Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

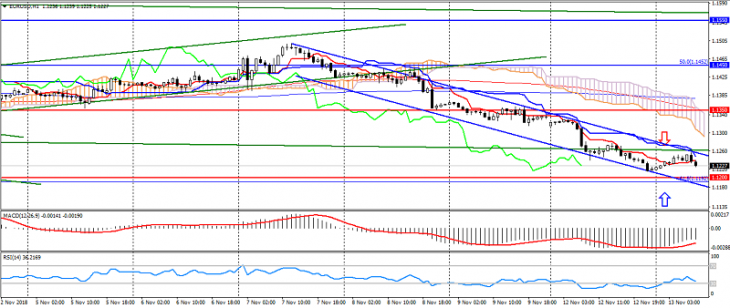

EUR USD (current price: 1.1230)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1260, 1.1300, 1.1340.

- Alternative recommendation: buy entry is from 1.1200, 1.1180, 1.1160.

The euro dollar pair remains under pressure from the American dollar, keeping the downtrend, limited to oversold and the psychology of 1.1200, while remaining under the pressure of risks in Europe.

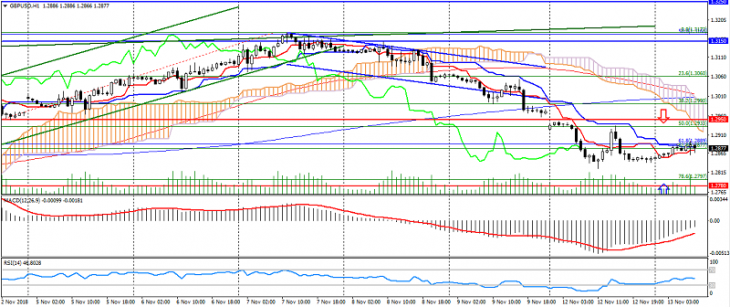

GBP USD (current price: 1.2880)

- Support levels: 1.2950, 1.2780, 1.2600 (June 2017 minimum).

- Resistance levels: 1.3150, 1.3250, 1.3350.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2900, 1.2930, 1.2950.

- Alternative recommendation: buy entry is from 1.2850, 1.2830, 1.2800.

The British pound also moved to the correction after the decline, but is limited to risk and lateral dynamics.

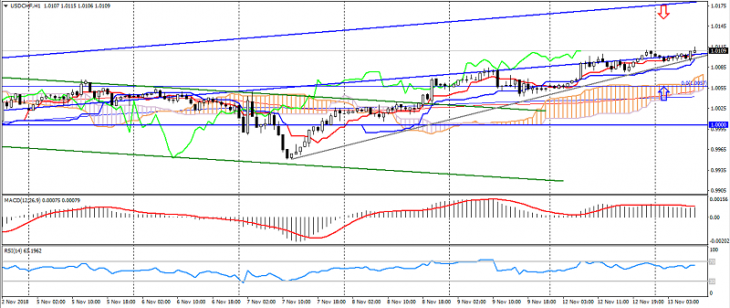

USD CHF (current price: 1.0110)

- Support levels: 0.9700, 0.9600, 0.9550.

- Resistance levels: 0.9850, 0.9900, 1.0000.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in a light overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.0130, 1.0150, 1.0170.

- Alternative recommendation: buy entry is from 1.0080, 1.0050, 1.0030.

The US dollar Swiss franc is back to an uptrend, but is limited to overbought and the boundaries of the upward channel.

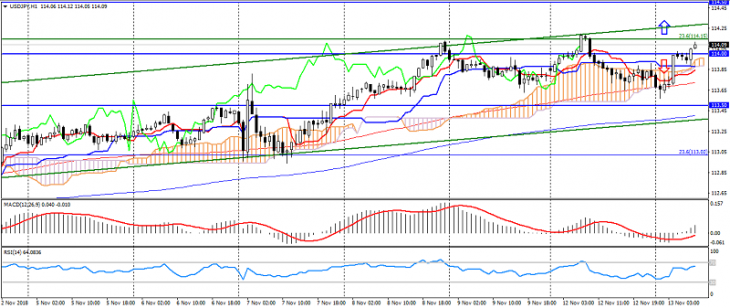

USD JPY (current price: 114.10)

- Support levels: 112.00, 111.50, 111.00.

- Resistance levels: 113.50, 114.00, 114.50.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 114.30, 114.50 114.70.

- Alternative recommendation: buy entry is from 114.00, 113.80, 113.60.

A pair of US dollar the Japanese yen is trading in an uptrend, limited to the upper boundary of the channel, receiving support from risk reduction.

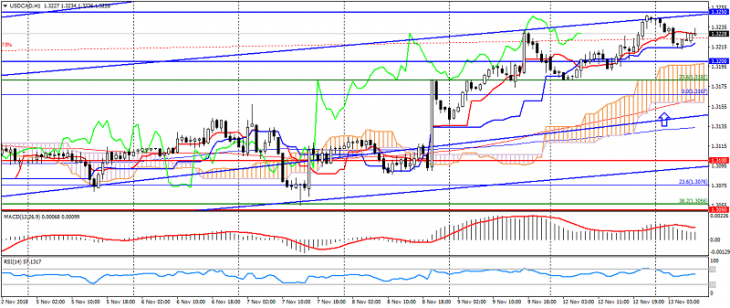

USD CAD (current price: 1.3230)

- Support levels: 1.3100, 1.3050, 1.3000.

- Resistance levels: 1.3200, 1.3250, 1.3300.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.3250, 1.3270, 1.3290.

- Alternative recommendation: buy entry is from 1.3200, 1.3180, 1.3150.

A pair of US dollar the Canadian dollar is trading with strengthening, limited to overbought, while maintaining upward dynamics.

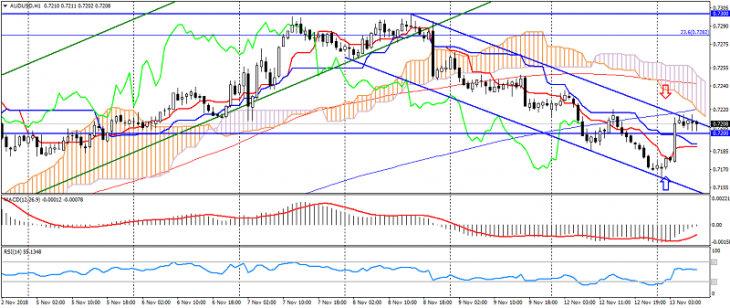

AUD USD (current price: 0.7210)

- Support levels: 0.7100, 0.7040, 0.6950.

- Resistance levels: 0.7100, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7220, 0.7250, 0.7270.

- Alternative recommendation: buy entry is from 0.7180, 0.7160, 0.7140.

The Australian dollar returned to growth on an increase in optimism, but maintains a downward trend.

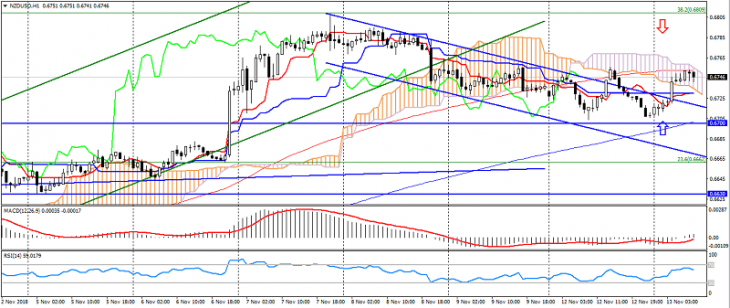

NZD USD (current price: 0.6740)

- Support levels : 0.6450, 0.6350, 0.6300.

- Resistance levels: 0.6550, 0.6630, 0.6700.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near Kijun-sen line, price is in the cloud.

- The main recommendation: sale entry is from 0.6770, 0.6790, 0.6810.

- Alternative recommendation: buy entry is from 0.6720, 0.6700, 0.6680.

The New Zealand dollar slowed down the decline in the formation of a “double bottom” and the growth of optimism.

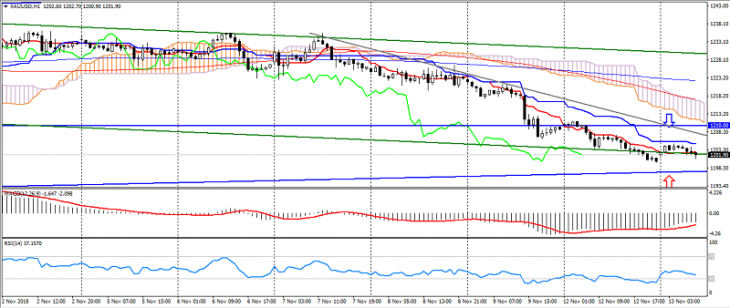

XAU USD (current price: 1202.00)

- Support levels: 1180.00, 1150.00, 1120.00.

- Resistance levels: 1210.00, 1250.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1205.00, 1210.00, 1215.00.

- Alternative recommendation: buy entry is from 1195.00, 1190.00, 1185.00.

Gold remains under pressure, limited to a three-month uptrend.