Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

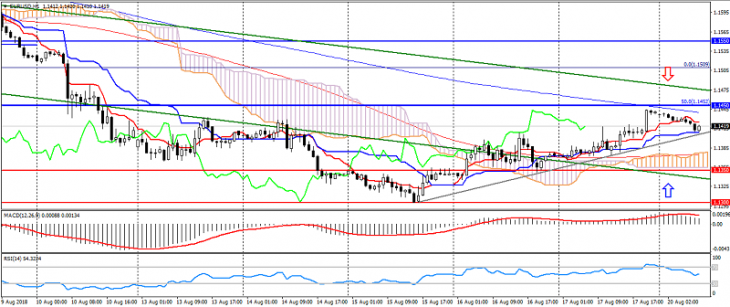

EUR USD (current price: 1.1420)

- Support levels: 1.1350, 1.1300, 1.1200.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.1450, 1.1470, 1.1500.

- Alternative recommendation: buy entry is from 1.1380, 1.1350, 1.1330.

The euro-dollar pair keeps attempts to grow on reducing risks and correction, limiting itself to risks that can resume at any moment.

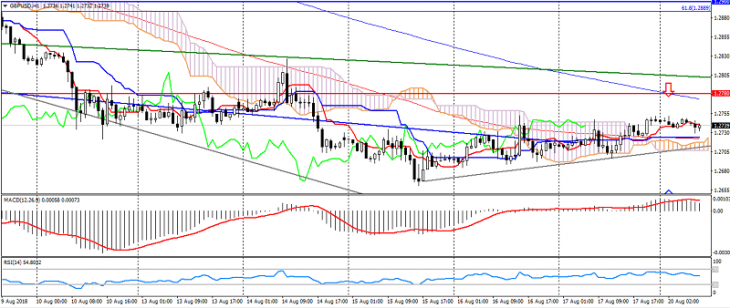

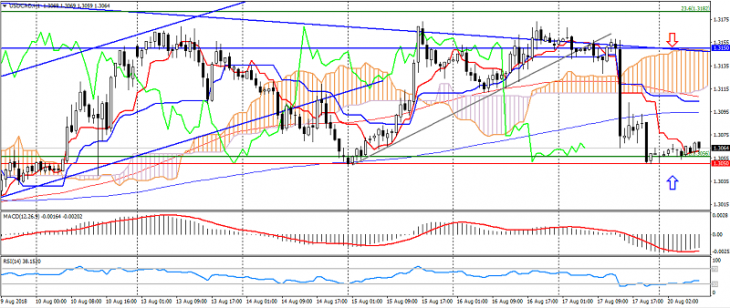

GBP USD (current price: 1.2740)

- Support levels: 1.2780, 1.2600 (June 2017 low), 1.2370 (low of April 2017).

- Resistance levels: 1.2900, 1.3050, 1.3150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.2760, 1.2780, 1.2800.

- Alternative recommendation: buy entry is from 1.2690, 1.2670, 1.2650.

The British pound also trades with correction, but is limited by existing risks.

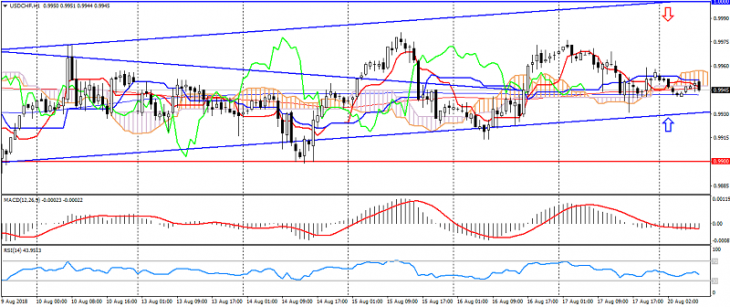

USD CHF (current price: 0.9940)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.9980, 1.0000, 1.0020.

- Alternative recommendation: buy entry is from 0.9930, 0.9920, 0.9900.

The Swiss franc is trading in an uptrend limited by a change in sentiment in the market.

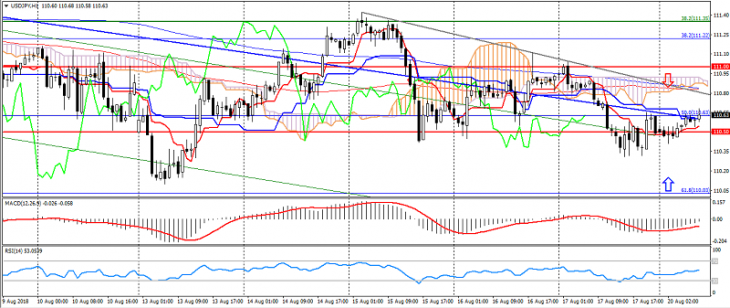

USD JPY (current price: 110.60)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 110.80, 111.00 111.20.

- Alternative recommendation: buy entry is from 110.30, 110.00, 109.80.

The USD / JPY pair is trading lower, limiting itself to a general downtrend and the possibility of a resumption of risks in the market.

USD CAD (current price: 1.3060)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3080, 1.3100, 1.3120.

- Alternative recommendation: buy entry is from 1.3050, 1.3030, 1.3000.

The US dollar the Canadian dollar is trading near the support of 1.3050 after a rapid decline in data for Canada, which came out on Friday, correcting and maintaining a downward trend.

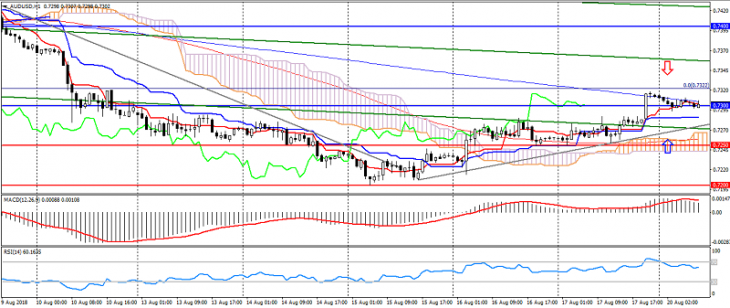

AUD USD (current price: 0.7300)

- Support levels: 0.7250, 0.7200, 0.7100.

- Resistance levels: 0.7300, 0.7400, 0.7500.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7330, 0.7350, 0.7370.

- Alternative recommendation: buy entry is from 0.7270, 0.7250, 0.7230.

The Australian dollar remains in the correction phase, but is limited by the general downward trend.

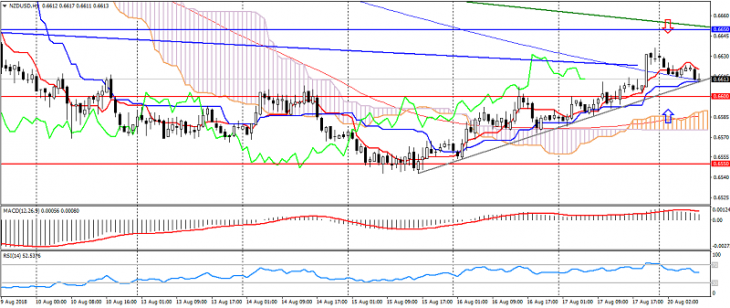

NZD USD (current price: 0.6620)

- Support levels: 0.6600, 0.6550, 0.6500.

- Resistance levels: 0.6650, 0.6700, 0.6800.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.6650, 0.6680, 0.6700.

- Alternative recommendation: buy entry is from 0.6600, 0.6580, 0.6550.

The New Zealand dollar also shows growth, limiting itself to a downward trend.

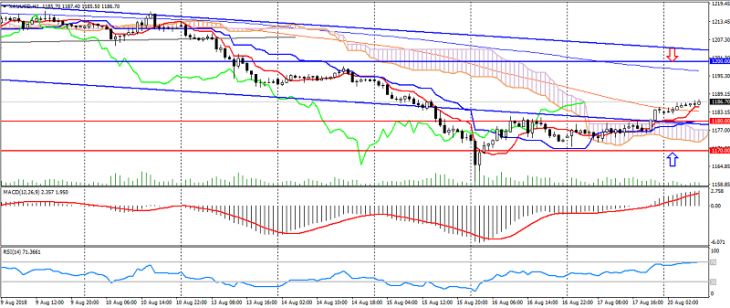

XAU USD (current price: 1186.00)

- Support levels: 1180.00, 1170.00, 1155.00.

- Resistance levels: 1200.00, 1220.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1195.00, 1200.00, 1210.00.

- Alternative recommendation: buy entry is from 1185.00, 1180.00, 1170.00.

Gold went to correction on the weakness of American dollar and correction after the decline.