Analysis of the American session

Friday’s trading ended with a moderate US dollar growth across the market. The reason for this was the growth of optimism amid a decline in unemployment to a historical minimum. But on the growth of optimism, stock indices with commodity assets also received support. As a result, American dollar growth was more evident against safe assets.

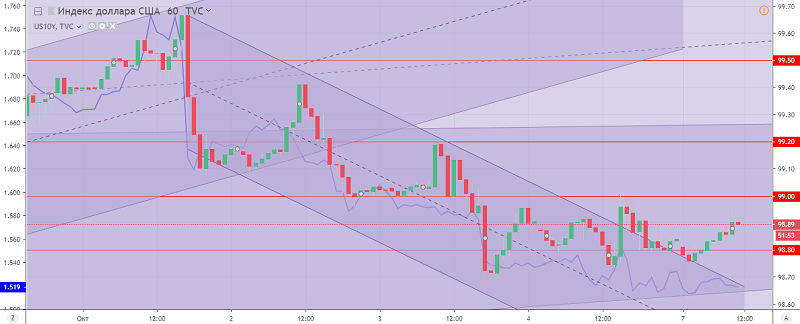

The US dollar index closed the week with the formation of a rebound from the support zone 98.70-80. In the future, this may indicate attempts to form a reversal and upward correction. But for now, this zone acts as the lower boundary of the lateral channel, which is limited from above by zone 99.00-10.

Fig. US dollar index chart. Current price – 98.90 (10-year US government bonds yield – blue line)

Read also: “How real is the slowdown of a bearish trend for the euro?“

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- What indicators choose Forex traders (Part 2)

- Stock indices are ready to renew a historical high

- What indicators choose Forex traders (Part 1)

Current Investment ideas: