Analysis of the American session

Wednesday’s trading closed with a restrained growth of the US dollar against most major competitors, this was due to the preservation of positive expectations on the US – China trade talks. At the same time, a significant increase in the American dollar was traced against commodity currencies, which was associated with a weakening oil price amid mixed data on the US oil inventories and market uncertainty.

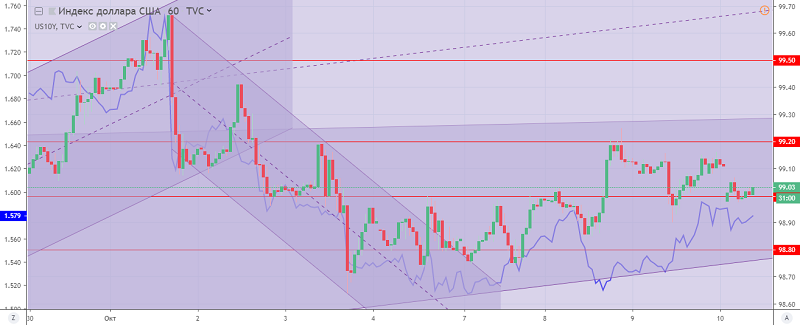

The dynamics of the US dollar index remained moderately upward and trading on Wednesday closed at the opening of the day level despite attempts to downward correction and update the Wednesday low at 98.90. This preserves the upward trend of the American dollar, while the dollar index remains above the psychological mark of 99.00.

Fig. US dollar index chart. Current price – 99.00 (10-year US government bonds yield – blue line)

Read also: “OPEC + Market expects

continuation of the agreement to limit production“

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Risks of global economic slowdown are escalating

- What indicators choose Forex traders (Part 2)

- Stock indices are ready to renew a historical high

Current Investment ideas: