European inflation data

United Kingdom:

- Consumer Price Index (CPI) (y/y) (September), fact 1.7%, forecast 1.8%.

- Consumer Price Index (CPI) (m/m) (September), fact 0.1%, forecast 0.2%.

- Producer price index of producers (m/m) (September), fact -0.8%, forecast 0.2%.

Eurozone:

- Core Consumer Price Index (CPI) (y/y) (September), fact 1.0%, forecast 1.0%.

- Consumer Price Index (CPI) (y/y) (September), fact 0.8%, forecast 0.9%.

- Consumer Price Index (CPI) (m/m) (September), fact 0.2%, forecast 0.2%.

- Trade balance (Aug), fact 14.7B, forecast 17.5B.

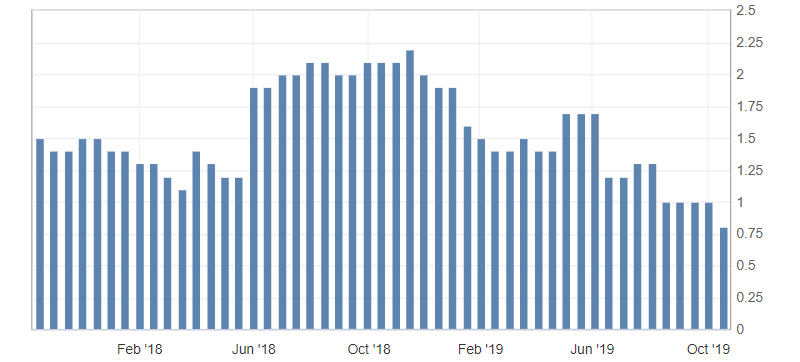

Consumer inflation in Europe slowed in September, confirming the slowdown in this indicator of the economy. Despite the decline in inflation in the UK and the eurozone, it is worth to note the accelerated slowdown. So, in the UK, inflation continues to show a moderate decline, despite signs of growth. In the eurozone, it accelerated its decline to its lowest levels since early 2017.

Fig. 1. Eurozone consumer price index (CPI) (y) chart

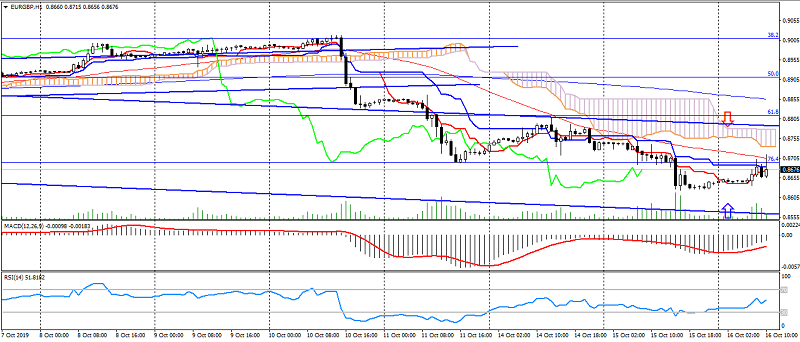

The dynamics of the euro and the British pound slowed on weak inflation data, indicating attempts of correction after the growth of Brexit optimism. But the main driver for the movement of these currencies remains data on the progress in the Brexit deal. The EUR/GBP currency pair moved to a restrained upward correction, maintaining a downtrend, limited by resistance levels: 0.8750 and 0.8780, support: 0.8630-00.

Fig. 2. EUR/GBP chart

Read also: “The results of the July Fed meeting for the market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The results of the US-China trade talks

- Cloudy prospects for the oil market

- Risks of global economic slowdown are escalating

Current Investment ideas: