Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

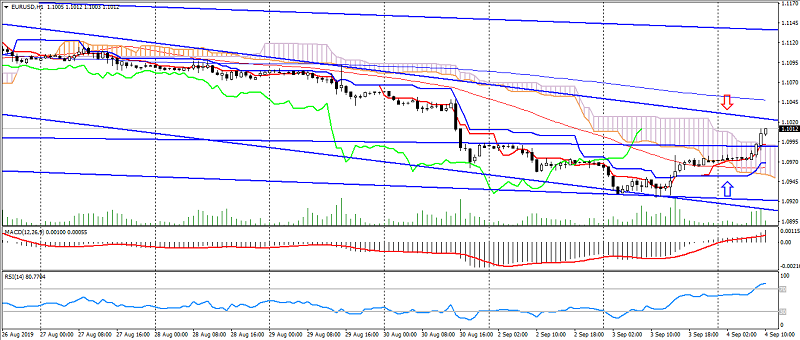

EUR USD (current price: 1.1010)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.10200, 1.1050, 1.1080.

- Alternative recommendation: buy entry is from 1.0980, 1.0950, 1.0920.

The euro/dollar is trading with strengthening on the weakness of the American dollar, limited to a downtrend.

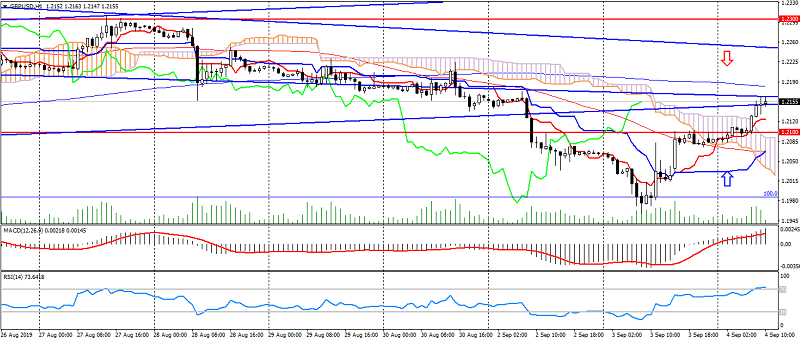

GBP USD (current price: 1.2160)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.2000, 1.2230, 1.2250.

- Alternative recommendation: buy entry is from 1.2130, 1.2100, 1.2080.

The British pound accelerated the growth on the weakness of the dollar and correction, maintaining a downtrend.

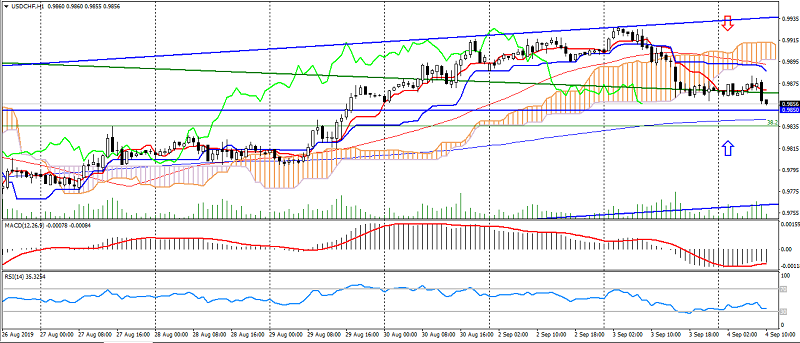

USD CHF (current price: 0.9860)

- Support levels: 0.9750, 0.9650, 0.9500.

- Resistance levels: 0.9850, 1.0000, 1.0060.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out from the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9880, 0.9900, 0.9920.

- Alternative recommendation: buy entry is from 0.9850, 0.9820, 0.9800.

The US dollar Swiss franc is trading lower, despite lower risks.

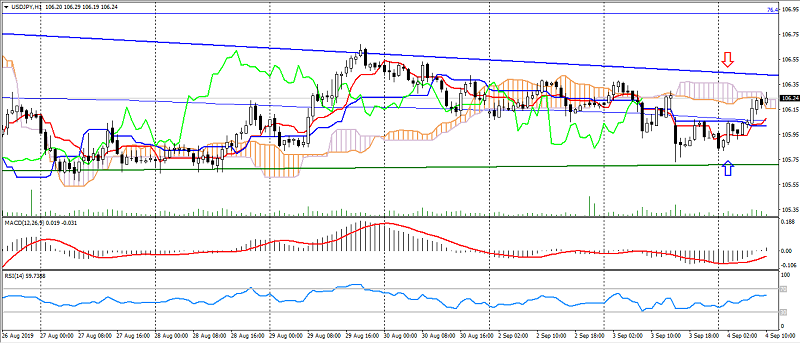

USD JPY (current price: 106.20)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out from the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 106.50, 106.80, 107.00.

- Alternative recommendation: buy entry is from 106.00, 105.50, 105.50.

The US dollar and the Japanese yen are trading strengthened, maintaining a restrained downward trend.

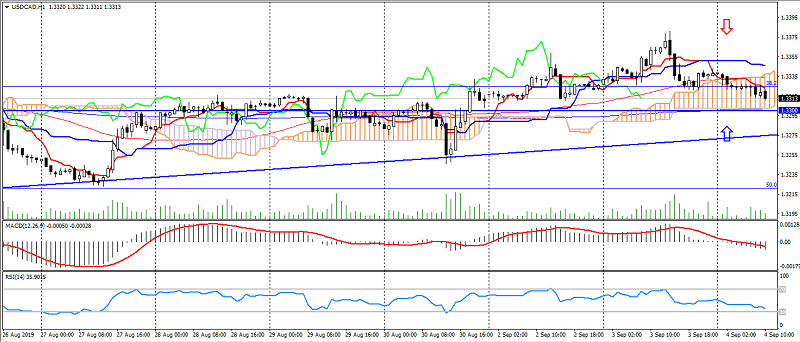

USD CAD (current price: 1.3320)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator below 0, signal line in the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3330, 1.3350, 1.3380.

- Alternative recommendation: buy entry is from 1.3300, 1.3280, 1.3250.

The pair US dollar Canadian dollar returned to decline, maintaining an uptrend.

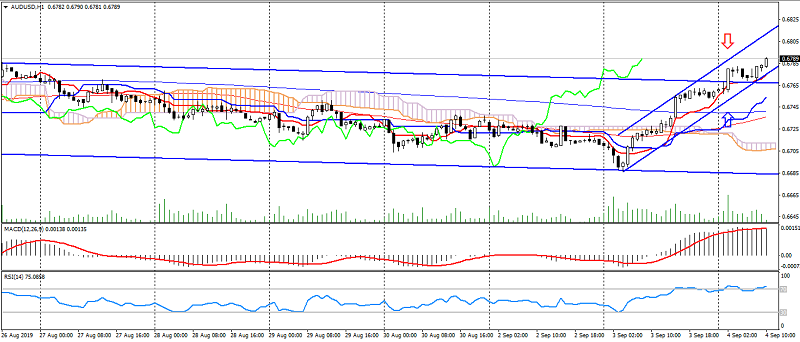

AUD USD (current price: 0.6790)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 0.6800, 0.6820, 0.6850.

- Alternative recommendation: buy entry is from 0.6750, 0.6730, 0.6700.

Australian dollar accelerated the growth, limiting to overbought.

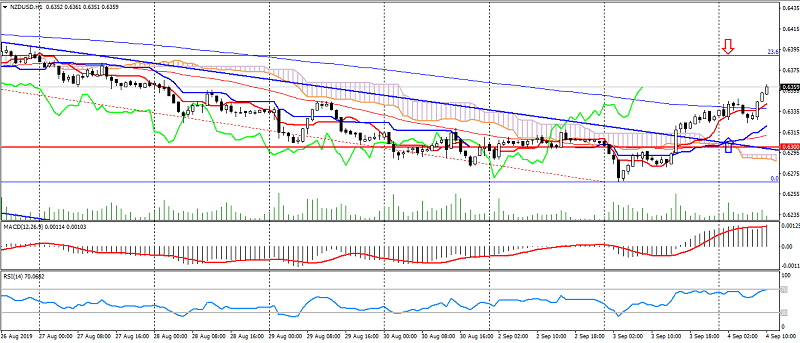

NZD USD (current price: 0.6360)

- Support levels 0.6300, 0.6200, 0.6100.

- Resistance levels: 0.6700, 0.680, 0.6950.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the histogram body. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, price is above the cloud.

- The main recommendation: sale entry is from 0.6380, 0.6400, 0.6430.

- Alternative recommendation: buy entry is from 0.6320, 0.6300, 0.6280.

The New Zealand dollar also accelerated the growth on reducing risks, moving into the correction phase after a long decline.

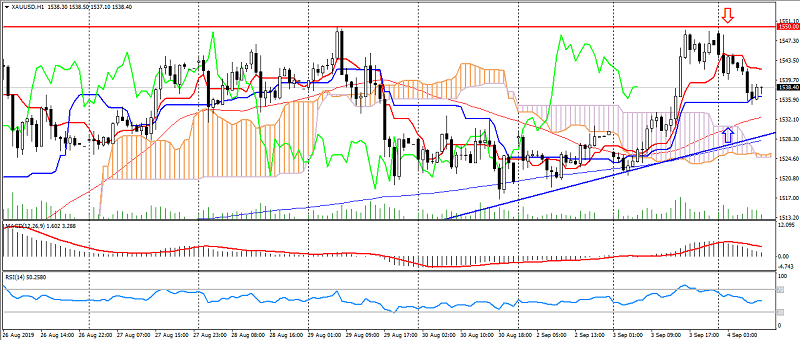

XAU USD (current price: 1538.00)

- Support levels: 1450.00, 1360.00, 1300.00.

- Resistance levels: 1550.00, 1600.00, 1670.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): indicator is above 0, the signal line has left the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1540.00, 1550.00, 1530.00.

- Alternative recommendation: buy entry is from 1530.00, 1520.00, 1510.00.

Gold is trading lower on the growth of optimism and correction after growth, while maintaining the side channel.