Тechnical analysis of currency pairs (Anton Hanzenko)

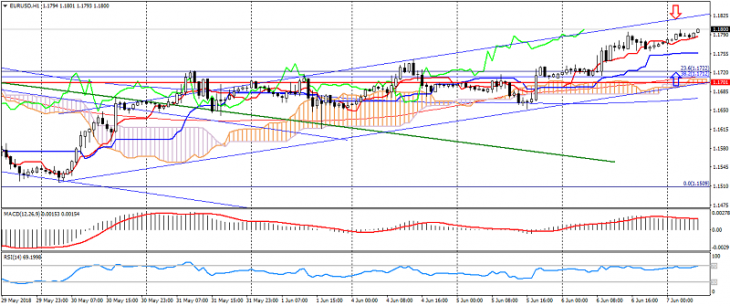

EUR USD (current price: 1.1800)

- Support levels: 1.2100 (September 2017maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.1820, 1.1840, 1.1860.

- Alternative recommendation: buy entry is from 1.1760, 1.1740, 1.1700.

The euro dollar is strengthening in an uptrend, limiting itself to overbought.

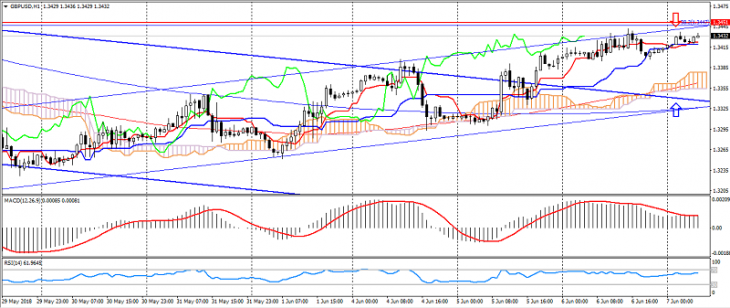

GBP USD (current price: 1.3430)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the zone of easy overbought. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the line Tenkan-sen near the line Kijun-sen, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3450, 1.3480, 1.3500.

- Alternative recommendation: buy entry is from 1.3400, 1.3380, 1.3340.

The British pound also maintains an upward trend, but is limited by overbought and significant resistance 1.3450.

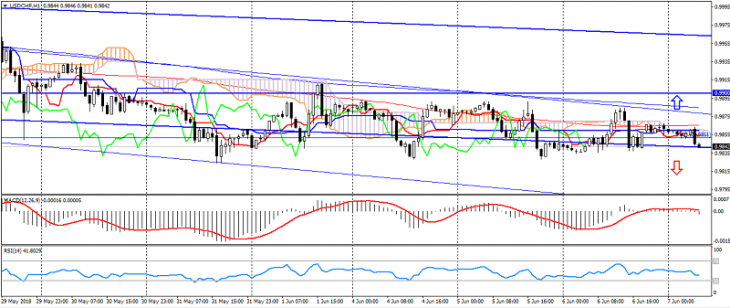

USD CHF (current price: 0.9840)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9870, 0.9900, 0.9920.

- Alternative recommendation: buy entry is from 0.9820, 0.9800, 0.9790.

The Swiss franc also traded downward, confining itself to the lateral triangle and supporting 0.9820-00.

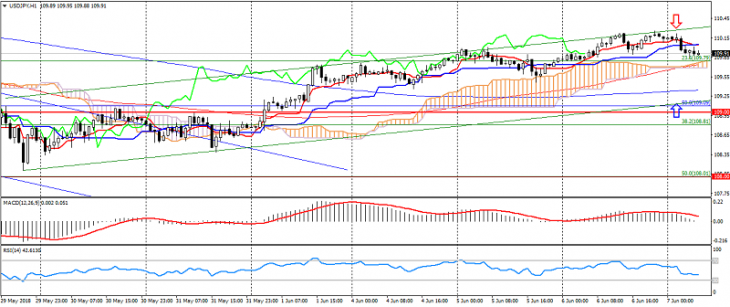

USD JPY (current price: 109.90)

- Support levels: 109.00, 108.00, 107.00.

- Resistance levels: 110.80, 112.00, 113.70.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 110.40, 110.60 110.80.

- Alternative recommendation: buy entry is from 109.50, 109.30, 109.00.

The pair maintains an upward trend, limiting overbought and the upper limit of the upward channel.

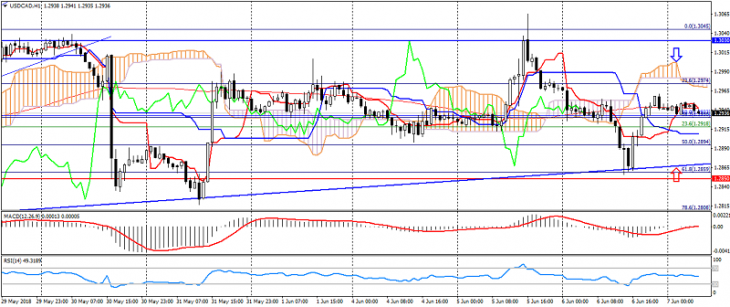

USD CAD (current price: 1.2940)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator of will 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2980, 1.3000, 1.3030.

- Alternative recommendation: buy entry is from 1.2900, 1.2880, 1.2850.

The pair broke off the support level at 1.2850, while continuing to maintain a downward trend.

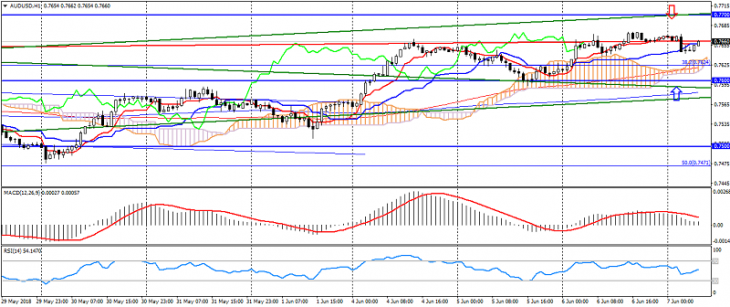

AUD USD (current price: 0.7660)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7680, 0.7700, 0.7730.

- Alternative recommendation: buy entry is from 0.7630, 0.7600, 0.7580.

The Australian dollar continues to trade with the strengthening, but is limited by resistance of 0.7680-0.7700.

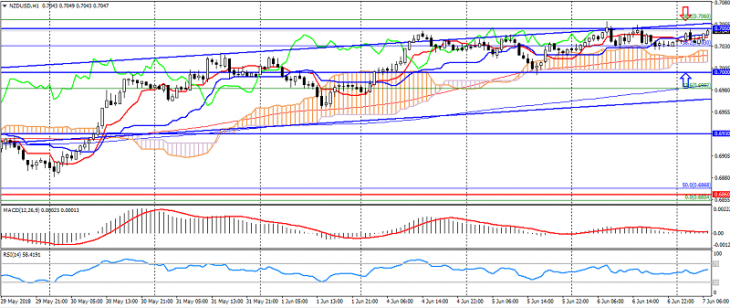

NZD USD (current price: 0.7050)

- Support levels: 0.6860, 0.6920, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7050, 0.7080, 0.7100.

- Alternative recommendation: buy entry is from 0.7000, 0.6970, 0.6950.

The New Zealand dollar maintains an upward trend, limited to overbought and upper boundary of the upward channel.

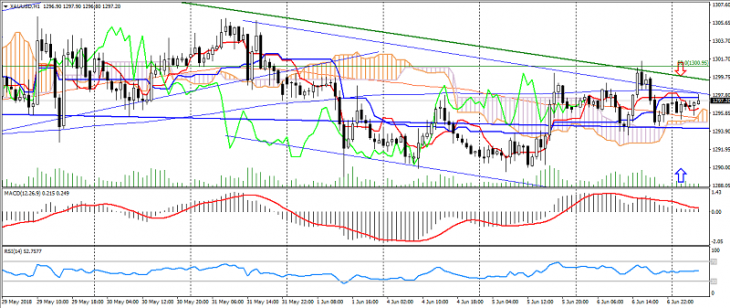

XAU USD (current price: 1297.00)

- Support levels: 1280.00, 1265.00, 1250.00.

- Resistance levels: 1315.00, 1335.00, 1355.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1299.00, 1302.00, 1305.00.

- Alternative recommendation: buy entry is from 1294.00, 1290.00, 1285.00.

Gold retains the potential for growth, but is limited by a downward trend and attempts to form a reversal.