The results of the July Fed meeting for the market

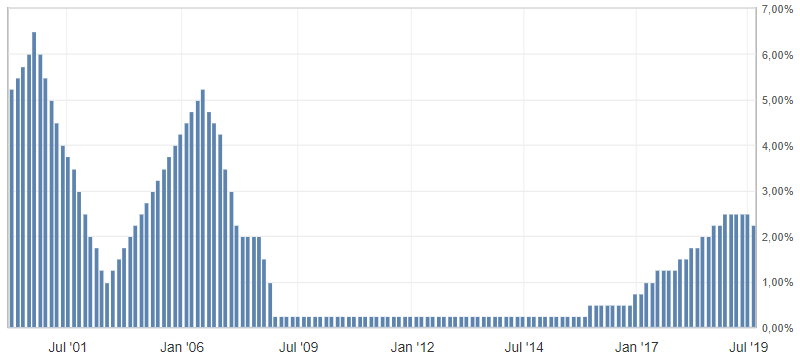

According to the results of the July Fed meeting, the key interest rate in the United States was reduced by 0.25% from 2.50% to 2.25%. This is the first Fed rate cut since the end of 2008.

Fig. 1. Chart of changes of the US Federal Reserve interest rates

Despite the reduction in rates, which turned out to be the minimum possible, the Fed turned out to be tougher in its monetary policy than even the most positive expectations had anticipated. So, the main market expectations regarding the US monetary policy focused on two options:

- The rate cut at the July meeting of the US Federal Reserve by 25 b. n. and another 25 b.p. in September or December.

- To reduce rates in the United States immediately by 50 b. n. at the July meeting and will not touch rates by the end of the year.

Read: Expectations from the July Fed meeting

As the results of the Fed meeting showed, not one of the forecasts came true completely. Rather, its second half with a further reduction in rates during the current year. On the contrary, during his speech, the US Federal Reserve Chairman Powell made it clear that this reduction in rates is not a new cycle of reduction in rates. Rather, it acts as a correction in the cycle of raising rates by the US Federal Reserve.

As a result, expectations about softening the US monetary policy were completely dispelled. They caused a resumption of pessimistic sentiment on the US dollar and its widespread growth.

Fig. 2. Graph of the US dollar index. Market reaction to the results of the US Federal Reserve meeting

What could mean such a decision by the US Federal Reserve

The main reason for the Fed’s rate cuts was bearish risks, such as a trade war and a slowdown in the global economy. This was directly indicated by the US Federal Reserve Chairman, in fact calling the Fed’s motive to keep the opportunity to further stimulate the economy by reducing rates. At the same time, without giving obvious reasons to do this in the future. So the Fed fixed a neutral status, which will partially protect against the US President D. Trump attacks.

Recognition of the global economy risks

At the same time, the recognition of the risks of a slowdown in the global economy and the possibility of an aggravation of the trade war are an alarming bell for other world economies, and directly for the large central banks.

So, if the US Federal Reserve pointed to a further reduction in interest rates, other major global economies would start to soften monetary policy after the United States. The Fed and major global economies are only preparing for the risks of a significant slowdown in the global economy and are taking a wait-and-see position in the current conditions.

Anton Hanzenko