The US economy continues its growth, confirming the rates hike policy

Last US Federal Reserve protocol showed that the United States monetary policy will remain tight and aimed at raising rates in the United States. As of October 2018, the US key interest rate is 2.25%. At the same time, the US Federal Reserve signals a policy of further rate increases, which is confirmed by the Fed’s forecasts and the US economy. As a result, the market expects again increase rates in the US at the December or January Fed meeting.

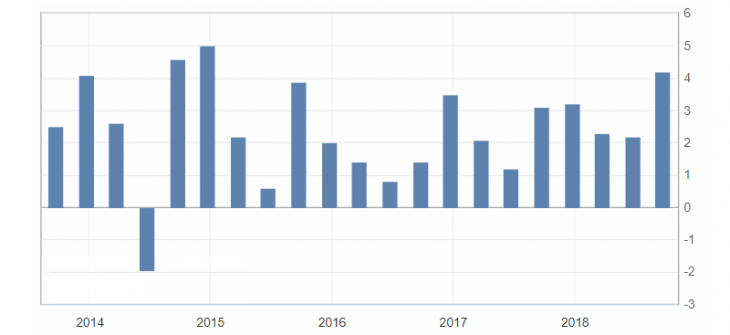

The US Federal Reserve maintains a policy of rate increases due to US economic indicators and forecasts. Thus, the latest indicators of the US GDP (q/q) showed one of the most significant quarterly growth in three years.

Fig. 1. U.S. GDP chart (q/q)

The average Fed forecast for the US GDP growth for 2018 was 3.1%, and for 2019 – 2.5%, even a bit lower than the current dynamics.

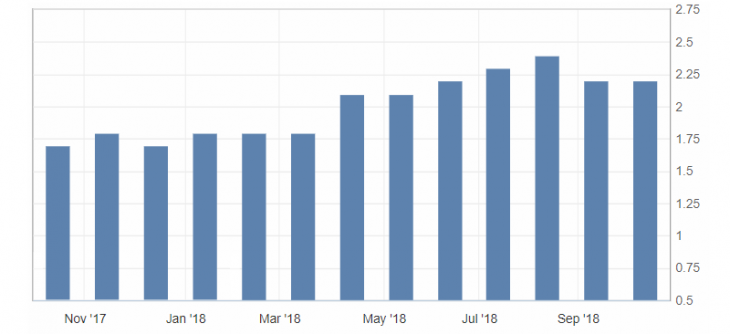

The Fed expectations concerning inflation in the United States also remain very optimistic, about 2%. At the same time, the actual figure remains close to the forecast, despite the restrained values in recent months, which nevertheless remain above expectations.

Fig. 2. U.S. Core consumer price index chart (y/y)

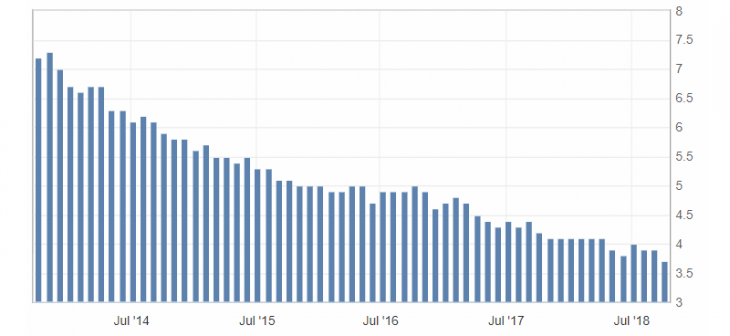

The US Federal Reserve forecasts an unemployment at a level of 3.5% in 2019 and 2020. The latest figures for October showed 3.7%, the lowest since 1970.

Fig. 3. U.S. Unemployment chart

It is very optimistic, but also quite possible in the conditions of preserving the current trend.

Risks for the global economy have arisen with optimism around the rise in the US interest rates and strengthening of the dollar. And it caused the collapse of global stock indices in October.

Fig. 4. DOW index chart

The index dropped in 5%, which is a very significant indicator. It applies not only to the US indices, but to all world indices, even some declining were more significant.

The US trade war was an additional risk factor and remains a major factor in the uncertainty of the global market. Also, Trump’s criticism of the US Federal Reserve’s policy in the person of Fed Chairman J. Powell was not ignored.

The President of the United States has repeatedly criticized the Fed’s policy of raising interest rates because it complicates the implementation of Trump’s goals. In this case, the intervention of the US president in the Fed policy remains unacceptable and causes a lot of condemnations.

In a recent interview with D. Trump, he said: “The Central Bank is an independent organization, so I don’t communicate with Powell, but I don’t like what he does because he does it too fast.” Implying a rapid increase in rates in the United States.

Summing up, we can say that the US Federal Reserve will continue to adhere to the policy of raising rates. At least as long as the US economic indicators allow it. At the same time, the risks associated with it for the global economy probably will be ignored until it begin to affect clearly the economic performance of the United States.

Anton Hanzenko