Gold in the light of current events. How long is its growth

The global economy slowed sharply and safe haven assets, including gold, jumped in price after the US President D. Trump announced the introduction of new trade duties on Chinese goods.

Read: “A new round of trade war: duties, restrictions, prospects”

Gold in this case led the move to buy safe assets. Exacerbation of risks also allowed gold to exit the July side channel, which ranged from 1380.00 to 1440.00. At the same time, this trading range, until the risks of a trade war escalated, looked more like a reversal after growth. Especially considering three attempts to fix above the level of 1440.00.

Everything would be fine if it were not for the fact that in the absence of a clear advance in the trade war, gold would not continue to strengthen. Thus, for example, the safe haven currencies the Japanese yen and the Swiss franc remained very restrained. What can be said about the dynamics of gold, which continued to show steady upward dynamics in the flat currency market, showing growth of about 8% over seven trading days.

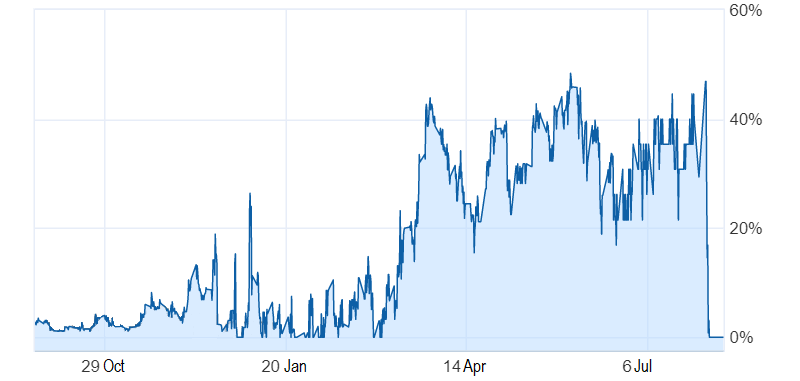

While the annual volatility for the current 2019 year is about 19%. A similar movement of gold this year was observed in June, when the Fed was expected to lower rates. In fact, it took place only at the Fed July meeting.

Thus, the main driver for the strengthening of gold remains the probability, or rather, the expectation of a key interest rates cuts by the US Federal Reserve. This can be clearly seen in the charts of forecasts on interest rates by the US Federal Reserve already at the September meeting, which will be held on September 18.

Fig. 1. The forecast chart for the Fed interest rate of 1.75-2.00%

Fig. 2. The forecast chart for the Fed interest rate of 2.00-2.25%

The first chart indicates the probability of a rate cut at the US Federal Reserve September meeting. The second – to maintain the current rate at 2.25%. Obviously, the market is confident that rates will be reduced.

Gold, trading near the level of 1500.00, meets the prices of April 2013. However, then this level was quickly broken down. Further strengthening of gold remains limited, but possible only in conditions of exacerbation of trade tension and/or pressure on the Fed from Trump. The existing leverage on the Fed is already taken into account.

Under the current conditions, a significant resistance for gold are the levels of 1530.00 and 1550.00.

Anton Hanzenko