Тechnical analysis of currency pairs (Anton Hanzenko)

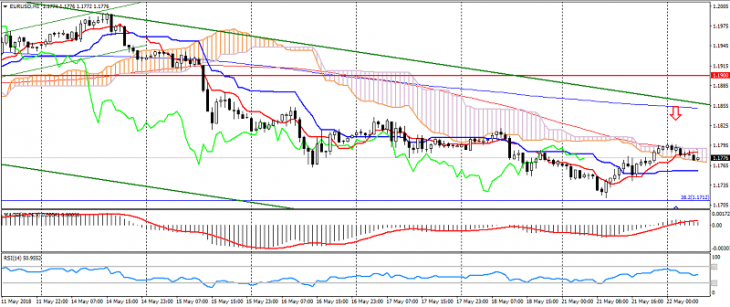

EUR USD (current price: 1.1770)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.1800, 1.1830, 1.1850.

- Alternative recommendation: buy entry is started from 1.1750, 1.1730, 1.1700.

The pair is traded with a decrease on the movement against Monday, limiting itself to a general downtrend.

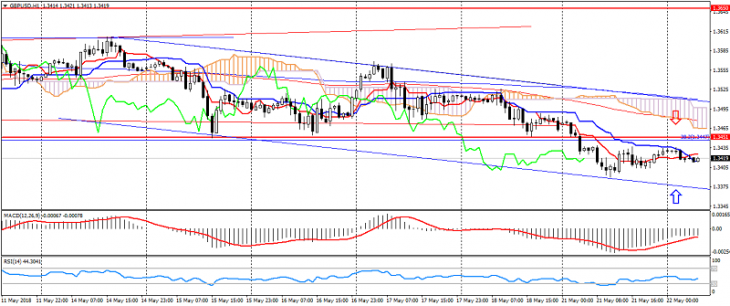

GBP USD (current price: 1.3420)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the line Tenkan-sen is below Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.3450, 1.3490, 1.3520.

- Alternative recommendation: buy entry is from 1.3400, 1.3370, 1.3350.

The British pound accelerated the decline against the American, thereby restoring the overall downward trend due to the expectation of upcoming news on the UK.

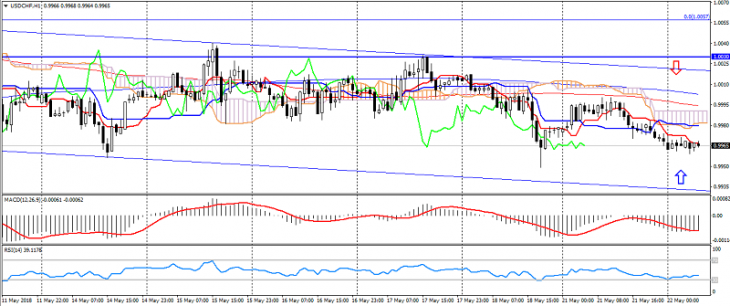

USD CHF (current price: 0.9970)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9980, 1.0000, 1.0020.

- Alternative recommendation: buy entry is from 0.9960, 0.9940, 0.9920.

The Swiss franc accelerated growth on the weakness of the American, but retains the possibility of realizing a bullish divergence.

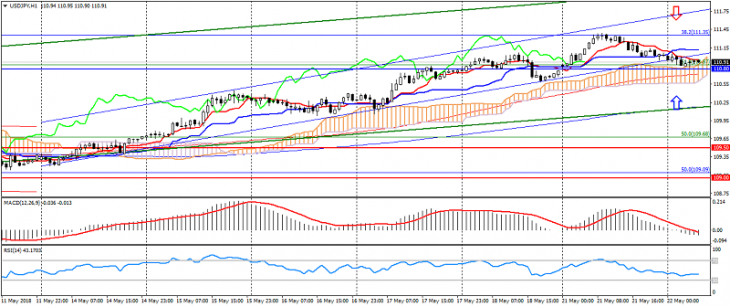

USD JPY (current price: 111.30)

- Support levels: 109.50, 109.00, 108.50.

- Resistance levels: 110.80, 112.00, 113.70.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 111.20, 111.40, 111.70.

- Alternative recommendation: buy entry is from 110.80, 110.50, 110.20.

The pair emerged from the upward weekly trend, thus indicating the possibility of a reversal.

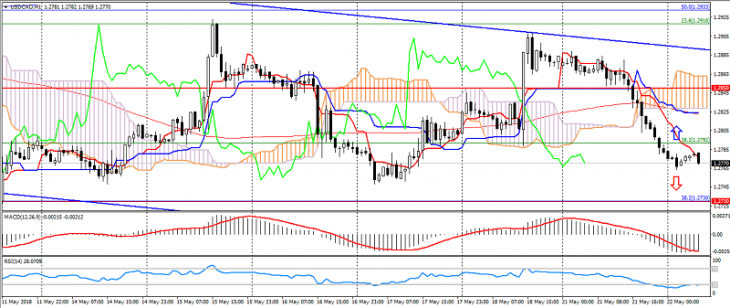

USD CAD (current price: 1.2770)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2800, 1.2830, 1.2850.

- Alternative recommendation: buy entry is from 1.2750, 1.2730, 1.2700.

The pair accelerated the decline in the cost of raw materials and correction of the American, thereby increasing the likelihood of development of the figure “double top” on the timeframe H4.

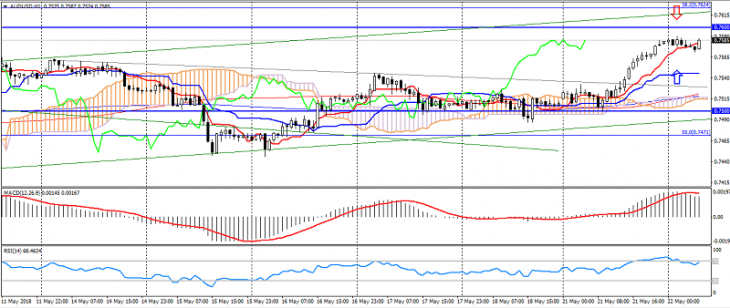

AUD USD (current price: 0.7580)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7600, 0.7620, 0.7580.

- Alternative recommendation: buy entry is from 0.7550, 0.7530, 0.7500.

The Australian accelerated growth on optimism, but is limited to overbought.

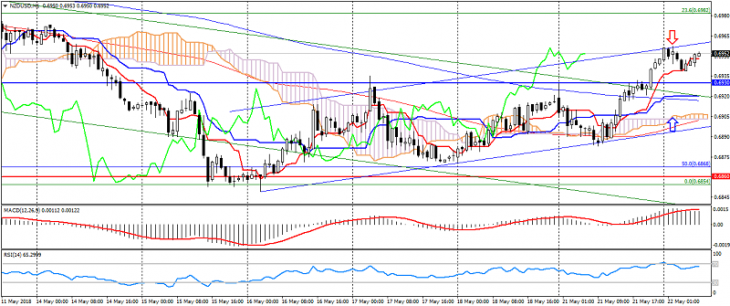

NZD USD (current price: 0.6950)

- Support levels: 0.6860, 0.6920, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the slight overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.6960, 0.6980, 0.6700.

- Alternative recommendation: buy entry is from 0.6930, 0.6900, 0.6880.

The New Zealand dollar broke the monthly downtrend.

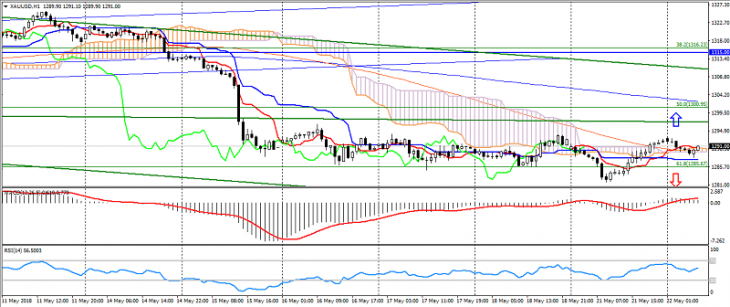

XAU USD (current price: 1291.00)

- Support levels: 1280.00, 1265.00, 1250.00.

- Resistance levels: 1315.00, 1335.00, 1355.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1295.00, 1399.00, 1305.00.

- Alternative recommendation: buy entry is from 1285.00, 1280.00, 1275.00.

Gold remains in flat, despite the reduction of risks.