U.S. data

- Core Retail Sales (m/m) (December), fact 0.0%, forecast 0.1%.

- Export Price Index (m/m) (January), fact -0.6%, forecast -0.1%.

- Import price index (m/m) (January), fact -0.5%, forecast -0.1%.

- NY Empire State Manufacturing Activity Index (Feb), fact 8.80, forecast 7.10.

- Retail sales (m/m) (December), fact 0.0%, forecast 0.2%.

Retail sales and export and import prices have been very negative. At the same time, retail sales figures for January significantly reduced the decline in December. It is worth noting that the negative retail sales data in the US market has already worked. And such a rapid recovery of the indicator, after a decline, can even be regarded by the market as positive.

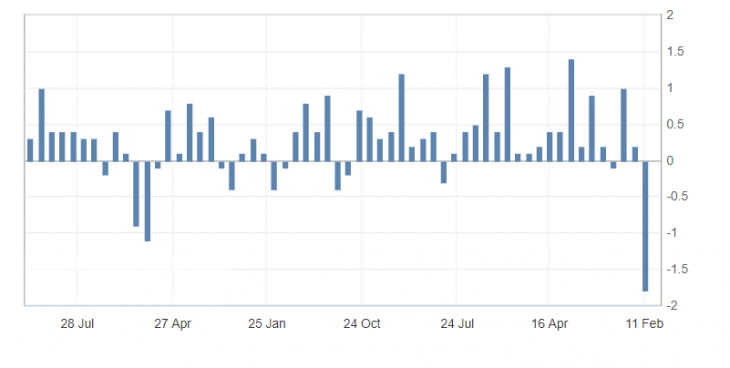

Fig. 1. U.S. core retail sales index (m) (December) chart

The US dollar index, on weak retail sales data for January, slowed the upward dynamics that it had received earlier, but continues to maintain its potential for growth, despite weak statistics. Resistance levels are 97.50 and 97.30, support: 97.20 and 97.00.

Fig. 2. The US dollar index chart. The current price is 97.30 (10-year government bonds yield is the blue line)

Read also: “Bitcoin versus gold, which is more valuable?”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Gold. Expectations for February and March 2019

- Features of trading within a week

- The political crisis in Venezuela and its impact on the markets!

Current Investment ideas: