U.S. inflation data

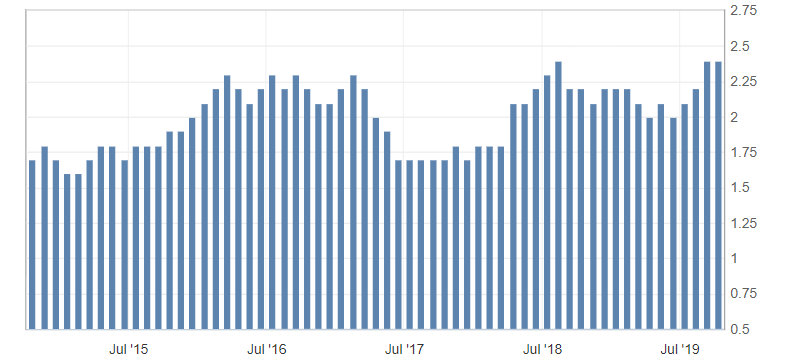

- Core Consumer Price Index (CPI) (y/y) (September), 2.4% fact, 2.4% forecast.

- Core Consumer Price Index (CPI) (m/m) (September), fact 0.1%, forecast 0.2%.

- Consumer Price Index (CPI) (m/m) (September), fact 0.0% 0.1%, forecast 0.1%.

- Initial jobless claims, fact 210K, forecast 215K.

Consumer inflation in the US in September year on year remained near five-year highs. At the same time, other indicators slowed down by 0.1%. This can be regarded as a restrained positive indicator of inflation. It is also worth to note the decrease in applications for unemployment benefits.

Fig. 1. Core consumer price index (CPI) (y) in the USA

The US dollar index reacted restrained to published statistics, continuing to recover after the decline. The probability of rates change at the October Fed meeting has not actually changed on this news. The US dollar index remains under the pressure from the uncertainty of trade talks, limiting itself to overselling and support levels: 98.70 and 98.50.

Fig. 2. The US dollar index chart. Current price – 98.80 (10-year US government bonds yield – blue line)

Read also: “The oil market and its cloudy prospects”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Cloudy prospects for the oil market

- Risks of global economic slowdown are escalating

- What indicators choose Forex traders (Part 2)

Current Investment ideas: