Тechnical analysis of currency pairs (Anton Hanzenko)

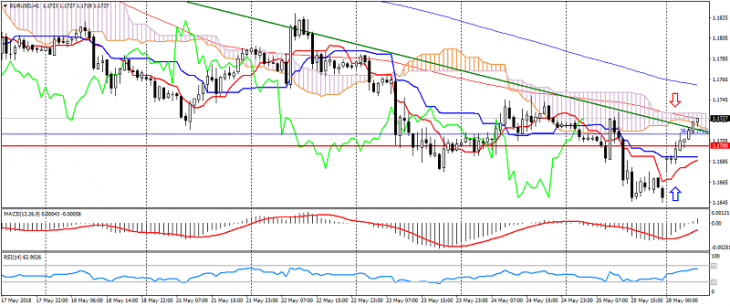

EUR USD (current price: 1.1720)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in easy overbought. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.1740, 1.1760, 1.1790.

- Alternative recommendation: buy entry is from 1.1700, 1.1680, 1.1650.

The pair has moved into a correction phase on the growth of optimism and the expectation of a decrease in liquidity.

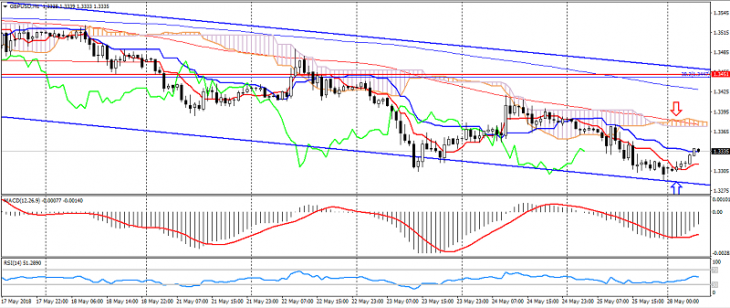

GBP USD (current price: 1.3330)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3360, 1.3380, 1.3410.

- Alternative recommendation: buy entry is from 1.3310, 1.3280, 1.3260.

The British pound also went into a correction phase on the rebound from the lower boundary of the descending channel, thereby confirming the development of the bullish divergence on the H4.

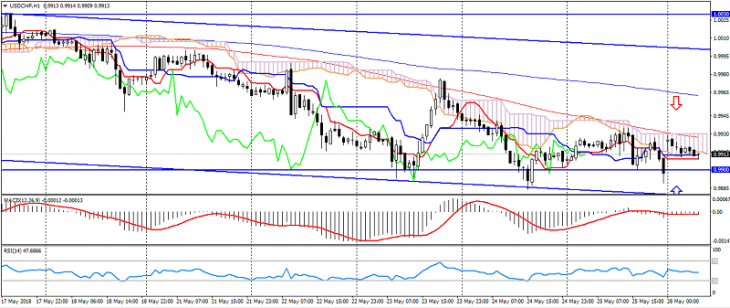

USD CHF (current price: 0.9910)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.9950, 0.9970, 1.0000.

- Alternative recommendation: buy entry is from 0.9900, 0.9880, 0.9860.

The Swiss franc continues to move in the sideways trend, limiting itself to a restrained correction after the decline.

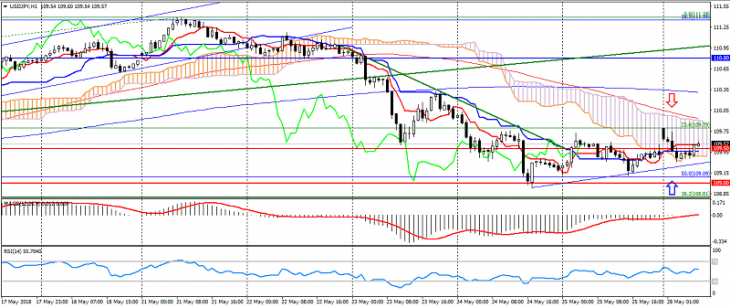

USD JPY (current price: 109.60)

- Support levels: 109.50, 109.00, 108.50.

- Resistance levels: 110.80, 112.00, 113.70.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 109.80, 110.30, 110.60.

- Alternative recommendation: buy entry is from 109.30, 109.00, 108.80.

The pair moved to a restrained correction, thereby opening the possibility of the resumption of the two-month uptrend.

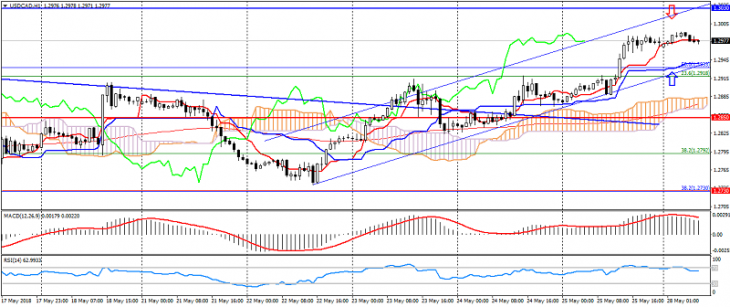

USD CAD (current price: 1.2980)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3000, 1.3030, 1.3060.

- Alternative recommendation: buy entry is from 1.2950, 1.2920, 1.2880.

The pair remains trading with a strengthening on the decline in oil prices.

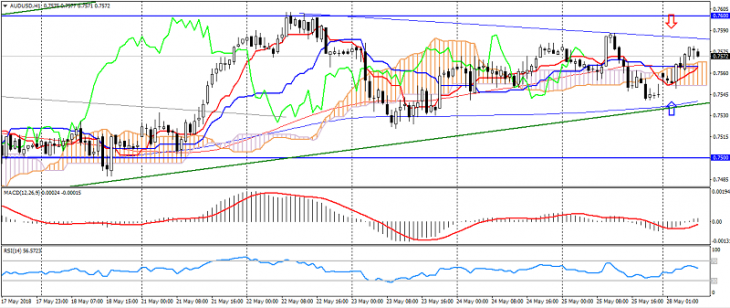

AUD USD (current price: 0.7570)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) ( signal – flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.7600, 0.7620, 0.7640.

- Alternative recommendation: buy entry is from 0.7550, 0.7520, 0.7500.

The Australian is traded in a contained uptrend, demonstrating a slight slowdown in growth.

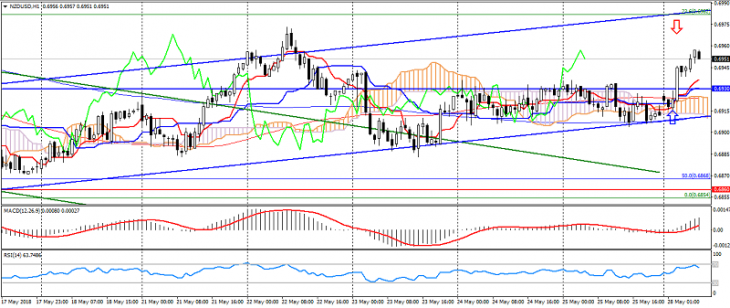

NZD USD (current price: 0.6950)

- Support levels: 0.6860, 0.6920, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – downward motion): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.6970, 0.6990, 0.7020.

- Alternative recommendation: buy entry is from 0.6930, 0.6900, 0.6880.

The New Zealand dollar accelerated growth on the decline of the American, confirming the uptrend.

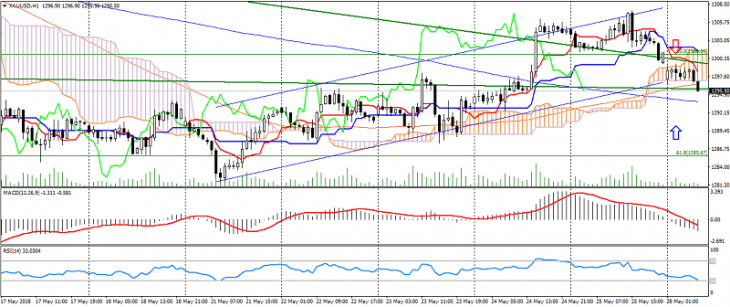

XAU USD (current price: 1295.00)

- Support levels: 1280.00, 1265.00, 1250.00.

- Resistance levels: 1315.00, 1335.00, 1355.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1300.00, 1305.00, 1308.00.

- Alternative recommendation: buy entry is from 1292.00, 1289.00, 1286.00.

Gold returned to the monthly downtrend on risk reduction.