Fundamental analysis: Influence of inflation indicators on world currencies. 2/2

Earlier we got acquainted with the main understandings related to inflation and the indicators that determine it. Now it is worth determining how the inflation indicators affect this or that currency.

Earlier, before the main world economies switched to ultra-soft monetary policy, the growth of inflation exerted pressure on the dynamics of the currency, thereby indicating the depreciation of money and exerting pressure.

Now the situation has changed a little and such large economies as the US, the eurozone and other countries demonstrate a weak inflation growth, which does not reach the target level of 2% per annum. This, in turn, causes the world’s Central Bank to adhere to a super-soft monetary policy, thereby stimulating a targeted increase in inflation.

Leaving this target growth of 2-3%, we can consider it as a positive signal for the curtailment of incentive measures. And, as a result, to strengthen the national currency.

With the targeted increase in inflation, the probability of an increase in the key interest rate, on which central banks often rely in their protocols, increases.

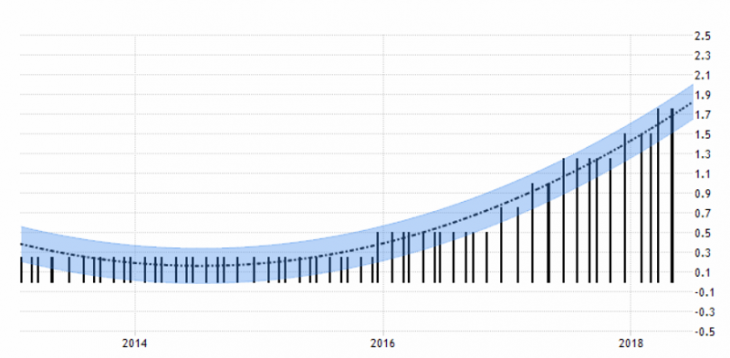

Fig. 1. US interest rate

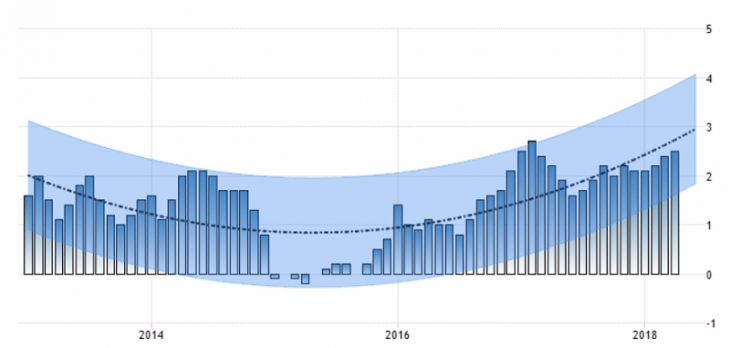

Fig. 2. US Inflation Rate

How to analyze inflation data

Data on inflation, as in the case of the employment report, should be analyzed in conjunction with a look at some factors:

- The growth of inflation should be the target, that is, not exceed the specified level of the CB. Otherwise, inflation will put pressure on the currency.

- With inflation, other key indicators should also grow: GDP and incomes.

Market reaction to inflation data

Market reaction to the publication of inflation data is one of the most violent and in value equates to changes in interest rates, which, as mentioned earlier, is due to the fact that inflation affects the tightening of monetary policy. Also, this news is suitable for tactics for trading on the news.

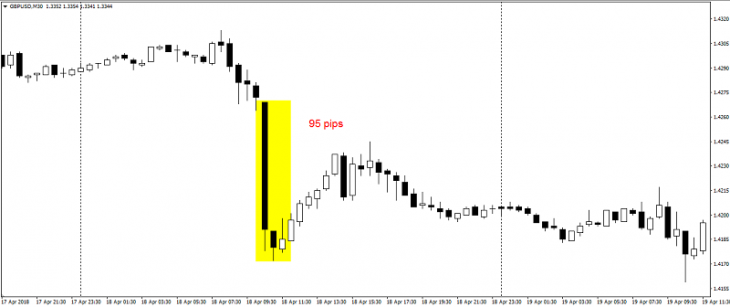

Fig. 3. GBP/USD pair reaction to CPI decline

As can be seen from the example, this event accelerated the existing trend. The importance of inflation indicators is very high for the world economies and often such news can serve as a reason for the trend reversal.

The role of inflation data for the economy

Before the transition of large developed economies to ultra-soft monetary policy, inflation growth rates in the country were regarded as a very negative indicator that exerted on average or strong pressure on the national currency. But, with the process of gradual tightening of monetary policies, the inflation rate became the main factor for raising rates. Therefore, the market appeared the notion of a target inflation rate (about 2%). Therefore, in existing realities, the target inflation growth is regarded as a signal to raise rates in the future.

In the next section of the “Fundamental Analysis” we will consider the GDP indicators.

Anton Hanzenko