Technical analysis of cross-rates. (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

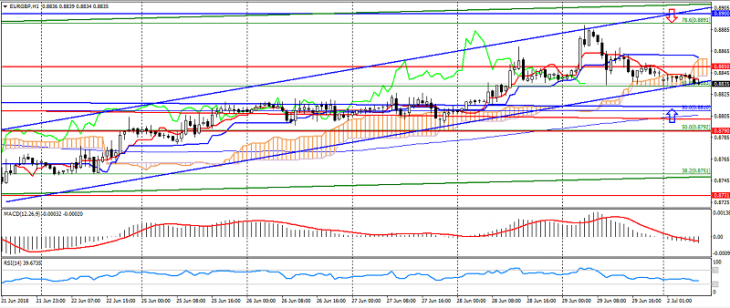

EUR GBP (current price: 0.8840)

- Support levels: 0.8850,0.8790, 0.8730 (minimum of the last months).

- Resistance levels: 0.8900, 0.8960 (March maximum), 0.9000 (strong psychology).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.8860, 0.8880, 0.8900.

- Alternative recommendation: buy entry is from 0.8800, 0.8800, 0.8790.

The euro pound pair is trading with a slight decrease in the growth of political risks in Germany, but retains an upward trend.

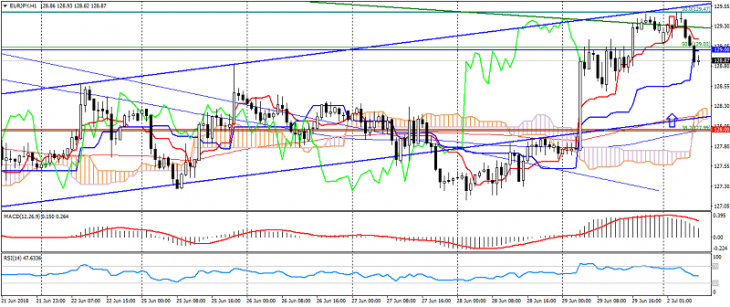

EUR JPY (current price: 128.80)

- Support levels: 128.00, 126.80, 125.00 (the minimum of May).

- Resistance levels: 129.00, 130.00 (strong psychological level), 130.50 (maximum of June).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 129.00, 129.30, 129.50.

- Alternative recommendation: buy entry is from 128.50, 128.00, 127.70.

The euro yen accelerated the decline in the growth of political risks in Germany, thereby forming a retreat from the level of 129.50.

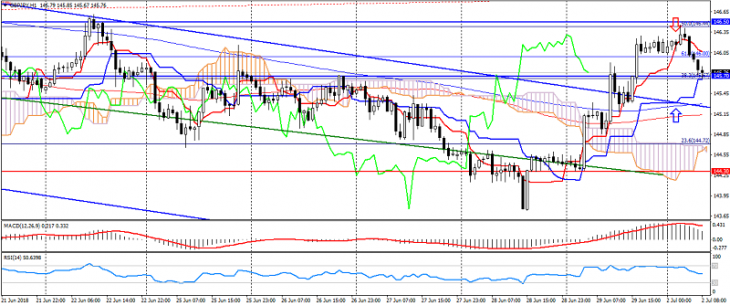

GBP JPY (current price: 145.70)

- Support levels: 144.30, 143.50, 143.00 (the minimum of May).

- Resistance levels: 145.70, 146.50, 147.00 (psychological level).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 146.00, 146.30, 146.50.

- Alternative recommendation: buy entry is from 145.70, 145.30, 145.00.

A pair of pound of yen is under pressure to increase risks.

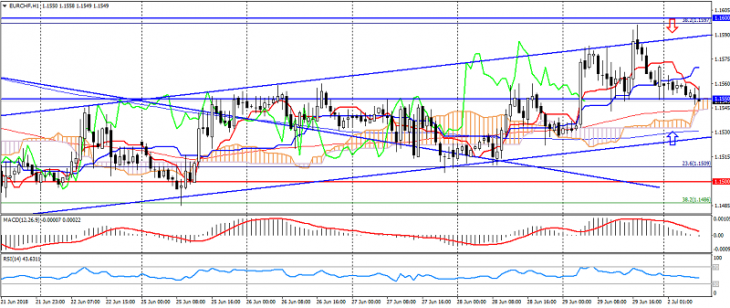

EUR CHF (current price: 1.1550)

- Support levels: 1.1500, 1.1450, 1.1360 (the minimum of the current year).

- Resistance levels: 1.1550, 1.1600, 1.1650 (June maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1580, 1.1600, 1.1630.

- Alternative recommendation: buy entry is from 1.1540, 1.1520, 1.1500.

The euro-franc pair remains under pressure, but is limited by an uptrend.