Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

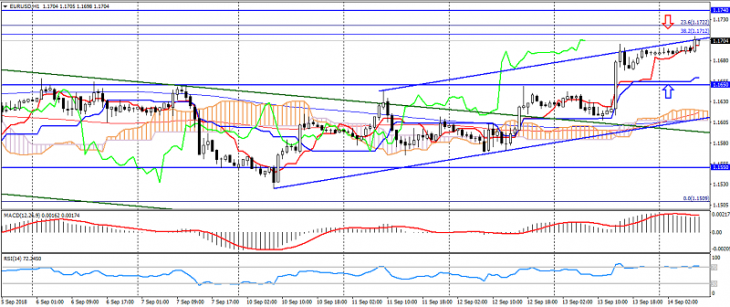

EUR USD (current price: 1.1700)

- Support levels: 1.1450, 1.1350, 1.1200.

- Resistance levels: 1.1550, 1.1650, 1.1740.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.1730, 1.1750, 1.1780.

- Alternative recommendation: buy entry is from 1.1680, 1.1650, 1.1620.

The euro-dollar pair continues to show growth, on the weakness of the American dollar, limiting itself to overbought.

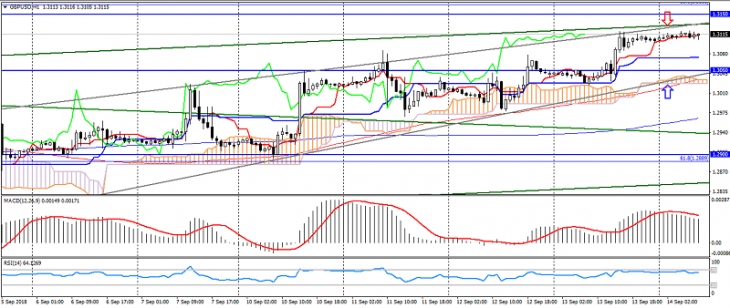

GBP USD (current price: 1.3120)

- Support levels: 1.2780, 1.2600 (June 2017 low), 1.2370 (low of April 2017).

- Resistance levels: 1.2900, 1.3050, 1.3150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3120, 1.3150, 1.3180.

- Alternative recommendation: buy entry is from 1.3080, 1.3050, 1.320.

The British pound is limited to overbought after growth on the decline of the dollar.

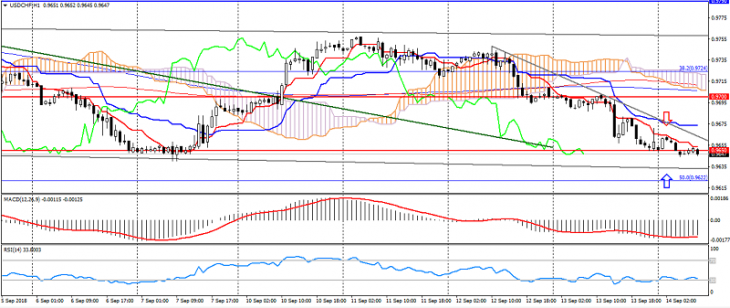

USD CHF (current price: 0.9650)

- Support levels: 0.9700 (June low), 0.9650, 0.9600.

- Resistance levels: 0.9790, 0.9850, 0.9900.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9660, 0.9680, 0.9700.

- Alternative recommendation: buy entry is from 0.9630, 0.9600, 0.9580.

The Swiss franc remains in the downtrend, limited to a significant support of 0.9630-00.

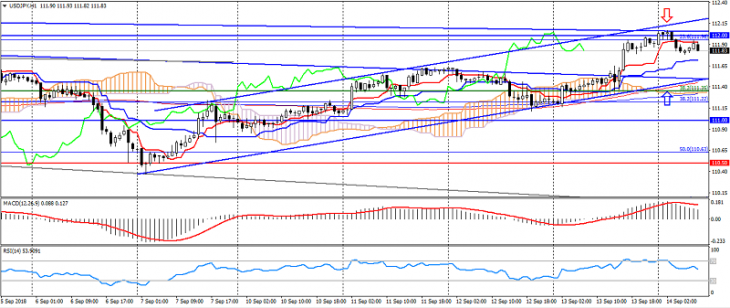

USD JPY (current price: 111.80)

- Support levels: 110.50, 109.80, 109.00.

- Resistance levels: 111.00, 112.00, 113.30 (maximum of January).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 112.00, 112.20 112.50.

- Alternative recommendation: buy entry is from 111.60, 111.40, 111.20.

The US dollar the Japanese yen moved to correction, after rising on risk reduction.

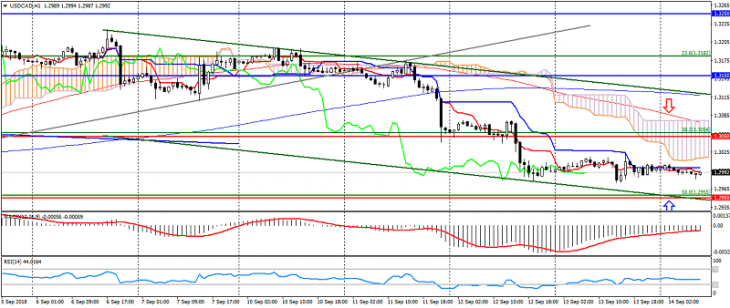

USD CAD (current price: 1.2990)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3020, 1.3050, 1.3080.

- Alternative recommendation: buy entry is from 1.2980, 1.2950, 1.2930.

The US dollar the Canadian dollar remains under pressure on the growth of positive sentiment.

AUD USD (current price: 0.7210)

- Support levels: 0.7200, 0.7100, 0.7040.

- Resistance levels: 0.7300, 0.7400, 0.7500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7230, 0.7250, 0.7280.

- Alternative recommendation: buy entry is from 0.7200, 0.7170, 0.7150.

The Australian dollar retains the potential for growth in reducing risks.

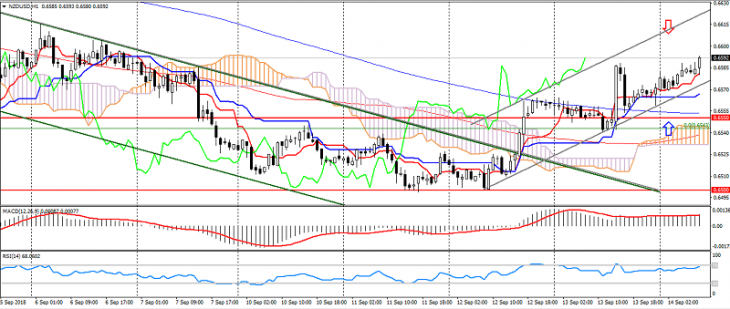

NZD USD (current price: 0.6590)

- Support levels: 0.6550, 0.6500, 0.6470.

- Resistance levels: 0.6630, 0.6700, 0.6750.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from of 0.6520, 0.6630, 0.6650.

- Alternative recommendation: buy entry is from 0.6570, 0.6550, 0.6530.

The New Zealand dollar also broke the downtrend on the growth of optimism.

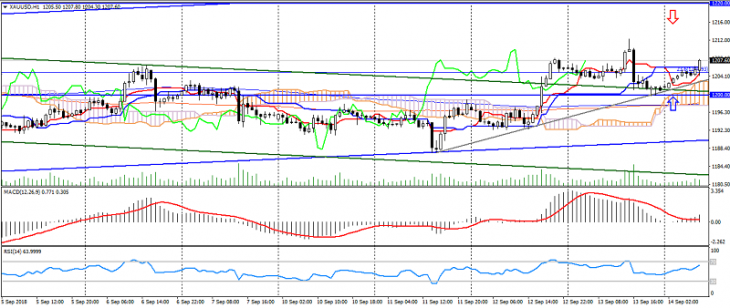

XAU USD (current price: 1207.00)

- Support levels: 1180.00, 1170.00, 1155.00.

- Resistance levels: 1200.00, 1220.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1210.00, 1215.00, 1220.00.

- Alternative recommendation: buy entry is from 1200.00, 1195.00, 1190.00.

Gold moved to growth on the weakness of the dollar, forming a moderately upward trend.