Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

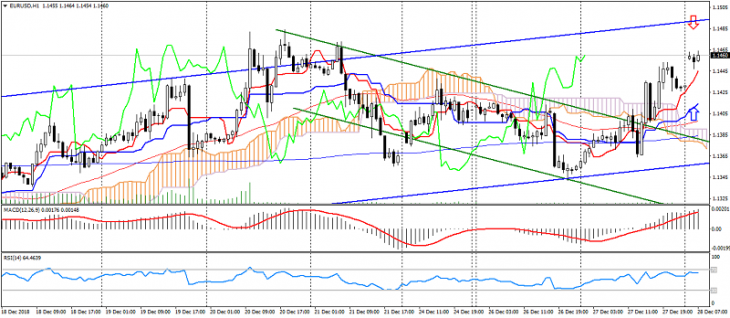

EUR USD (current price: 1.1460)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.1480, 1.1500, 1.1520.

- Alternative recommendation: buy entry is from 1.1450, 1.1420, 1.1400.

The euro dollar pair returned to growth on the weakness of the American dollar, while limited to overbought.

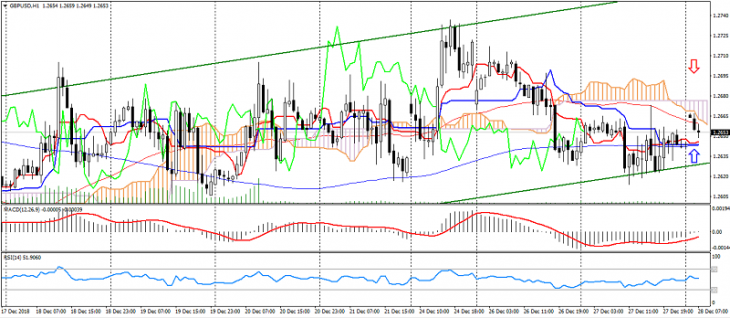

GBP USD (current price: 1.2660)

- Support levels: 1.2470, 1.2350, 1.2250.

- Resistance levels: 1.2800, 1.2900, 1.2970.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line near the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2680, 1.2700, 1.2720.

- Alternative recommendation: buy entry is from 1.2630, 1.2600, 1.2570.

The British pound maintains a moderately upward trend, limited to a downward correction and low trading volumes.

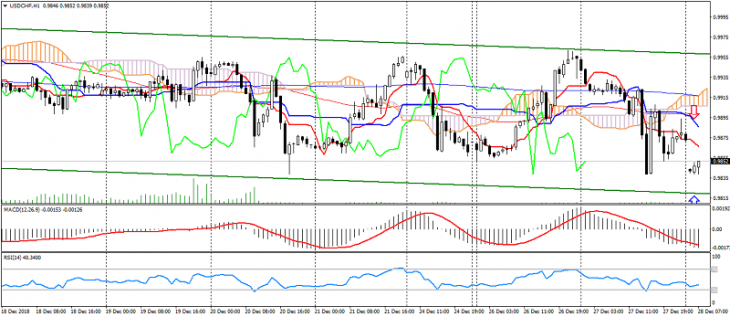

USD CHF (current price: 0.9840)

- Support levels: 0.9850, 0.9750, 0.9600.

- Resistance levels: 1.0000, 1.0100, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- Primary recommendation: sale entry is from 0.9880, 0.9900, 0.9930.

- Alternative recommendation: buy entry is from 0.9830, 0.9800, 0.9780.

The US dollar Swiss franc moved to oversold correction, maintaining the overall downtrend.

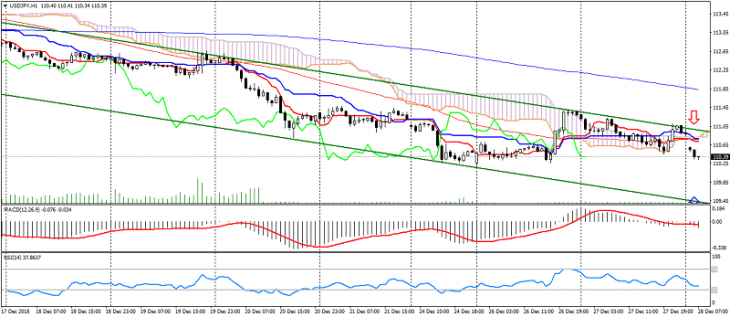

USD JPY (current price: 110.40)

- Support levels: 110.30, 109.50, 109.00.

- Resistance levels: 112.00, 113.00, 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 111.00, 111.30, 111.60.

- Alternative recommendation: buy entry is from 110.00, 109.80, 109.50.

The pair of the US dollar Japanese yen maintains a downward trend, despite the attempts of correction and significant support at the level of 110.20-30.

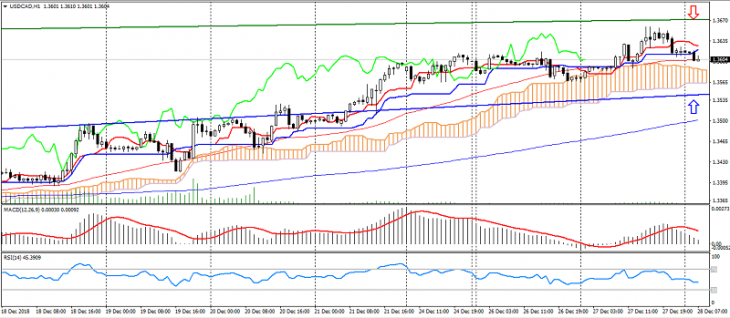

USD CAD (current price: 1.3610)

- Support levels: 1.3450, 1.3300, 1.3150.

- Resistance levels: 1.3700, 1.3850, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line came out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.3640, 1.3670, 1.3690.

- Alternative recommendation: buy entry is from 1.3560, 1.3530, 1.3500.

A pair of the US dollar Canadian dollar is trading in an uptrend to preserve overall risks, limited to overbought and low volumes.

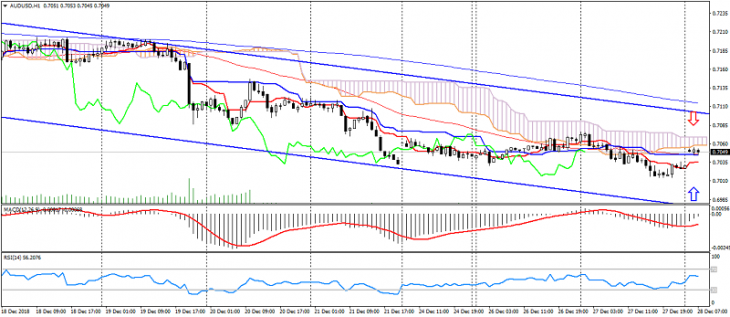

AUD USD (current price: 0.7050)

- Support levels: 0.7000, 0.6900, 0.6800.

- Resistance levels: 0.7200, 0.7300, 0.7450.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7060, 0.7100, 0.7120.

- Alternative recommendation: buy entry is from 0.7020, 0.7000, 0.6970.

The Australian dollar moved to growth in attempts to increase optimism, limited to the downward trend.

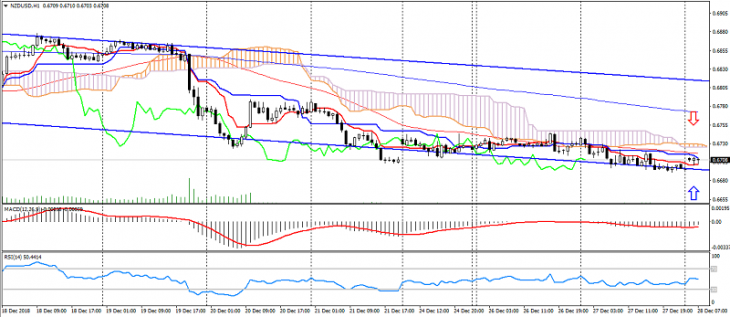

NZD USD (current price: 0.6710)

- Support levels: 0.6650, 0.6500, 0.6400.

- Resistance levels: 0.6950, 0.7070, 0.7200.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6750, 0.6780, 0.6830.

- Alternative recommendation: buy entry is from 0.6700, 0.6680, 0.6650.

The New Zealand dollar shows a decrease in risk retention, limited to the trade channel.

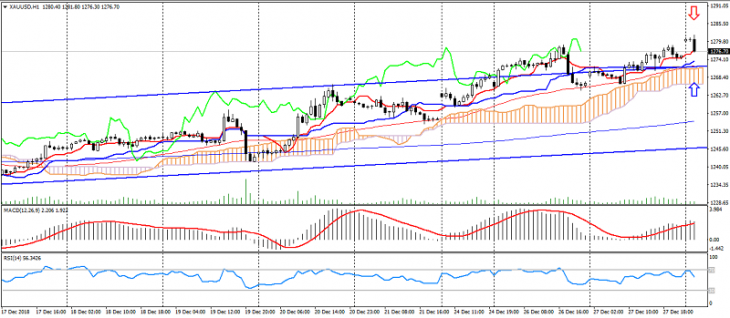

XAU USD (current price: 1277.00)

- Support levels: 1245.00, 1230.00, 1210.00.

- Resistance levels: 1270.00, 1285.00, 1300.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1280.00, 1285.00, 1290.00.

- Alternative recommendation: buy entry is from 1274.00, 1270.00, 1265.00.

Gold continues to show growth in the flight of investors from risks, limited to overbought.