Black swan and its prospects in the near future. Anton Hanzenko.

The Black Swan is an event that cannot be predicted, causing a sharp collapse in the market. A global event that has an impact on if not the whole market then at least a significant part of it.

Despite a clear and understandable description, the concept of “Black Swan” can be regarded ambiguously, but in any case it has a significant impact on the market. So, some events can be absolutely unpredictable, like the terrorist attack in the USA on September 11, 2001; and very expected, but due to low probability of implementation, such events do not receive attention, for example, a referendum on the withdrawal of the UK from EU.

Black swan – how to recognize?

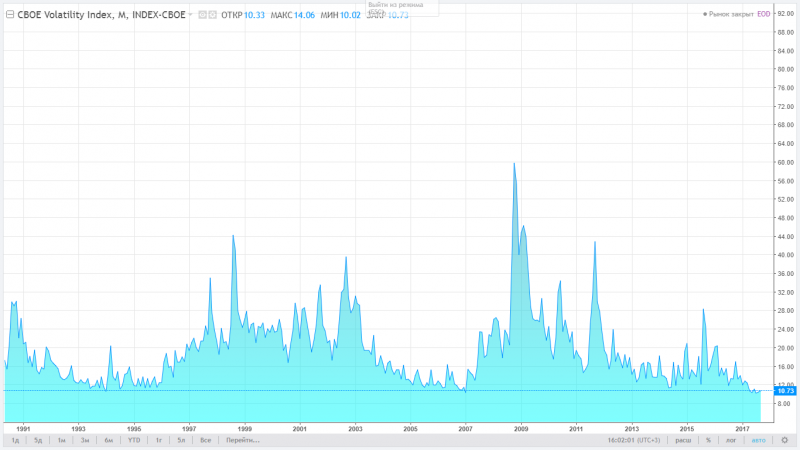

The VIX index can be considered as a relative graphical interpreter of extraordinary events. VIX is the market volatility index of the Chicago Board Options Exchange (CBOE), or as it is often called the “fear index”. Many will say – volatility, what’s wrong with that? But the growth of the VIX index, and as a result, of volatility, is perceived by the market as a negative signal and speaks of a possible catastrophe in the market.

At this time, the VIX index is near historical lows, which confirms the relatively calm state of the market. Despite the geopolitical risks and the political crisis in the United States.

On the other hand, given the cyclical nature of the market, the decline in the index indicates the possibility of the rapid formation of the “Black Swan”. In conditions of low activity or volatility, many market participants begin to lose their vigilance and become the most vulnerable to market fluctuations.

So, with the graph of the VIX volatility index, one can single out one regularity. After a series of highs, in which the first is higher than the next, there comes a lull with the renewal of the minimum, which is now being traced. After the movement near the lows, a restrained growth of volatility, fear, appears, which ultimately indicates awareness – the new Black Swan is close.

Of course, in the market there is always a certain share of risks, which can both grow and decline, depending on the conditions that are constantly changing. It is also impossible to accurately predict the formation of the “Black Swan”, relying only on a series of data or volatility as well as the possibility of this event, since its main feature is unpredictability. But, one can be secured from the consequences of the “Black Swan”, using the basics of money management. And as you know: “Forewarned is forearmed.”

Being always up to date is easy with the analytical support of Ester! The flow of global news online is on our website in the Market News!

Hanzenko Anton