VSA analysis: a test of supply and demand, and the culmination of purchases and sales. Anton Hanzenko.

Continuing with the topic of VSA analysis, which was covered in part 1 and part 2, one should consider very important topics: the test of supply and demand, and the culmination of purchases and sales.

Test of supply and demand

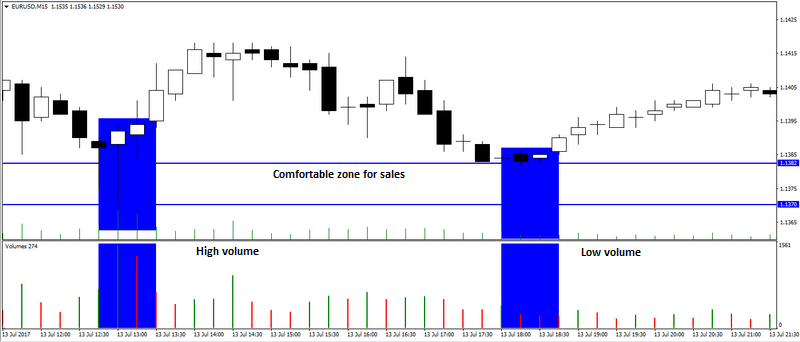

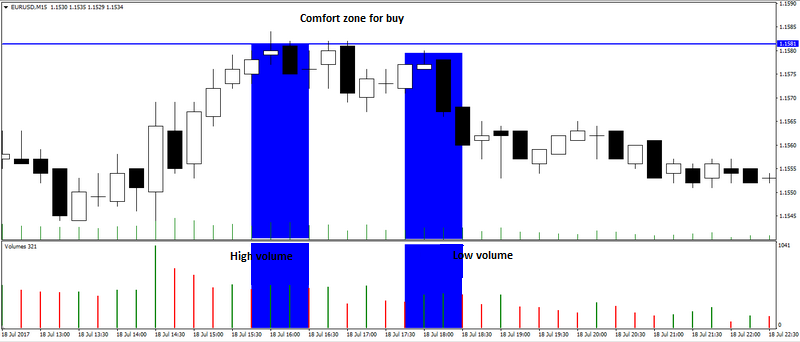

The concept of the supply and demand test in VSA analysis implies the defining of resistance to both the ascending and descending movements. So, with the accumulation of sufficient positions, for example, to buy, large players need to check whether there are sellers in the market who will resist the uptrend. For this, the price is understated in a zone that is comfortable for sales, where, as a rule, there was previously a relatively high volume of trades. As a result, the market throws out small players and checks for short positions. A successful supply test is considered when the price does not continue to decline in the purchase zone, but begins to grow. This, in turn, indicates the lack of large sellers in the market, which will prevent the uptrend.

Supply test is considered not successful when the price continues to reduce in the purchase area. In this case, as a rule, the volume begins to grow and the price goes down.

The demand test has a similar approach only in the case of sales. So, with the accumulation of sufficient positions for sale, large players need to check whether there are buyers in the market who will resist the downward trend. For this, the price is overstated in a zone comfortable for purchases, where, as a rule, there was a relatively high volume of trades earlier. A successful test of demand is considered when in the sales area the price does not continue to increase, but begins to decline. This, in turn, indicates the absence of large buyers in the market, which will prevent a downward trend.

Demand test is considered not successful when the price continues to increase in the purchase zone.

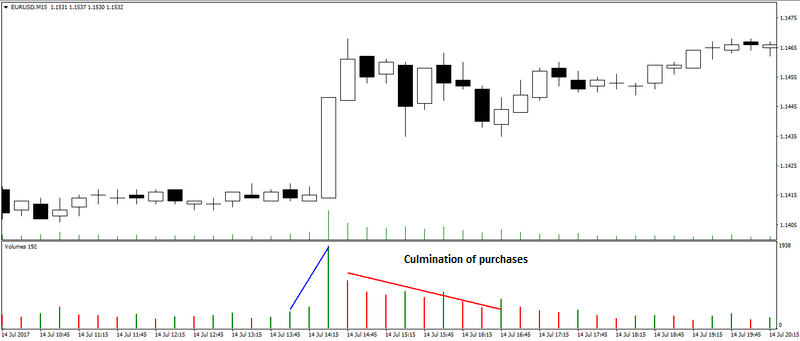

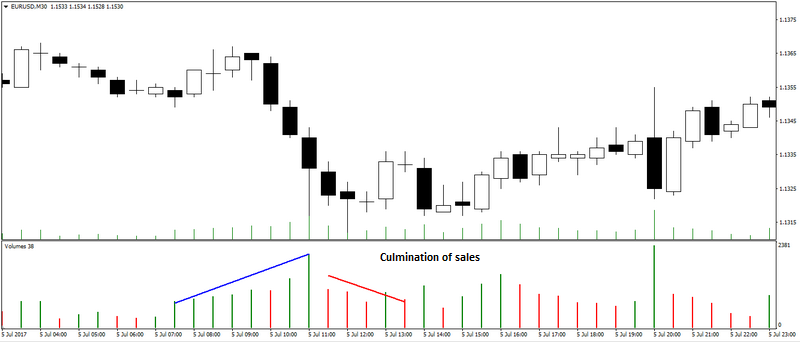

The culmination of purchases and sales

The culmination of purchases and sales represents the end of the trend after the growth of volume. So the culmination of purchases is a gradually growing price, a trend with a growing volume. The decrease in volume in such cases indicates the formation of correction after the uptrend.

The culmination of sales is a gradually declining price, a trend with a growing volume. The decrease in volume in such cases indicates the formation of correction after the downtrend.

This is not the whole list of tools that VSA analysis can provide for trading in financial markets. In more detail about VSA analysis and not only you can learn from the training courses offered by Ester Holdings Inc. Learn more>

Anton Hanzenko