Analysis of the past day

On Friday, the day the US dollar strengthened across the market, which was caused by data on employment data in the United States. As a result, the market came out with a weekly flat, in which it was trading due to market uncertainty amid expectations of the US employment data and a new round of the US-China trade talks.

Stock indices also came under the pressure from the US dollar on its overall strengthening despite a positive start at the start of the day. (Nikkei 225 + 0.20; DAX -0.70; FTSE 100 -0.80; Dow 30 -0.70)

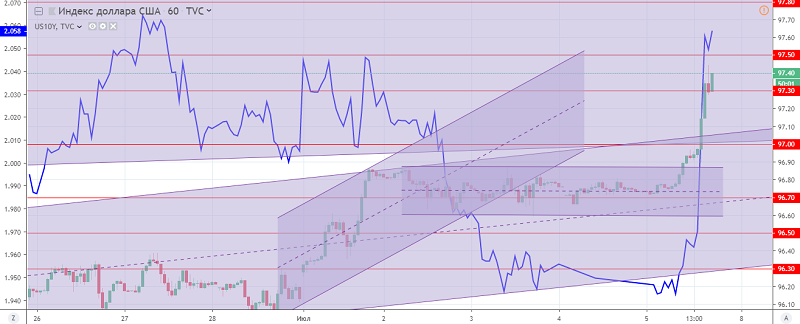

The dollar index on the general strengthening overcame a number of significant resistance levels: 97.00 and 97.30, which caused the American dollar to be overbought. A significant resistance is the level of 97.50, from which we can expect the formation of a correction. Support levels are located at the levels: 97.30-20 and 97.00.

Fig. The US dollar index chart. The current price is 96.80 (10-year US government bonds yield is the blue line)

Hanzenko Anton