Technical analysis of cross-rates. (Anton Hanzenko)

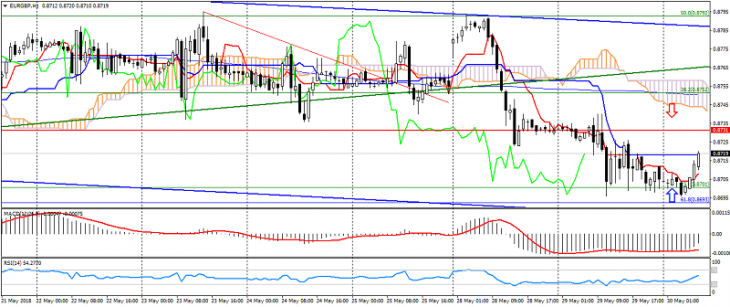

EUR GBP (current price: 0.8720)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.8730, 0.8750, 0.8790.

- Alternative recommendation: buy entry is from 0.8700, 0.8680, 0.8650.

The pair is traded with the strengthening on the correction, keeping the downward trend.

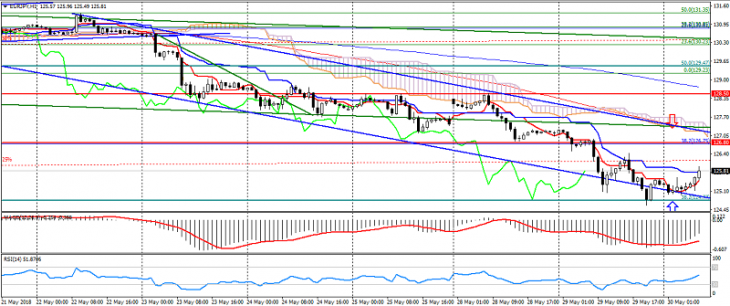

EUR JPY (current price: 125.80)

- Support levels: 130.20, 128.50, 126.80.

- Resistance levels: 133.00, 134.50, 136.80.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 127.40, 127.90, 128.20.

- Alternative recommendation: buy entry is from 125.50, 125.20, 124.70.

The pair rebounded from the lower border of the descending channel and went to correction, but is limited by the downward dynamics.

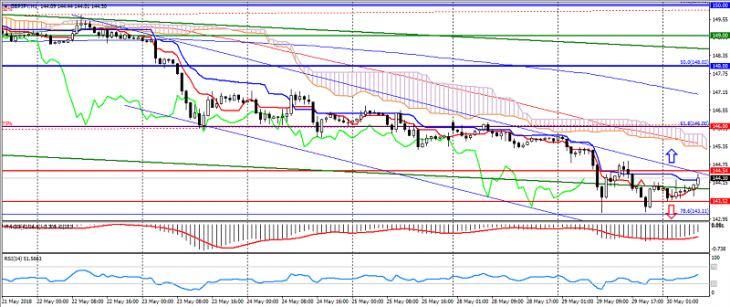

GBP JPY (current price: 144.20)

- Support levels: 146.00, 144.50, 143.50.

- Resistance levels: 148.00, 150.00, 151.50.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 144.70, 145.30, 145.60.

- Alternative recommendation: buy entry is from 143.80, 143.50, 142.80.

The pair is limited to the level of 143.50, from which the correction is expected.

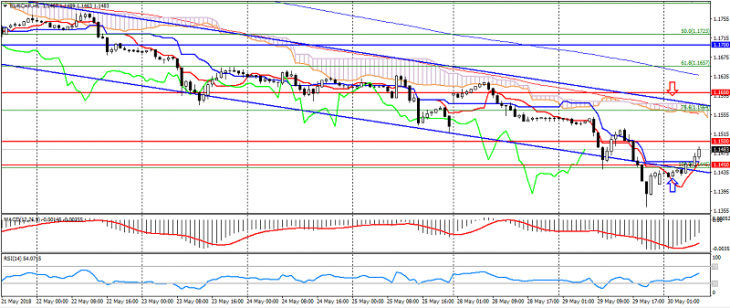

EUR CHF (current price: 1.1480)

- Support levels: 1.1600, 1.1500, 1.1450.

- Resistance levels: 1.1700, 1.1800, 1.1880.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1520, 1.1550, 1.1600.

- Alternative recommendation: buy entry is from 1.1450, 1.1420, 1.1400.

The pair returned to the established trend, thereby correcting after the decline.