Analysis of the American session

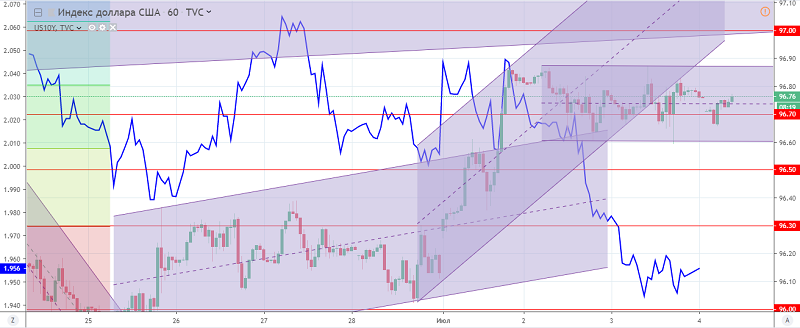

The US session on Wednesday closed with the preservation of the lateral dynamics of the US dollar index. The reason for the restraint of the market was the low activity before the weekend in the US on Thursday, the weakening of optimism about the US-China trade negotiations, and the expectation of Friday data on the US employment. Against this background, restraint remained on the market, while the American dollar continued to trade in the side trading range from 96.80-90 to 96.70-60.

Fig. The US dollar index chart. The current price is 96.80 (10-year US government bonds yield is the blue line)

Read also: “Prospects for the euro based on the ECB policy”

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- OPEC + Market expects continuation of agreement to limit production

- G20 Summit – what to expect and to beware of

- Prospects for the USD/JPY for early July

Current Investment ideas: