US pricing data

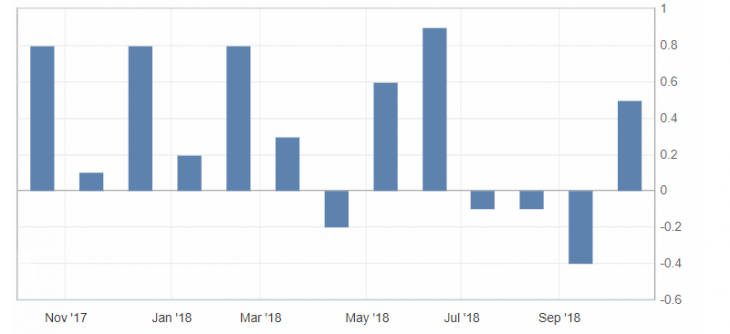

- Export Price Index (MoM) (Sep), fact 0.0%, forecast 0.2%.

- Import Price Index (MoM) (September), fact 0.5%, forecast 0.2%

Significant support for the US currency was provided by data on the rise in import prices to the United States in September, which increased markedly after a three-month decline.

Fig. 1.The US Import Price Index chart

As a result, the US dollar index accelerated the correction against yesterday’s decline, which was caused by the continued optimism in the stock markets and the correction of positions on the American dollar at the end of the week. Thus, the US dollar index is testing the resistance level of 95.30, indicating a slowdown in the downtrend.

Fig. 2. The US dollar index. The current price is 95.30 (10-year government bonds yield is the blue line)

Read also: “Popular Forex Tools: Fibonacci Fan”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Trump presidency results (1/2).

- Trump presidency results (1/1).

- Trading with shares. Advantages and disadvantages.

Current Investment ideas: