Technical analysis of cross-rates. (Anton Hanzenko)

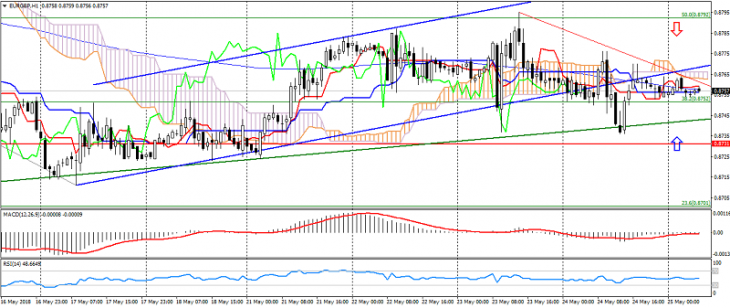

EUR GBP (current price: 0.8760)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.8780, 0.8810, 0.8830.

- Alternative recommendation: buy entry is from 0.8740, 0.8720, 0.8700.

The pair is traded lower, but is limited by the overall upward trend.

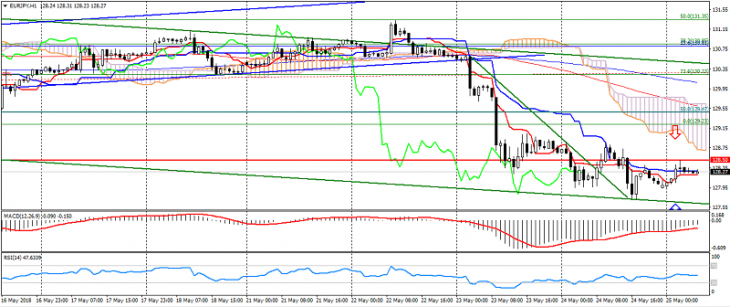

EUR JPY (current price: 128.20)

- Support levels: 130.20, 128.50, 126.80.

- Resistance levels: 133.00, 134.50, 136.80.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale emntry is from 128.50, 129.00, 129.40.

- Alternative recommendation: buy entry is from 127.90, 127.60, 127.30.

The pair remains in the monthly downtrend, limited to oversold and bullish divergence.

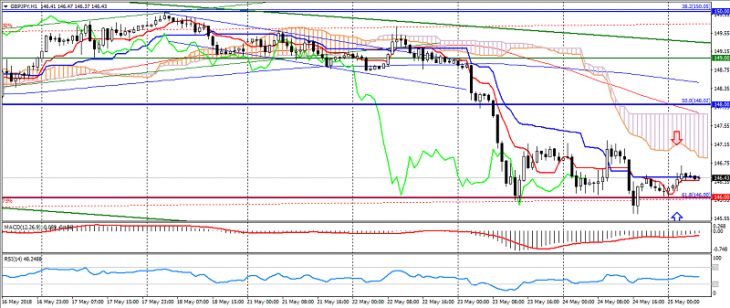

GBP JPY (current price: 146.40)

- Support levels: 146.00, 144.50, 143.50.

- Resistance levels: 148.00, 150.00, 151.50.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 147.00, 147.50, 148.00.

- Alternative recommendation: buy entry is from 146.00, 145.50, 145.00.

The pair remains under pressure of flight from risks, limited to oversold and bullish divergence.

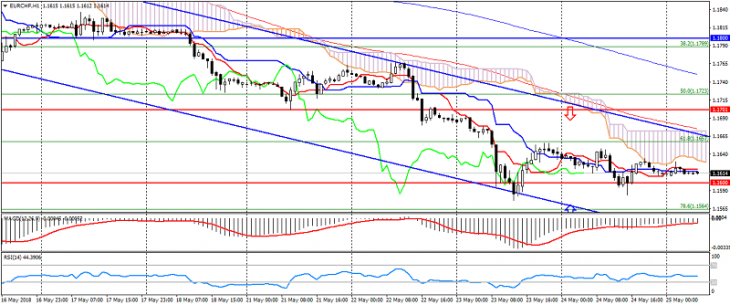

EUR CHF (current price: 1.1610)

- Support levels: 1.1700, 1.1600, 1.1500.

- Levels of resistance: 1.1800, 1.1900, 1.2030.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the line Tenkan-sen is near the line Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.1650, 1.1680, 1.1700.

- Alternative recommendation: buy entry is from 1.1600, 1.1560, 1.1520.

The pair remains under pressure from a downtrend and resumption of political risks in Italy, but is limited to psychology 1.1600.