Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

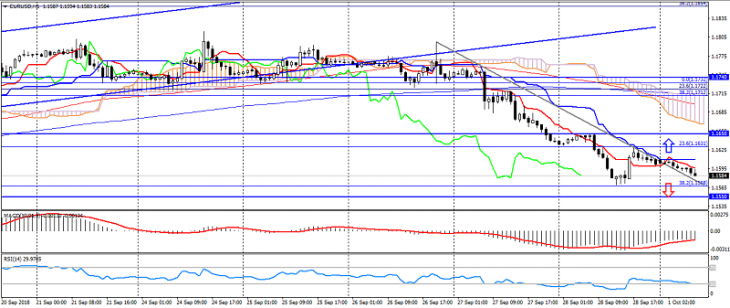

EUR USD (current price: 1.1590)

- Support levels: 1.1450, 1.1350, 1.1200.

- Resistance levels: 1.1550, 1.1650, 1.1740.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1630, 1.1650, 1.1680.

- Alternative recommendation: buy entry is from 1.1560, 1.1530, 1.1500.

The euro dollar remains under the pressure of American dollar, but is limited to oversold.

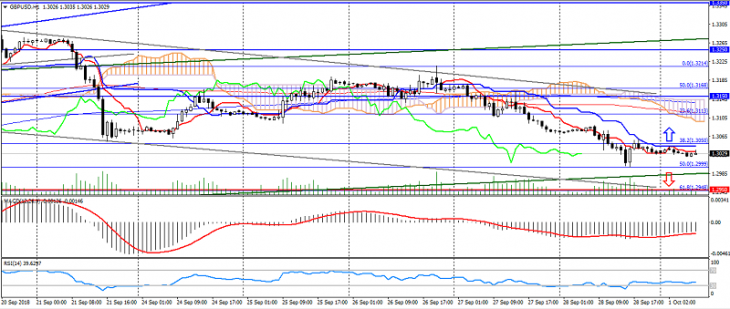

GBP USD (current price: 1.3030)

- Support levels: 1.2950, 1.2780, 1.2600 (the minimum of June 2017).

- Resistance levels: 1.3150, 1.3250, 1.3350.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3060, 1.3080, 1.3100.

- Alternative recommendation: buy entry is from 1.3000, 1.2980, 1.2950.

The British pound also remains under pressure, limited to oversold and a general upward channel.

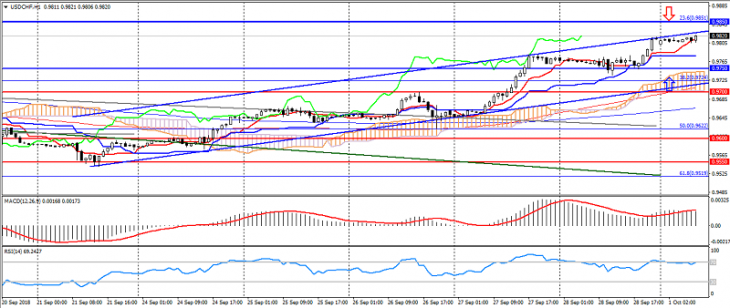

USD CHF (current price: 0.9820)

- Support levels: 0.9700, 0.9600, 0.9550.

- Resistance levels: 0.9750, 0.9850, 0.9900.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.9830, 0.9850, 0.9880.

- Alternative recommendation: buy entry is from 0.9780, 0.9750, 0.9730.

The Swiss franc is trading with a strengthening on the growth of optimism, limited to overbought.

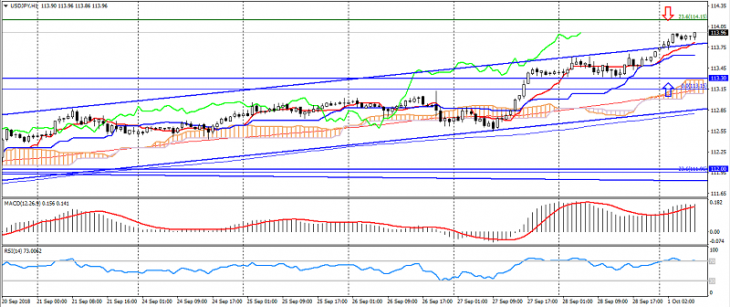

USD JPY (current price: 113.90)

- Support levels: 110.50, 109.80, 109.00.

- Resistance levels: 111.00, 112.00, 113.30 (maximum of January).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 114.00, 114.30 114.50.

- Alternative recommendation: buy entry is from 113.50, 113.30, 113.30.

The US dollar the Japanese yen continues to rise, limited to overbought.

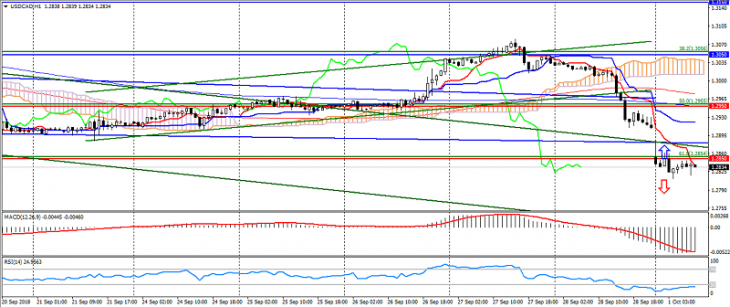

USD CAD (current price: 1.2840)

- Support levels: 1.2950, 1.2850, 1.2750.

- Resistance levels: 1.3050, 1.3150, 1.3250.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2880, 1.2900, 1.2950.

- Alternative recommendation: buy entry is from 1.2800, 1.2780, 1.2750.

The US dollar the Canadian dollar remains under pressure on advance of negotiations on the NAFTA trade agreement.

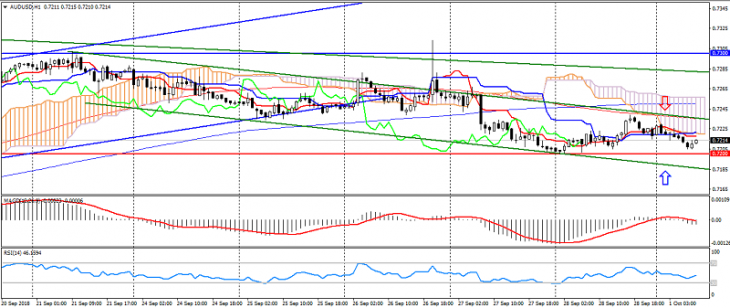

AUD USD (current price: 0.7210)

- Support levels: 0.7200, 0.7100, 0.7040.

- Resistance levels: 0.7300, 0.7400, 0.7500.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7230, 0.7250, 0.7280.

- Alternative recommendation: buy entry is from 0.7200, 0.7180, 0.7160.

The Australian dollar is trading in a downtrend, limited to the level of 0.7250.

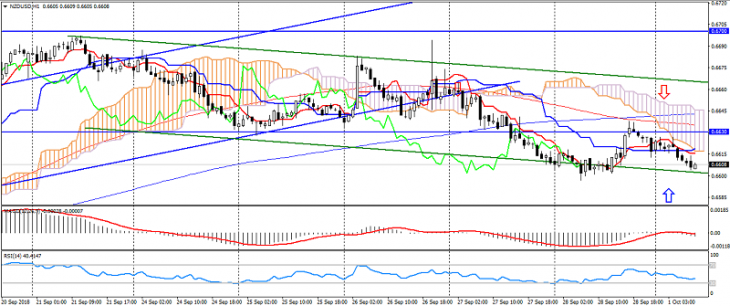

NZD USD (current price: 0.6610)

- Support levels : 0.6550, 0.6500, 0.6470.

- Resistance levels: 0.6630, 0.6700, 0.6750.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6630, 0.6650, 0.6680.

- Alternative recommendation: buy entry is from 0.6600, 0.6580, 0.6550.

The New Zealand dollar was also under pressure, limiting itself to a downward trend.

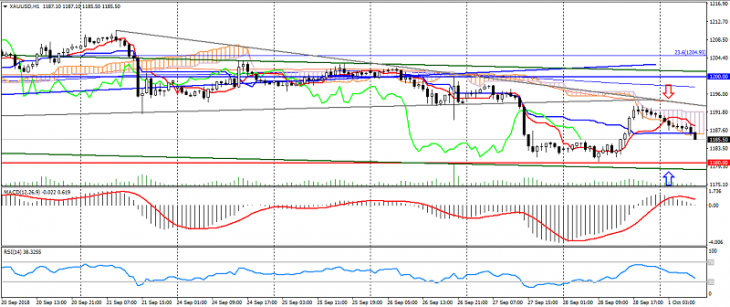

XAU USD (current price: 1185.00)

- Support levels: 1180.00, 1170.00, 1155.00.

- Resistance levels: 1200.00, 1220.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1190.00, 1195.00, 1200.00.

- Alternative recommendation: buy entry is from 1180.00, 1175.00, 1170.00.

Gold remains under pressure, keeping a downward trend.