entry is from 0.6820, 0.6800, 0.6780.

The Australian remains under the pressure of correction and risk, maintaining the upward channel.

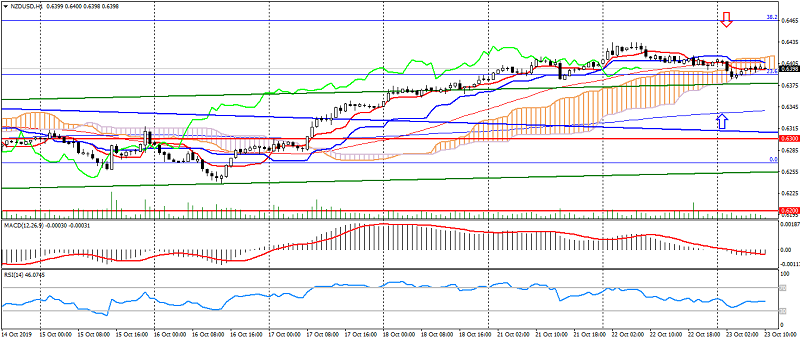

NZD USD (current price: 0.6390)

- Support levels 0.6300, 0.6200, 0.6100.

- Resistance levels: 0.6700, 0.680, 0.6950.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator below 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.6430, 0.6450, 0.6480.

- Alternative recommendation: buy entry is from 0.6380, 0.6350, 0.6330.

The New Zealand dollar maintains an upward trend, limiting itself to the formation of a correction.

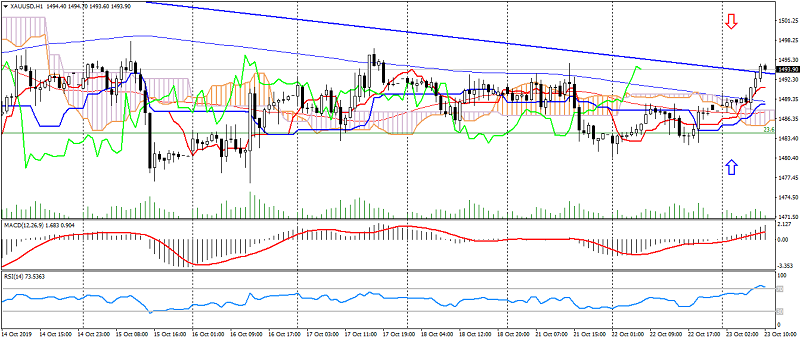

XAU USD (current price: 1493.00)

- Support levels: 1450.00, 1360.00, 1300.00.

- Resistance levels: 1550.00, 1600.00, 1670.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1500.00, 1510.00, 1520.00.

- Alternative recommendation: buy entry is from 1490.00, 1480.00, 1470.00.

Gold gained a support on the risks, but continues to be limited to a weekly flat.