Золото в свете текущих событий. На сколько продолжителен его рост

После того как президент США Д. Трамп заявил о внедрении новых торговых пошлин относительно китайских товаров, на рынке резко возросло замедление мировой экономики, а активы безопасной гавани, включая золото, подскочили в цене.

Читайте: “Новый виток торговой войны: пошлины, ограничения, перспективы”

Золото в данном случае возглавило движение скупки безопасных активов. Обострение рисков также позволило золоту выйти с июльского бокового канала, который расположился в диапазоне от 1380.00 до 1440.00. При этом данный торговый диапазон, до обострения рисков торговой войны, в большей степени выглядел как разворот после роста. Особенно учитывая три попытки закрепиться выше уровня 1440.00.

Всё бы ничего, если бы не тот факт, что в условиях отсутствия явного продвижения по торговой войне золото не продолжило бы укрепляться. Так, к примеру, валюты безопасной гавани японская иена и швейцарский франк оставались весьма сдержанными. Чего не сказать о динамике золота, которое в условиях движения валютного рынка во флэте продолжало демонстрировать устойчивую восходящую динамику, показав рост около 8% за семь торговых дней.

В то время как годовая волатильность за текущий 2019 год составляет около 19%. Подобное движение золота в текущем году прослеживалось в июне, когда от ФРС ожидали снижения ставок. Фактически оно состоялось только на июльском заседании ФРС.

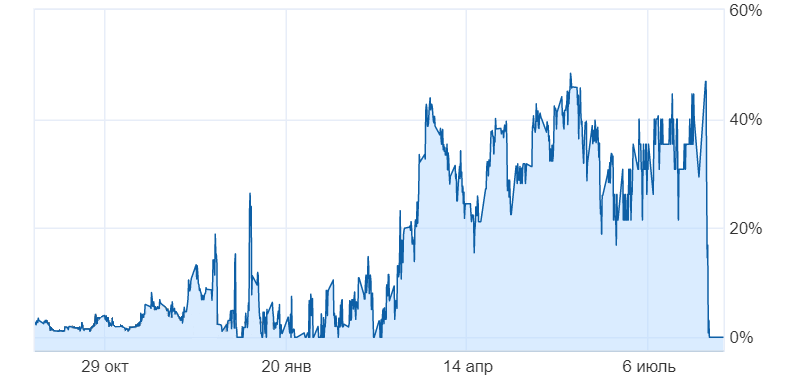

Так, основным драйвером к укреплению золота остаётся вероятность, а вернее говоря, ожидания снижения ключевых процентных ставок ФРС США. Это отлично прослеживается в графиках прогнозов по процентным ставкам ФРС США уже на сентябрьском заседании, которое состоится 18 сентября.

Рис. 1. График прогноза по целевой ставке ФРС 1,75-2,00%

Рис. 2. График прогноза по целевой ставке ФРС 2,00-2,25%

Первый график указывает на вероятность снижения ставок на сентябрьском заседании ФРС США. Второй – на сохранение текущей ставки на уровне 2,25%. Очевидно, рынок уверен в том, что ставки будут снижены.

Золото, торгуясь возле уровня 1500.00, отвечает ценам апреля 2013 года. Однако тогда данный уровень был быстро пробит вниз. Дальнейшее укрепление золота остаётся ограниченным, но возможным только в условиях обострения торгового напряжения и/или давления на ФРС со стороны Трампа. Существующие рычаги давления на ФРС уже учтены.

В сложившихся условиях значимым сопротивлением для золота выступают уровни 1530.00 и 1550.00.

Антон Ганзенко