Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

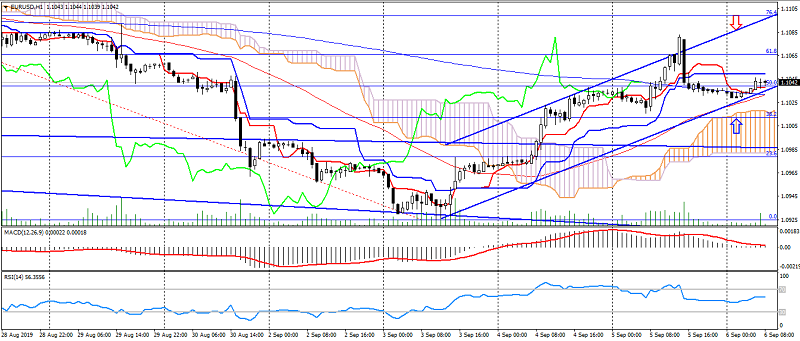

EUR USD (current price: 1.1040)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.1050, 1.1080, 1.1100.

- Alternative recommendation: buy entry is from 1.1000, 1.0980, 1.0950.

The euro dollar is trading with attempts of growth to maintain upward dynamics, limited to upcoming data.

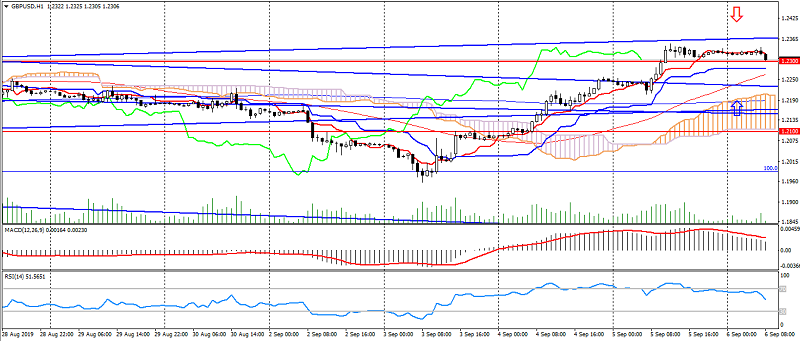

GBP USD (current price: 1.2300)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is above 0, the signal line has left the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.2350, 1.2380, 1.2400.

- Alternative recommendation: buy entry is from 1.2280, 1.2250, 1.2220.

The British pound slowed down, maintaining an upward dynamics.

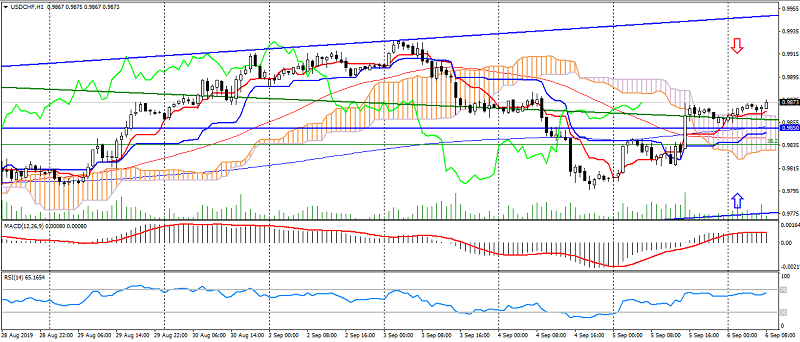

USD CHF (current price: 0.9880)

- Support levels: 0.9750, 0.9650, 0.9500.

- Resistance levels: 0.9850, 1.0000, 1.0060.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.9880, 0.9900, 0.9920.

- Alternative recommendation: buy entry is from 0.9850, 0.9820, 0.9800.

The US dollar Swiss franc is showing growth on risk reduction and American dollar recovery.

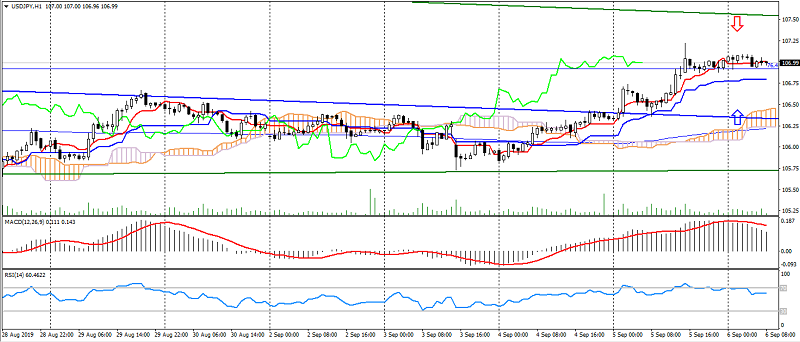

USD JPY (current price: 107.00)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is above 0, the signal line has left the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 107.30, 107.50, 107.80.

- Alternative recommendation: buy entry is from 106.80, 106.50, 106.30.

The US dollar and the Japanese yen are trading modestly, maintaining an upward trend.

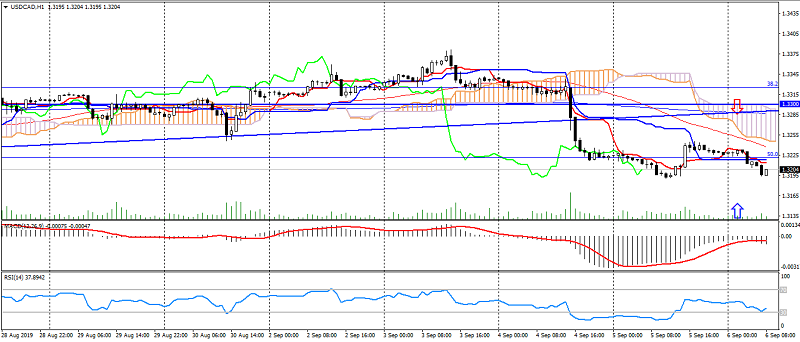

USD CAD (current price: 1.3200)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is below 0, the signal line is in the histogram body. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line near the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3250, 1.3280, 1.3300.

- Alternative recommendation: buy entry is from 1.3180, 1.3150, 1.3120.

The pair US dollar Canadian dollar is trading lower, limited by general oversold and trading flat.

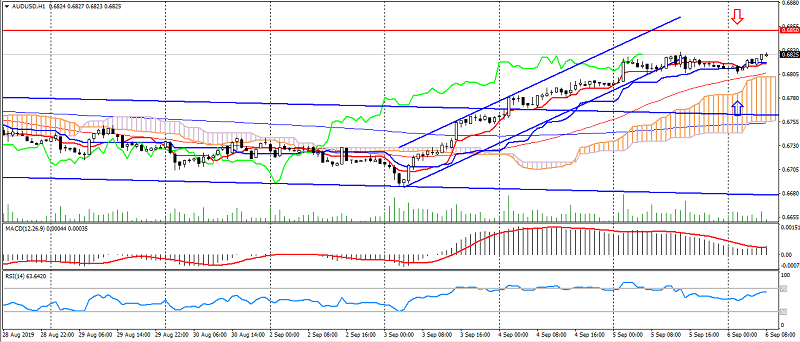

AUD USD (current price: 0.6830)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 0.6850, 0.6880, 0.6900.

- Alternative recommendation: buy entry is from 0.6800, 0.6780, 0.6750.

The Australian dollar accelerated the growth and maintains upward dynamics, limiting itself to overbought and downward divergence.

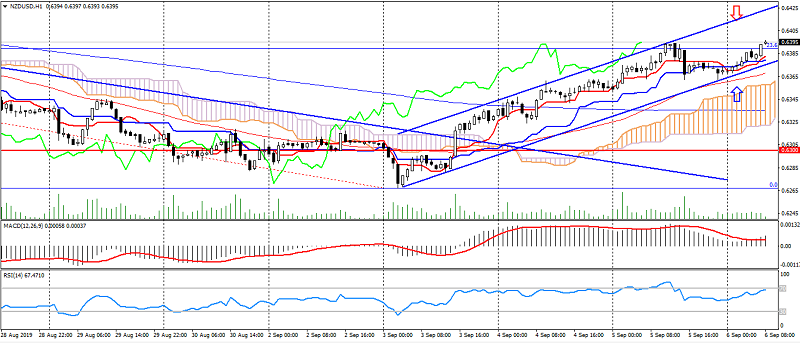

NZD USD (current price: 0.6390)

- Support levels 0.6300, 0.6200, 0.6100.

- Resistance levels: 0.6700, 0.680, 0.6950.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.6400, 0.6420, 0.6450.

- Alternative recommendation: buy entry is from 0.6350, 0.6330, 0.6300.

The New Zealand dollar also accelerated the growth on risk reduction, limiting itself to overbought and divergence.

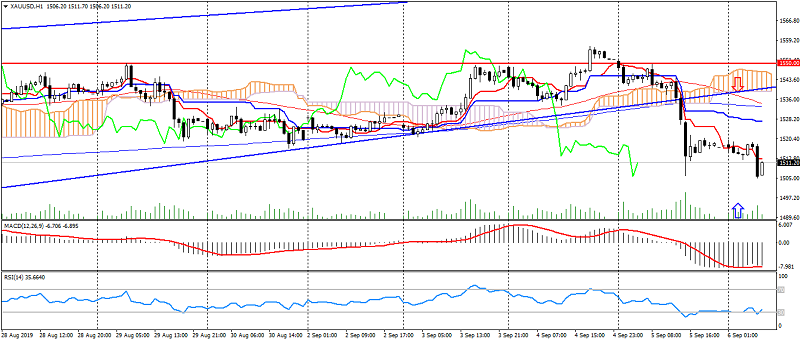

XAU USD (current price: 1511.00)

- Support levels: 1450.00, 1360.00, 1300.00.

- Resistance levels: 1550.00, 1600.00, 1670.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out from the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1520.00, 1530.00, 1540.00.

- Alternative recommendation: buy entry is from 1500.00, 1490.00, 1480.00.

Gold remains under the pressure, limited to overbought. But also forms a lateral weekly dynamics.