Expenditure data in the US

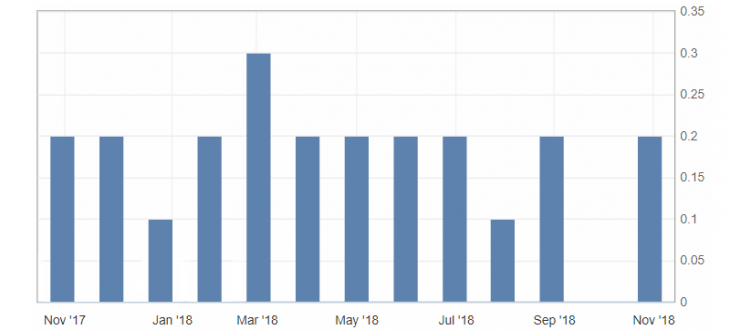

- Core price index for personal consumption expenditures (m/m) (September), fact 0.2%, forecast 0.1%.

- Core price index for personal consumption expenditures (y/y) (September), fact 2.0%, forecast 2.0%.

- Personal spending (m/m) (September), fact 0.4%, forecast 0.4%.

The report on personal spending in the United States coincided with market expectations, with the exception of the core price index of personal consumption expenditures (m/m), which resumed after September decline, which is a positive signal of growth in the target inflation rate in the United States.

Fig. 1. Core price index for personal consumption expenditures chart (m / m)

The US dollar index reacted to the news with restrained growth. The data served as a driver for the resumption of the uptrend for the American dollar and opens the way to resistance levels 96.70-80, against the background of the preservation of the uptrend. The support is the marks: 96.50 and 96.30.

Fig. 2. The US dollar index. The current price is 96.60 (10-year government bonds yield is the blue line)

Read also: “Strategy MACD + Parabolic SAR is a successful duet”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- GDP of the world’s fast-growing economies

- Dow Theory – the basics of technical analysis.

- The US economy continues its growth, confirming the rates hike policy.

Current Investment ideas: