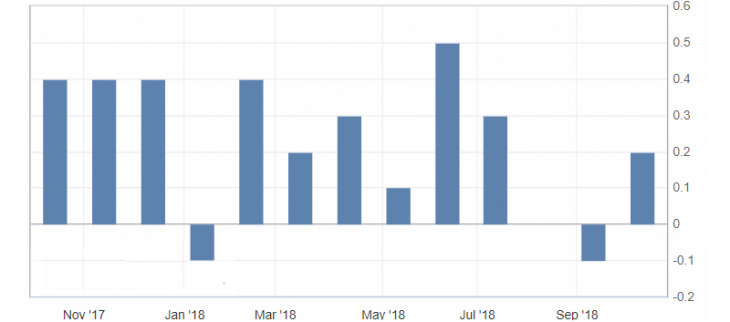

The US producer prices data

- Core Producer Price Index (PPI) (m / m) (Sep), fact 0.2%, forecast 0.2%.

- Producer Price Index (PPI) (m / m) (Sep), fact 0.2%, forecast 0.2%.

Data on the US producer prices for September fully coincided with market expectations and confirmed optimistic expectations. But at the same time, they confirmed only the general expectations, which were taken into account by the price of the US dollar. This indicator remains ahead and confirms the continued positive dynamics of consumer prices in the United States, which contributes to the preservation of the tight monetary policy of the US Federal Reserve.

Fig. 1. The US Producer price index chart.

Growing optimism on the American currency may, against the background of market restraint, shift the general interest for the US dollar. As a result, it can serve as a driver for the growth of the dollar, which also contributes to an increase of the US state bonds profitability.

Fig. 2. The US dollar index chart. Current price – 95.70 (10-year government bonds yield – blue line)

Read also: “Pattern 123. Just as 1-2-3!”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Trading with shares. Advantages and disadvantages.

- Does Monday is so hard as everybody say?

- How to trade CFD contracts with Ester Holdings Inc.?

Current Investment ideas: